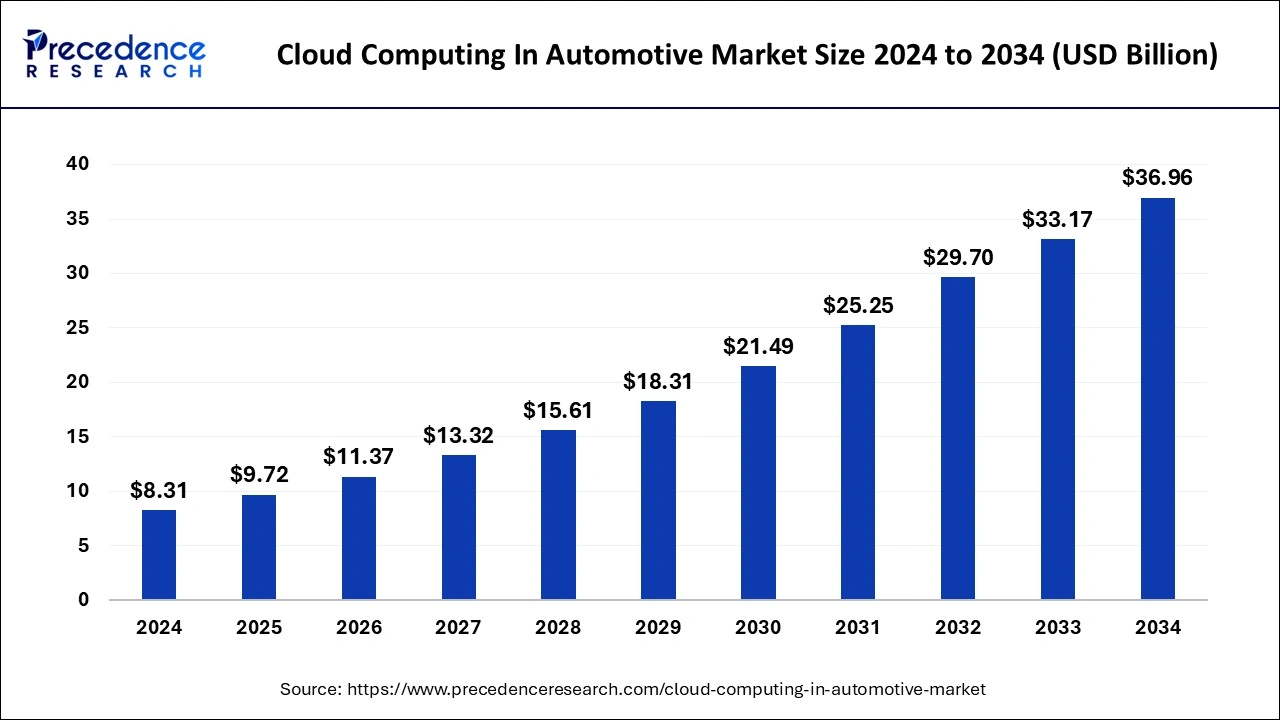

According to Precedence Research, the global cloud computing in automotive market size is expected to attain around USD 36.96 billion by 2034 from USD 8.31 billion in 2024 with a CAGR of 16.09%.

