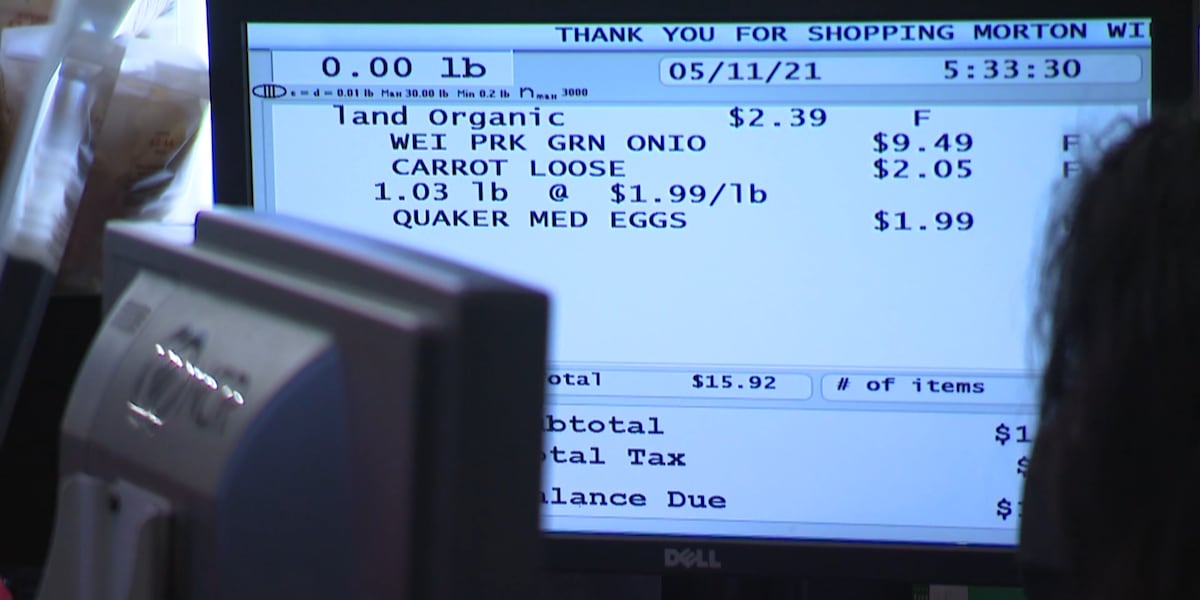

WILMINGTON, N.C. (WECT) – Federal government data shows inflation holding steady at 2.7%, but consumers continue to face higher costs across essential categories, from groceries to utilities.

The latest statistics show inflation rates vary significantly by category. Groceries overall increased 3.1%, with meats, poultry, fish and eggs rising 3.9%. Food away from home jumped 4.1%, while non-alcoholic beverages climbed 5.1%.

Energy costs overall rose 2.3%, but fuel and oil spiked 7.4%. Electric bills increased 6.7%, and natural gas costs surged 10.8%.

University of North Carolina at Wilmington (UNCW) economist Dr. Mouhcine Guettabi said consumers now pay about 30% more for groceries than five years ago. What cost $100 at the grocery store now costs $130.

“The bottom line is that how you feel about inflation depends on their take-home pay. And how much that take-home pay has increased, relative to what’s happened to that box of cereal or that lemon. Because that’s what ultimately tells you about your purchasing power,” Guettabi said.

Inflation rates for the following categories can be seen below:

Groceries

- Overall: 3.1%

- Meats, poultry, fish, and eggs: 3.9%

- Food away from home: 4.1%

- Non-alcoholic beverages: 5.1%

Energy costs

- Overall: 2.3%

- Fuel/oil: 7.4%

- Electric: 6.7%

- Natural gas: 10.8%

Medical services

- Overall: 3.5%

- Hospital services: 6.6%

- Physican services: 1.9%

Other

- Car maintenance and repair: 5.4%

- Rent, mortgage, property taxes, etc: 3.2%

The inflation prices can be attributed to the cost of labor or supply costs.

“Either supply costs increase over time. If the farmer has increased prices because the things that they buy have increased, they’re going to try to pass on some of that cost to you. Then there is the fact that wages over the pandemic have increased. If I’m a restaurant and my bill to pay my workers has increased quite substantially, I’m going to have to increase my prices to keep up,” said Guettabi.

Another factor contributing to inflation is tariffs. But economists report the effect of tariffs hasn’t been what they expected to see.

“So far, the effects of tariffs have actually been much milder than most people have assumed and forecasted. The shock on inflation from tariffs have been milder than anticipated so far,” said Guettabi.

Many families aren’t seeing the same increase in paychecks, forcing tough budgeting choices as prices rise across categories.

“Be cognizant of where the deals potentially are, do a little more research, and then just try to stay away from impulse buying, and that’s where those purchases tend to hurt,” said Guettabi.

Guettabi said discount stores like Walmart tend to perform better during inflation peaks because of competitive pricing and everyday deals. He recommends shopping in bulk and researching purchases.

“Set a budget and stick to it. Do your research. The internet has made it really easy to do comparison shopping. It doesn’t hurt to go to a few different stores; some deals pop up at different stores,” Guettabi said.

Simple changes like switching brands or shopping locations can provide some relief, though consumers shouldn’t expect significant changes on receipts anytime soon.

“Unfortunately, the price increases we’ve experienced over the last few years because of COVID, because of supply restrictions, because of a myriad of factors, are here to stay. And there is really not much relief the consumer is going to face,” said Guettabi.

Making the tough choices is frustrating for the everyday consumer, said Guettabi. When everyday necessities are getting more expensive at a faster rate than your paycheck, it may feel like you’re drowning.

“Your dollar is not stretching as far as it used to. You feel like you can’t make it to the end of the month. And that’s really the big, big challenge with inflation is that it just eats up money, especially if our wages are not increasing at the same clip as the things that we tend to buy, in particular necessities.”

Copyright 2026 WECT. All rights reserved.