A group of Los Angeles labor unions is proposing a ballot measure they say would combat income inequality in the city by raising taxes on companies whose chief executive officers make at least 50 times more than their median-paid employee.

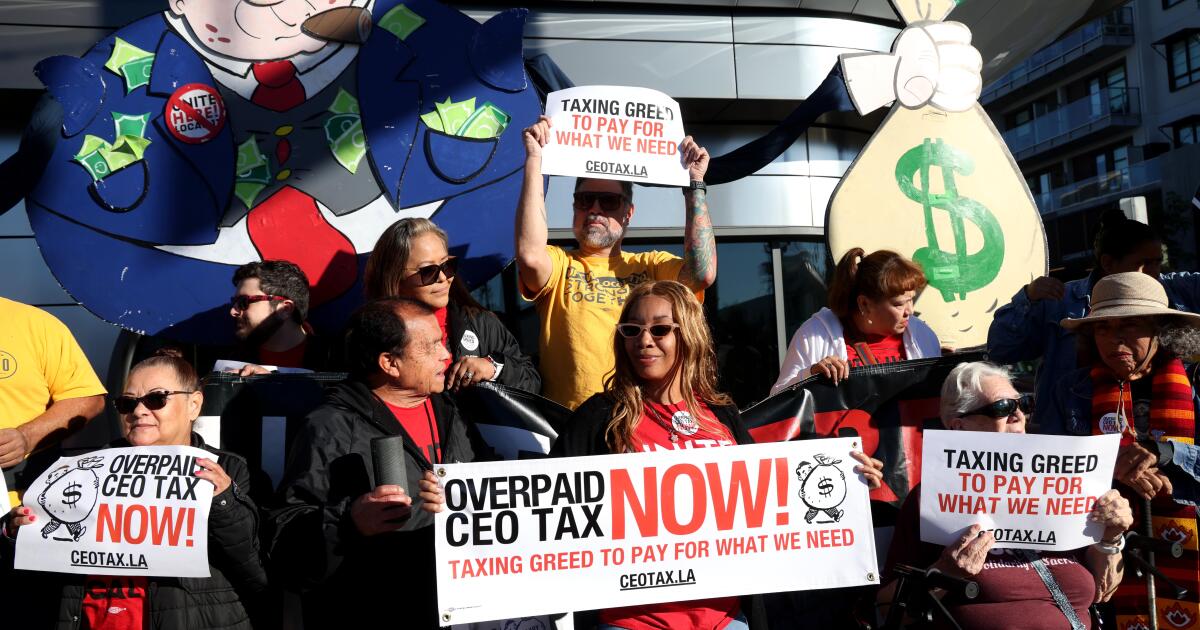

The so-called Overpaid CEO Tax initiative was announced Wednesday at a rally outside Elon Musk’s Tesla Diner in West Hollywood, and featured union workers holding signs that read “Taxing greed to pay for what we need,” and a cartoon cutout of a boss carrying money bags and puffing a fat cigar.

“It’s high time the rich paid more taxes,” said Kurt Petersen, the co-president of Unite Here Local 11, which represents airport and hotel employees.