Cloud Computing in Automotive Market Key Highlights

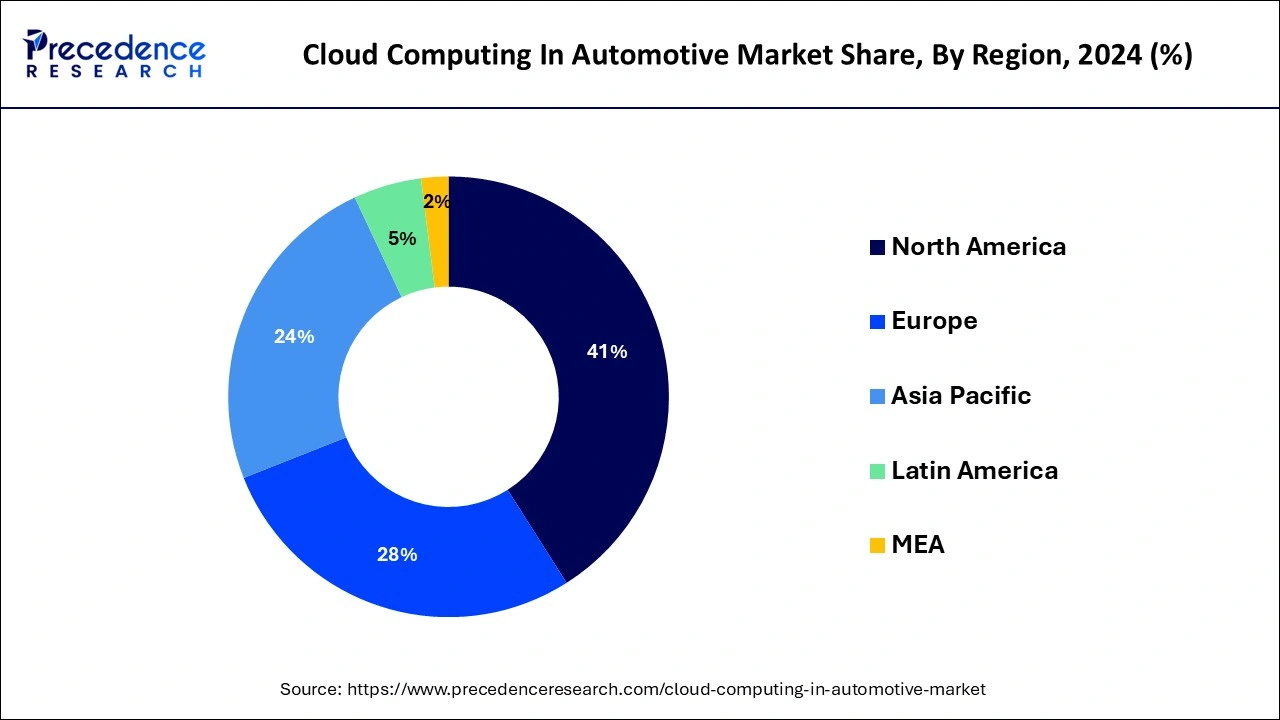

- Regional Insights: North America led the global cloud computing in automotive market in 2024, accounting for the largest share of 41%. Meanwhile, the Asia Pacific region is expected to witness the fastest growth during the forecast period.

- Service Model Analysis: In 2024, the Software as a Service (SaaS) segment held the dominant position with a 40% market share. The Platform as a Service (PaaS) segment is projected to grow at a strong CAGR of 18.7% throughout the forecast timeline.

- Application Insights: The connected cars segment emerged as the leading application, contributing over 35% of the market share in 2024. On the other hand, supply chain management is expected to register the highest growth rate in the coming years.

- Deployment Type Overview: The public cloud segment generated the highest revenue share of 44% in 2024, whereas the hybrid cloud deployment is forecasted to expand at a significant CAGR of 19.9% during the forecast period.

Regional Outlook: Cloud Computing in Automotive Market

North America

- United States: The U.S. is the largest individual market in North America, with the sector valued at USD 1.94 billion in 2024 and projected to reach USD 8.75 billion by 2034. This growth is propelled by a mature automotive industry, advanced cloud infrastructure, and strong regulatory support for connected vehicles. The presence of major automakers and tech firms, along with a tech-savvy consumer base, further accelerates adoption.

- Canada & Mexico: Both countries benefit from proximity to the U.S. market and are experiencing increased investment in connected vehicle technologies, though at a smaller scale compared to the U.S.

Europe

- Germany: As Europe’s automotive powerhouse, Germany leads in adopting cloud computing for automotive applications, driven by its strong manufacturing base and innovation in connected and autonomous vehicle technologies.

- United Kingdom & France: Both countries are advancing rapidly in connected vehicle initiatives, with significant investments in cloud-based mobility solutions and regulatory backing for digital transformation in the automotive sector.

- Rest of Europe: Other countries, such as Italy and Spain, are catching up by investing in cloud infrastructure and connected car technologies, supported by EU digitalization policies.

