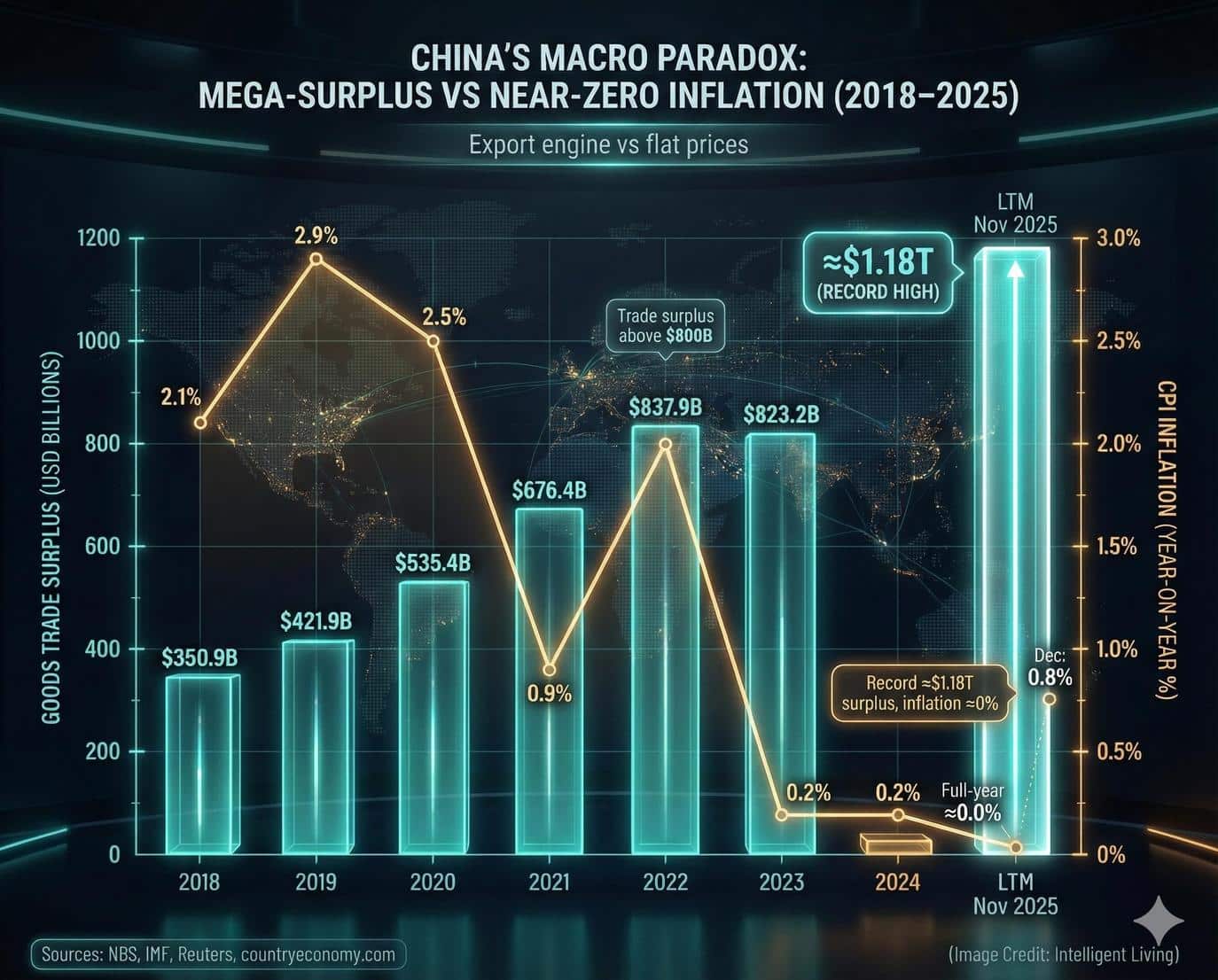

China’s economy unveiled a striking structural paradox throughout 2025, yielding a record-breaking trade surplus exceeding $1 trillion alongside virtually zero consumer inflation. Advanced economies frequently grappled with price instability throughout 2025, while China’s domestic prices remained flat.