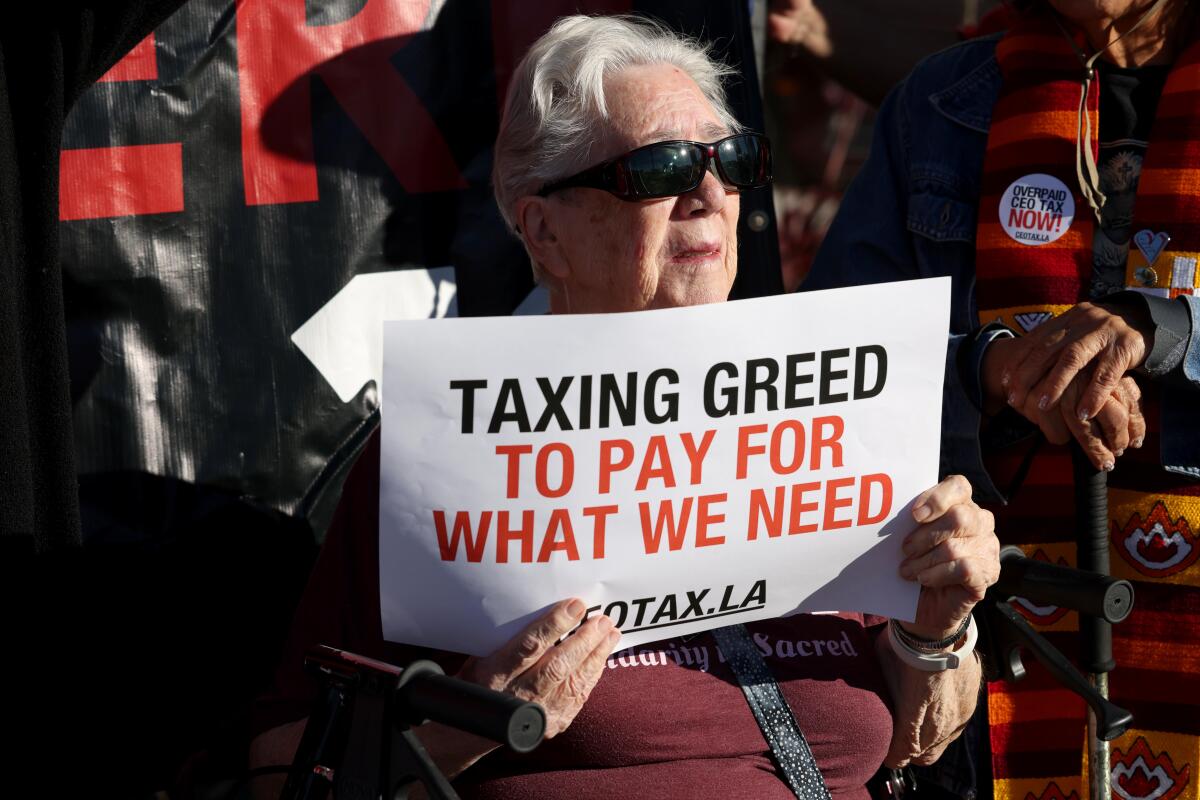

Sister Diane Smith of Clergy and Laity United for Economic Justice joins the Fair Games Coalition at a rally in West Hollywood on Wednesday.

(Genaro Molina / Los Angeles Times)

The proposal is sponsored by the Fair Games Coalition, a collection of labor groups that includes the Los Angeles teachers union, and comes on the heels of a statewide ballot proposal for a one-time 5% wealth tax on California billionaires that would raise money for healthcare for the most vulnerable.

Revenues raised by the CEO tax would be earmarked for specific purposes and not go directly to the city’s general fund.

According to proponents, 70% would go to the Working Families Housing Fund; 20% would go to the Street and Sidewalk Repairs Programs and 5% would go both to the After-School Programs Fund and the Fresh Food Access Fund.

In order to place the measure on the November ballot, supporters must collect 140,000 signatures in the next 120 days.

Critics say the proposal is misguided and would drive business away from the city.

“It would encourage companies that have minimal contact and business in Los Angeles to completely pull out,” said Stuart Waldman, head of the Valley Industry & Commerce Assn. “You’ll never see another hotel built in Los Angeles. It’s just one more thing that will drive business away.”

He added that $350 million for affordable housing would create about 350 units of affordable housing per year, which would not do much to affect the city’s housing crisis.

“That does nothing to help people. But on the contrary, that tax would do more to hurt people by pushing businesses out of Los Angeles and pushing jobs out of Los Angeles,” he said.

United Teachers-Los Angeles President Cecily Myart-Cruz said teachers support the proposal because it would not only raise money for after-school programs, but also help teachers find housing in L.A.

“They can’t live where we teach, because the prices are out of reach,” Myart-Cruz said.

Supporters argue that the tax will not chase businesses out of Los Angeles.

Kurt Petersen, co-president of Unite Here Local 11, speaks in favor of a measure that would increase taxes on companies whose chief executive officers make at least 50 times more than their median paid employee.

(Genaro Molina / Los Angeles Times)

“Sure if they want to leave the second largest market in the country, go for it. But no one’s leaving that,” Petersen said.

The ordinance, if passed by voters, would impose an additional tax of up to 10 times the company’s regular business tax, based on the pay difference between the highest-paid employee at the company and the lowest, the initiative said.

According to the coalition, the current city business tax is between 0.1% and 0.425% of gross receipts.

If a top manager at a company makes between 50 and 100 times the median employee, the company will pay an “Overpaid CEO tax” equal to the business tax otherwise paid by the company. If the top manager makes greater than 500 times the median employee, the business would be required to pay an additional tax of 10 times the business tax otherwise owed.

“The bigger the gap, the higher the tax,” Petersen said.