Asia-Pacific

- China: China commands the largest share in Asia-Pacific, fueled by massive demand for connected vehicles, rapid urbanization, and strong government support for smart mobility. The presence of leading cloud service providers and automakers drives innovation.

- India: India is witnessing fast growth due to increasing adoption of connected vehicles, a growing tech-savvy population, and favorable regulatory environments for technology innovation.

- Japan & South Korea: Both countries are leaders in automotive technology and are investing heavily in cloud-based solutions for autonomous driving and vehicle-to-infrastructure (V2I) communication.

- Rest of Asia-Pacific: Countries like Australia and Southeast Asian nations are gradually increasing their adoption of cloud computing in automotive, focusing on smart city and mobility projects.

Latin America

- Brazil: Brazil is the primary market in Latin America, with growing investments in automotive cloud solutions, especially for fleet management and connected logistics.

- Argentina & Rest of Latin America: These regions are at earlier stages of adoption, with gradual growth as cloud infrastructure improves and automotive digitalization accelerates.

Middle East & Africa

- United Arab Emirates (UAE) & Saudi Arabia: Both countries are investing in smart city and connected vehicle projects, leveraging cloud computing to enhance mobility and urban transportation.

- South Africa & North Africa: Adoption is slower but rising, driven by increasing demand for connected services and gradual improvements in cloud infrastructure.

Role of AI in Cloud Computing in the Automotive Market

Artificial Intelligence (AI) is playing a transformative role in enhancing the capabilities of cloud computing within the automotive industry. By integrating AI with cloud platforms, automakers and service providers are enabling smarter, faster, and more data-driven innovations across the automotive value chain. Here’s how AI is shaping the cloud computing landscape in this market:

Advanced Predictive Maintenance:

AI algorithms process real-time data from connected vehicles via cloud platforms to detect wear-and-tear patterns and predict potential failures before they occur. This minimizes downtime and extends vehicle lifespan, especially in commercial fleets.

Enhanced Autonomous Driving Capabilities:

AI-powered cloud systems support autonomous vehicles by processing massive datasets from sensors, cameras, and LIDARs. The cloud enables real-time updates and decisions through AI models, improving safety, navigation, and object recognition.

Smarter In-Vehicle Experiences:

With AI integrated into cloud services, vehicles can offer intelligent voice assistants, personalized infotainment, and context-aware features. Cloud-based AI also enables continuous learning and updating of these systems to adapt to driver preferences and behavior.

Optimized Supply Chain and Manufacturing:

AI in cloud computing supports automotive manufacturers by forecasting demand, managing logistics, and streamlining production. It analyzes large-scale operational data to enhance efficiency and reduce costs across the supply chain.

Real-Time Data Analytics and Insights:

The combination of AI and cloud allows for real-time analysis of vehicle telemetry and customer usage patterns. Automakers can use these insights to develop new features, improve product designs, and offer predictive customer services.

Cybersecurity Enhancements:

AI-driven threat detection in the cloud helps identify vulnerabilities in connected vehicles and automotive networks. Machine learning models continuously monitor systems for anomalies and help mitigate cyber threats proactively.

Efficient Over-the-Air (OTA) Updates:

AI models hosted on the cloud can determine optimal timing and content for OTA software updates based on vehicle usage and driver behavior, ensuring minimal disruption and higher customer satisfaction.

Cloud Computing in Automotive Market – Scope and Report Coverage

- Growth Rate (2025–2034): CAGR of 16.09%

- Market Size in 2025: USD 9.72 Billion

- Market Size by 2034: USD 36.96 Billion

- Largest Regional Market: North America

Segmental Insights: Cloud Computing in Automotive Market

By Service Model

- Software as a Service (SaaS):

SaaS leads the cloud computing in automotive market, accounting for about 40% of revenue share in 2024. Its dominance is due to cost-effective, scalable solutions that allow automakers to deploy software updates, telematics, and infotainment services without heavy hardware investments. SaaS also supports real-time data analytics and predictive maintenance, aligning well with consumer demand for on-demand, subscription-based services. - Platform as a Service (PaaS):

PaaS is expected to grow at a robust CAGR of 18.7%. It provides a development environment for building cloud-connected vehicle software, supporting rapid innovation in data analytics, real-time monitoring, and over-the-air (OTA) updates. PaaS offers scalability and reduced time-to-market, making it attractive for automakers seeking agile development of advanced automotive features. - Infrastructure as a Service (IaaS):

While not as dominant as SaaS or PaaS, IaaS is crucial for providing the foundational cloud infrastructure that supports the deployment of connected vehicle services and large-scale data storage and processing.