The balance of external power and internal restraint is fueling what economists call the Modernization Loop, a self-reinforcing cycle that converts export surpluses into large-scale investments in technology, infrastructure, and clean industrial systems. Surplus capital now flows directly into high-efficiency industries, enabling Beijing to export advanced capabilities to developing nations instead of relying on domestic household consumption for growth.

The current industrial transition marks China’s shift from the “world’s factory” to the architect of the Global South’s modernization. With massive projects spanning hydrogen pipelines, supercritical carbon dioxide power generation, and next-generation battery exports, the Modernization Loop is redefining global economic interdependence.

(Credit: Intelligent Living)

(Credit: Intelligent Living)

Quick Facts: China’s Modernization Loop in Numbers

- Trade Surplus: Surplus levels surpassed $1 trillion by November 2025, a milestone captured in historical data tracking record export strength.

- Inflation Rate: Consumer price inflation held at 0.0% through late 2025, matching the latest consumer price index from the National Bureau of Statistics.

- Household Income: Disposable income saw a 5.1% nominal increase during the first three quarters of 2025, as noted in the recent income report from the National Bureau of Statistics.

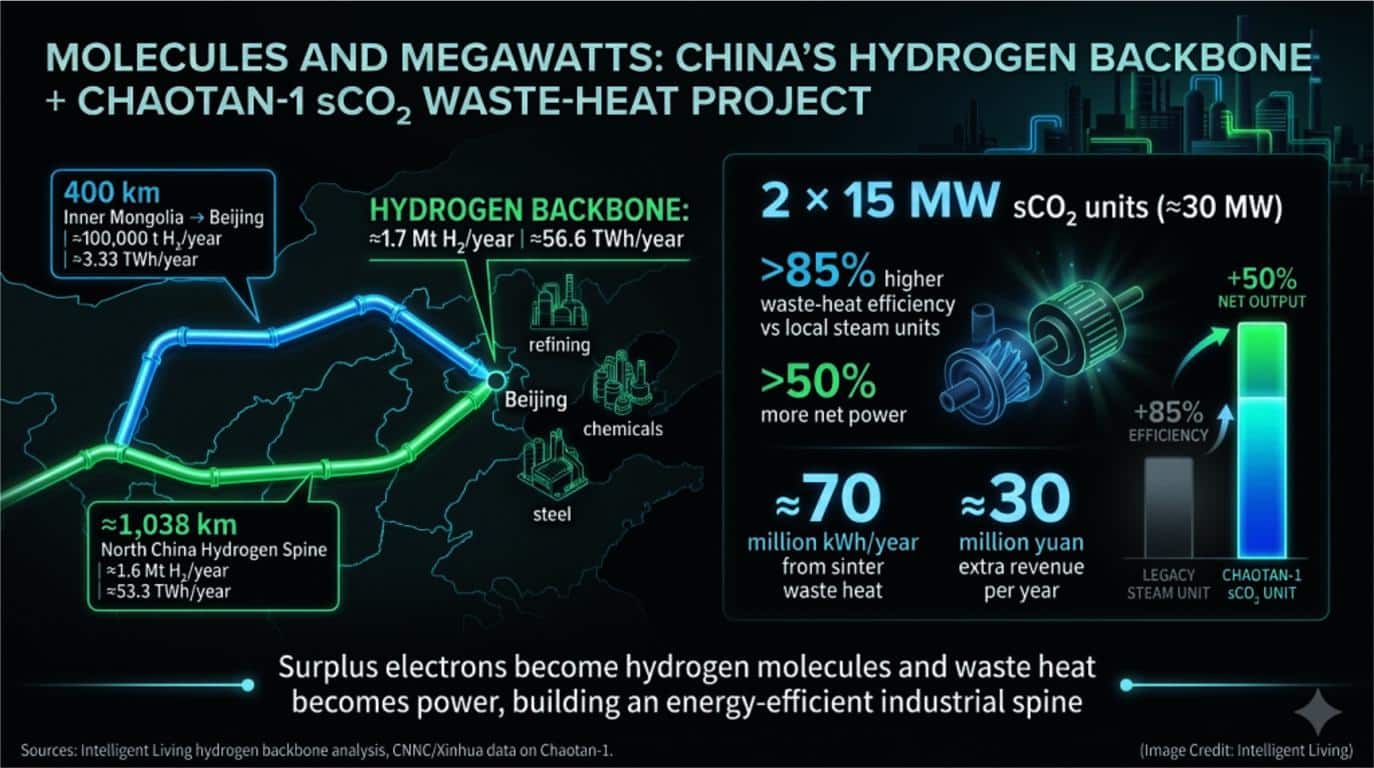

- Hydrogen Infrastructure: A 1,038 km pipeline network forms a North China hydrogen backbone that connects renewable-rich regions to industrial demand as part of an expanding national hydrogen pipeline network.