By Application

- Connected Cars:

The connected cars segment held the largest market share (over 35% in 2024). Cloud computing enables real-time navigation, infotainment, and remote diagnostics, enhancing the driving experience and customer loyalty. As autonomous driving technologies advance, the reliance on cloud-based data processing and communication grows even further. - Supply Chain Management:

This segment is projected to witness the fastest growth. Cloud solutions improve supply chain visibility, demand forecasting, and inventory management, helping automakers streamline production and collaborate in real time with suppliers. This is especially important for just-in-time manufacturing and operational agility. - Other Applications:

Additional applications include telematics, fleet management, advanced driver-assistance systems (ADAS), predictive maintenance, and over-the-air (OTA) updates. These functions benefit from cloud platforms’ ability to handle large data volumes and support continuous software enhancements.

By Deployment Type

- Public Cloud:

The public cloud segment captured the highest revenue share (44% in 2024). Automakers prefer public cloud for its scalability, cost-effectiveness, and ease of access, allowing rapid deployment and flexible management of data-intensive automotive applications. - Hybrid Cloud:

Hybrid cloud is anticipated to grow at a CAGR of 19.9%. It combines the benefits of public and private clouds, offering both scalability and enhanced security. This model is increasingly favored for sensitive automotive data and mission-critical applications. - Private Cloud:

Private cloud solutions are chosen for applications requiring strict data security and compliance, such as proprietary vehicle data and critical operational systems.

Role of Leading Companies in Cloud Computing for the Automotive Market

1. Amazon Web Services (AWS)

Connected Vehicles & Data Management: AWS provides cloud solutions for connected vehicles, advanced driver assistance systems, autonomous driving, fleet management, and vehicle data analytics. Automakers use AWS to process real-time vehicle data, enable remote diagnostics, and deliver over-the-air updates.

Manufacturing & Supply Chain: AWS streamlines automotive production and optimizes supply chains, supporting digital transformation and sustainability initiatives.

Simulation & Development: AWS enables large-scale simulation workloads for autonomous vehicle development, offering scalable compute and storage resources.

- FY2024 Revenue: ~$105 billion (AWS segment)

2. Microsoft Azure

Autonomous Driving & Digital Platforms: Azure is the primary cloud platform for many autonomous vehicle solutions and powers major automotive clouds, connecting millions of vehicles globally.

Connected Services: Azure supports telematics, predictive maintenance, and in-car consumer experiences, leveraging AI, IoT, and big data analytics.

Collaboration & Security: Azure provides robust security, real-time updates, and collaboration tools for automotive software development, including partnerships for software-defined vehicle platforms.

- FY2024 Revenue: ~$62 billion (Azure segment)

3. Google Cloud Platform

Simulation & AI Integration: Google Cloud powers high-performance computing for vehicle simulation, advanced driver assistance systems, and autonomous vehicle development. Companies use Google Cloud for large-scale simulation and data management.

Connected Vehicle Ecosystems: Google Cloud enables over-the-air updates, remote diagnostics, and integration with Android Automotive OS, supporting new connected vehicle use cases.

Strategic Partnerships: Google Cloud collaborates with automotive suppliers to integrate generative AI and conversational technologies directly into vehicle cockpits, enhancing user experience and in-car connectivity.

- FY2024 Revenue: ~$37.5 billion (Google Cloud)

4. IBM Cloud

Hybrid Cloud & AI: IBM Cloud helps automakers innovate with hybrid cloud strategies, supporting software-defined vehicles, connected manufacturing, and real-time data analytics.

Compliance & Edge Computing: IBM Cloud’s global footprint supports compliance with data regulations and enables edge computing for low-latency, real-time vehicle services.

Digital Transformation: IBM’s AI and automation tools streamline production, accelerate research and development, and enhance customer experiences across the automotive value chain.

- FY2024 Revenue: ~$17.1 billion (IBM Cloud & Cognitive Software)

5. Oracle Cloud

ERP & Analytics: Oracle Cloud provides comprehensive ERP and analytics solutions for automotive manufacturers and suppliers, optimizing product lifecycle management, supply chains, and demand forecasting.

AI & Edge Computing: Oracle’s AI and machine learning tools support autonomous vehicle research and development, predictive maintenance, and real-time data processing at the edge.

Customer Experience: Oracle’s platforms enhance customer engagement through personalized services and integrated marketing.

- FY2024 Revenue: ~$19.4 billion (Cloud Services & License Support)

6. Alibaba Cloud

Big Data & Autonomous Driving: Alibaba Cloud offers scalable infrastructure for collecting, storing, and analyzing massive vehicle data, essential for autonomous driving research and real-time telemetry.

AI & Smart Cockpits: Alibaba Cloud’s generative AI powers smart cockpit solutions, in-car voice assistants, and advanced driver interaction systems for automakers.

High-Precision Mapping: Alibaba Cloud delivers high-precision mapping and spatial intelligence for advanced autonomous vehicles.

- FY2024 Revenue: ~$12.7 billion (Alibaba Cloud)

7. SAP

Supply Chain & Manufacturing: SAP’s cloud solutions optimize automotive supply chains, manufacturing, and financial management, supporting real-time decision-making and compliance.

Digital Transformation: SAP enables digital twins, predictive maintenance, and connected car ecosystems, helping automakers adapt to electric vehicles, shared mobility, and advanced driver assistance trends.

Customer Engagement: SAP’s platforms enhance customer experiences and support new mobility services through integrated data analytics and cloud applications.

- FY2024 Revenue: ~$35.9 billion (Total SAP)

- SAP’s total revenue for 2024; cloud revenue was $14.6 billion.

8. Siemens

Cloud-Based Design & Simulation: Siemens offers cloud-based solutions for electrical and electronic systems design, leveraging digital twins and digital threads for rapid innovation and collaboration.

Software-Defined Vehicles: Siemens accelerates software development for software-defined vehicles using virtual validation and real-time simulation.

Manufacturing Efficiency: Siemens’ cloud tools streamline automotive software development, testing, and validation, improving efficiency and reducing time-to-market.

- FY2024 Revenue: ~$79.4 billion (Total Siemens)

9. Bosch

IoT & Edge Cloud Solutions: Bosch develops local and central cloud solutions for connected vehicles, enabling real-time data processing, vehicle-to-everything communication, and over-the-air updates.

Software Platforms: Bosch is building software-defined vehicle platforms on leading cloud infrastructure, simplifying the development and deployment of vehicle software.

Safety & Security: Bosch focuses on secure vehicle communications and privacy, supporting advanced driver assistance and connected mobility.

- FY2024 Revenue: ~$99.4 billion (Total Bosch)

10. Continental

Smart Cockpit & AI Integration: Continental integrates AI technologies into its smart cockpit systems, enabling natural language interactions and generative AI features for drivers.

Centralized Vehicle Computing: Continental’s high-performance computers, powered by cloud and AI, support software-defined vehicle architectures and rapid deployment of new digital features.

Cloud Collaboration: Continental collaborates with leading cloud providers to deliver scalable, secure cloud solutions for automotive applications, combining mobility expertise with cloud infrastructure.

- FY2024 Revenue: ~$47.5 billion (Total Continental)

11. NVIDIA

AI & Accelerated Computing: NVIDIA provides accelerated computing platforms for AI training, simulation, and in-vehicle processing, powering autonomous vehicles, advanced driver assistance systems, and digital twins.

Simulation & Digital Twins: NVIDIA enables automotive companies to create digital twins for product development, testing, and manufacturing optimization.

Industry Partnerships: NVIDIA collaborates with automakers and tech firms to deliver AI-driven solutions from the cloud to the car, advancing the development of safe and intelligent mobility systems.