- Supercritical CO₂ Power Generation: Early commercial projects utilize 15 MW units capable of generating 70 million kWh annually via waste heat recovery systems.

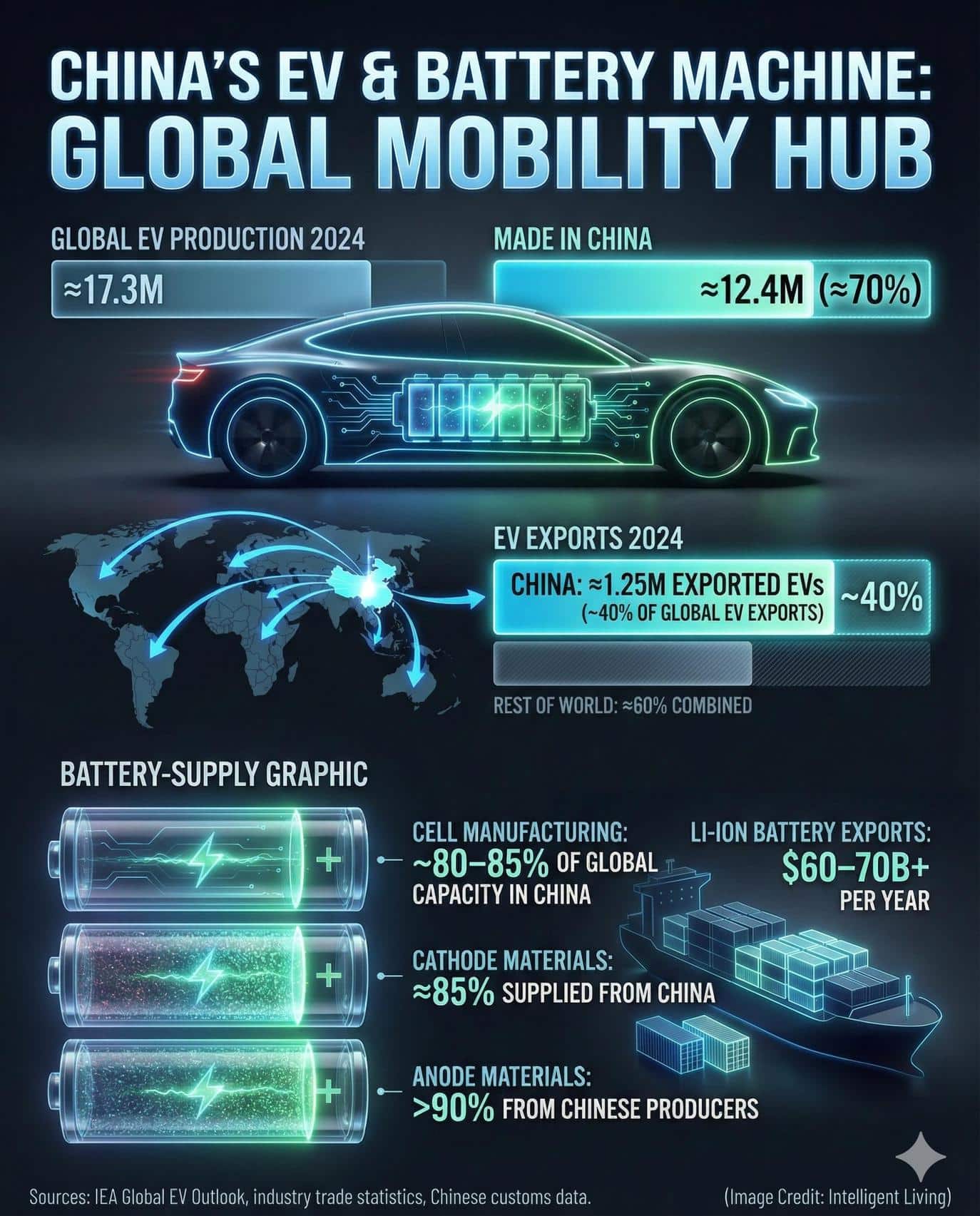

- EV Export Market Share: Roughly 40% of global EV exports originated from China by late 2025, with electric vehicle trade flows showing how these assets dominate international markets.

(Credit: Intelligent Living)

(Credit: Intelligent Living)

Maximizing Export Potential Within a Zero-Inflation Environment

A zero-inflation environment might appear stagnant, yet China’s economy in 2025 demonstrated the opposite. The country maintained steady growth rates above 4.5%, even as consumer prices remained unchanged. The secret lies in external demand and industrial specialization.

China’s record trade surplus, estimated around $1.1 trillion, reflects decades of industrial optimization and trade diversification. Reporting on the $1.1 trillion milestone highlights a significant shift in trade flows across Southeast Asia, Africa, and Europe.

Sustaining Domestic Stability through Deflationary Discipline

Internally, household earnings grew at a moderate but stable pace. The National Bureau of Statistics reported a 5.1% rise in disposable income, showing that while domestic consumption is cautious, purchasing power continues to expand. Targeted fiscal policies enforce deflationary discipline via credit control and energy subsidies. Such strategic maneuvers empower China to reinvest surplus capital into industrial technology, renewable energy, and research.

The IMF’s Article IV mission noted that while China’s reliance on exports carries risk, it also provides the liquidity necessary to modernize infrastructure. Such a mechanism fosters a self-sustaining loop where export revenue finances industrial innovation that then produces exportable technologies and strengthens China’s long-term economic architecture.

(Credit: Intelligent Living)

(Credit: Intelligent Living)

Fueling Global South Modernization through Molecular Energy Logistics

One of the clearest examples of this Modernization Loop is China’s investment in molecular energy logistics. Strategic energy investments have prioritized the expansion of the North China Hydrogen Spine to link renewable-rich northern provinces with major industrial centers such as Beijing and Tianjin.

- This 1,038 km pipeline serves as the primary artery for green fuel logistics.

- Excess solar and wind power are converted into green hydrogen molecules rather than going unused.

- The system provides a transferable energy medium that underpins an expanding hydrogen pipeline backbone.

Establishing the North China Hydrogen Spine for Industrial Decarbonization

Molecular energy logistics overcome the inherent transmission losses of traditional power grids, allowing solar and wind power to be stored and transported across vast distances. It also supports the country’s 44 hydrogen city clusters, where heavy industry and transportation are leveraging city cluster consortia to pilot fuel cell logistics.

Exporting hydrogen infrastructure technologies to partner nations across the BRICS and Belt and Road corridors allows China to share a blueprint for industrial decarbonization. These pipelines, electrolyzers, and control systems form the backbone of an energy operating system that can be replicated across emerging economies.

Project implementations range from ocean refineries coupling desalination with hydrogen production to extensive wind and solar investments across the Green Horizon in Serbia.

Redefining Efficiency with Waste-Heat Power Recovery Exports

China’s emerging industrial ecosystem revolves around a rigorous commitment to energy efficiency and waste-heat recovery. Industrial efficiency standards are currently being redefined by projects like Chaotan One, which demonstrate how waste heat can be converted into a valuable power product.

- Each installation generates over 70 million kWh per year, driving Global South Modernization by lowering manufacturer carbon footprints.

- Manufacturers benefit from significantly reduced operational costs.

- Scalable export models provide a pathway for industrial regions worldwide to recover waste heat.

The Chaotan One project in Guizhou Province employs supercritical CO₂ power generation units, each rated at 15 MW, to convert industrial waste heat into usable electricity. Surpassing traditional steam turbines in supercritical CO2 systems allows for over 85% energy recovery efficiency.

Countries in the Global South, particularly those developing manufacturing bases, stand to benefit from these systems to enhance energy independence. Analysts note that while supercritical CO₂ systems are still in their infancy and face durability challenges, they offer a promising path toward decarbonizing heavy industry. As these systems mature, they could become a central export product in China’s modernization portfolio, representing the practical fusion of engineering efficiency and environmental pragmatism.

(Credit: Intelligent Living)

(Credit: Intelligent Living)

Securing Global Trade through Battery and EV Mobility Hubs

China currently accounts for nearly 40% of global EV exports, leveraging this leadership to secure economic influence. This position also allows for the export of technologies and standards that underpin a cleaner mobility future, supported by global lithium discoveries and extraction analysis that secure production.

Controlling the Resource-to-Battery Pipeline for Global Supply Chains

Dominating the supply of critical raw materials—specifically lithium, nickel, and rare earth elements—cements the China Economy’s export advantage. Direct investments in critical mineral extraction technologies and refining capacity stabilize global supply chains even during intense demand volatility. Resource-to-battery pipelines have matured into a key component of the Modernization Loop, turning raw materials into high-value finished products that serve the growing electric mobility needs of the Global South.

The export of EVs, charging infrastructure, and battery components extends far beyond traditional trade. It acts as a form of industrial diplomacy, linking energy infrastructure, vehicle manufacturing, and transportation electrification into one cohesive ecosystem. These exports represent the literal and figurative mobility glue of China’s global modernization strategy.

Deploying Digital Foundations via the AI Belt and Road Initiative

China is constructing a digital counterpart to its industrial modernization drive, often described as an AI Belt & Road. Digital infrastructure expansion is a core component of this effort.

- Initiatives prioritize exporting AI data centers and gallium nitride-powered processors.

- Energy-efficient cooling systems are designed to operate in regions with unstable grid conditions.

- Executing an AI compute strategy focused on domestic chip resilience allows for broader technological self-reliance.

Integrating power electronics, software ecosystems, and hardware innovation into export packages allows China to achieve technological self-reliance while complementing physical infrastructure. As restrictions from Western semiconductor markets continue, China is leveraging bismuth-based transistor research to bypass silicon supply chains. These chips, combined with domestic fabrication capacity, underpin China’s growing influence over global compute standards.

Together, these systems embody a digital extension of the Modernization Loop, where compute, energy, and materials converge to support industrial modernization. Digital infrastructure serves as the cognitive backbone of China’s emerging global operating system, bringing data handling and decision-making capacity directly to emerging economies.

(Credit: Intelligent Living)

(Credit: Intelligent Living)

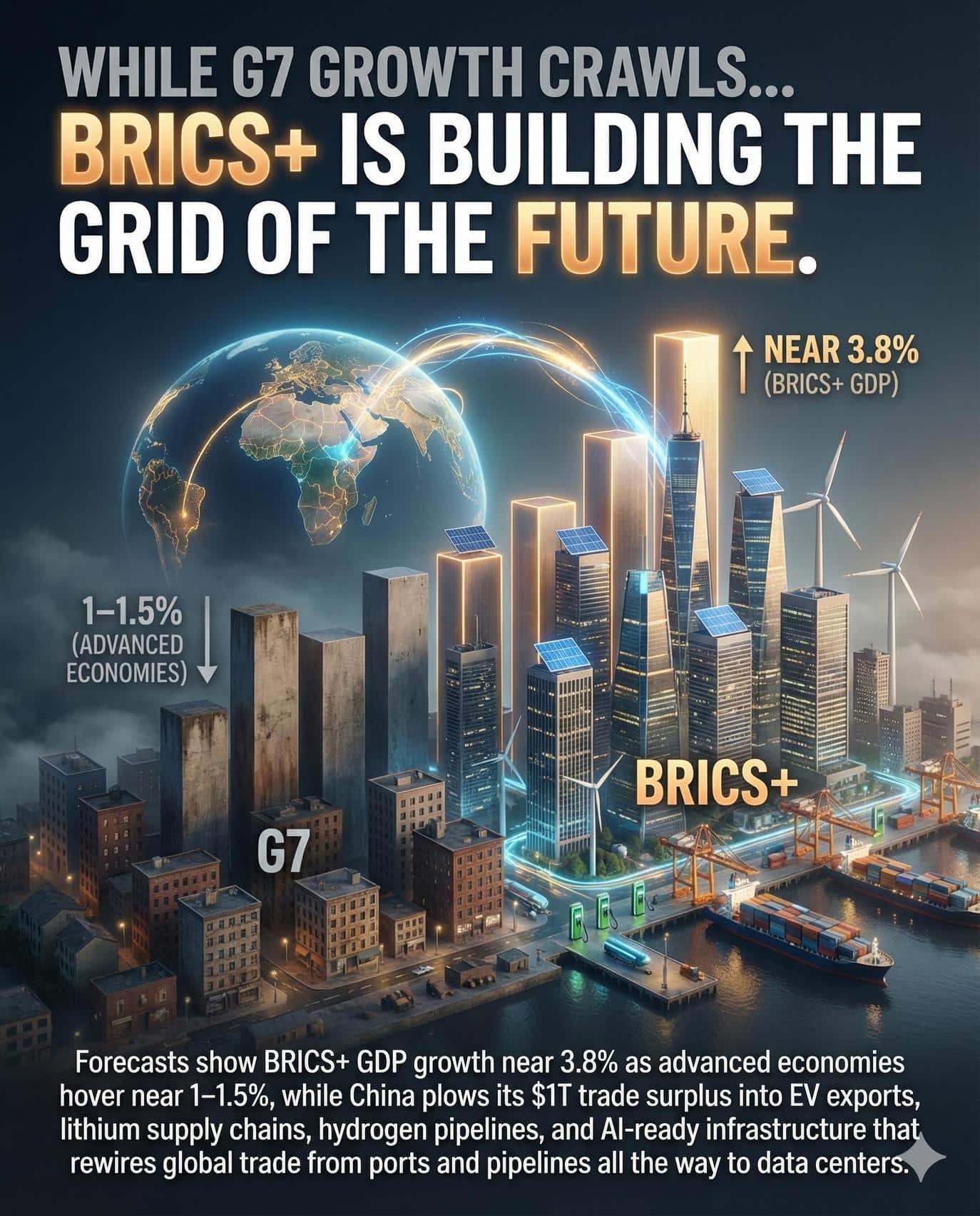

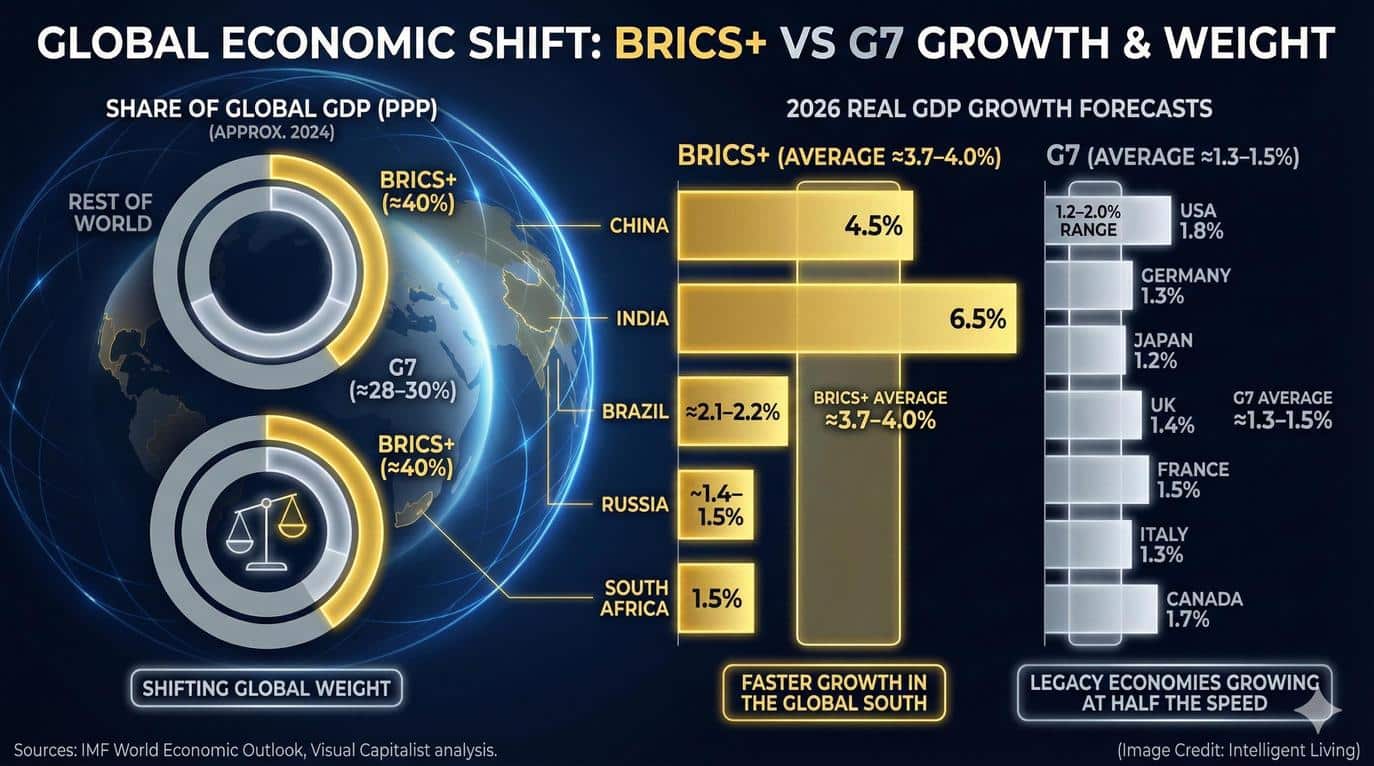

BRICS vs G7 as the Backdrop

The rise of the BRICS+ bloc underscores the shifting center of global economic gravity. Rapid expansion within the BRICS+ bloc signals a fundamental rebalancing of global economic power, a pattern seen in growth forecasts comparing GDP trajectories through 2026.

Economic divergence provides the contextual foundation for China’s Modernization Loop. As Global South economies expand, their demand for infrastructure, clean energy, and technology will intensify. China’s focus on exporting complete industrial ecosystems, including hydrogen pipelines, EV supply chains, and digital compute stacks, positions it as both supplier and architect of this growth. In contrast, G7 economies remain constrained by aging infrastructure and slower technological diffusion.

Rather than a competition between blocs, this trend represents the rebalancing of global production capacity, where industrial knowledge and capital increasingly flow toward regions with the fastest growth potential.

(Credit: Intelligent Living)

(Credit: Intelligent Living)

Strategic Impacts of China’s New Economic Operating System

Achieving industrial efficiency serves as the primary metric for success, directly fueling the Modernization Loop and securing long-term influence. The fusion of massive trade surpluses and advanced technology deployment secures the structural momentum required for sustained global growth.

Converting molecules and megawatts into exportable infrastructure provides a bridge to developing regions. This process essentially creates a proprietary demand network that operates outside traditional western financial constraints. Such a strategy mitigates domestic risks by ensuring that factory floors remain busy building the components for a global green transition.

China’s Modernization Loop represents a departure from the debt-fueled growth of the past, focusing instead on tangible asset creation and technological standard-setting. Challenges certainly remain, particularly regarding trade tensions and shifting demographics, but the structural momentum is undeniable. Establishing these deep industrial roots across the Global South ensures that the China Economy remains at the center of the next great wave of global development. The world is watching as molecules, megawatts, and megasurpluses redefine the very nature of economic power.

Frequent Inquiries Regarding China’s Industrial Evolution

How Does the Modernization Loop Function?

Surplus capital from global exports is systematically reinvested into advanced domestic technology and clean energy projects to fuel long-term industrial strength.

Why is Zero Inflation Significant for the Chinese Economy?

Stable prices reflect a government focus on industrial subsidies and credit control rather than stimulating volatile household consumer spending cycles.

What Role do Hydrogen Pipelines Play in Global Trade?

The North China Hydrogen Spine serves as a scalable blueprint for partner nations to integrate renewable energy into their manufacturing bases.

Is Supercritical CO₂ Power Generation a Viable Export?

Waste-heat recovery units provide a scalable energy efficiency solution for developing industrial sectors across the Global South.

How Does the AI Belt & Road Support Developing Nations?

Providing compute infrastructure and data centers allows emerging economies to modernize their industrial decision-making without relying on western silicon supply chains.