A third of Americans will learn the hard way about Social Security.

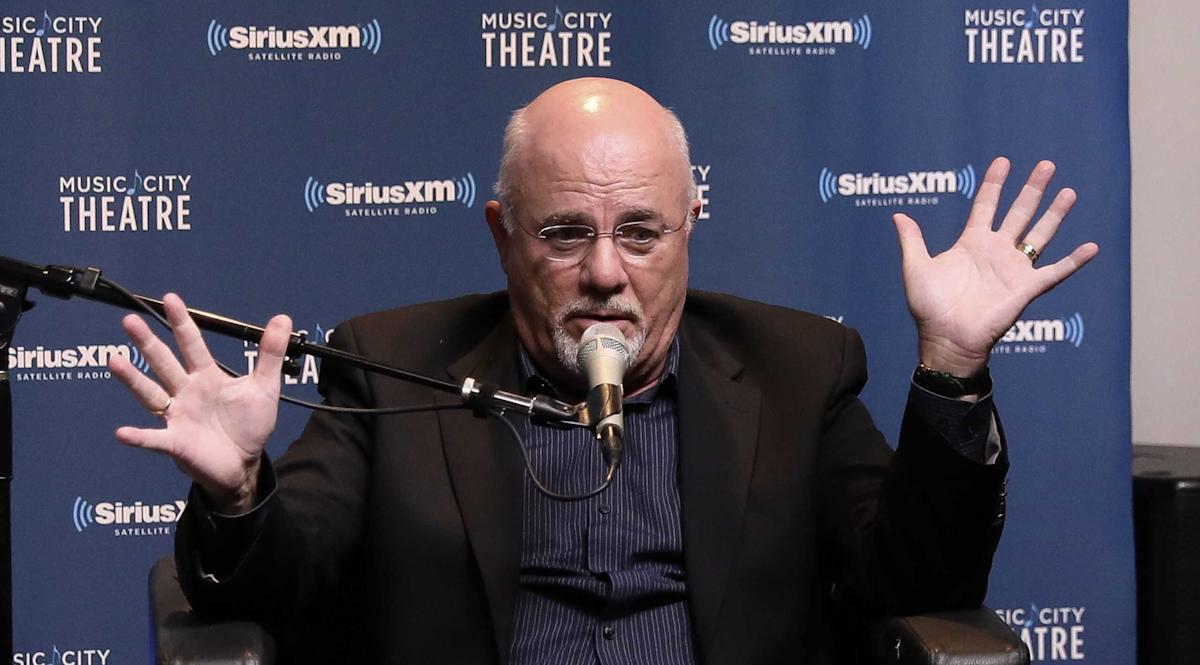

That’s according to finance guru, Dave Ramsey, who warns that Social Security alone is insufficient, and instead recommends maxing out 401(k) and IRA savings.

By 2034, he says, Social Security’s reserves are expected to run out of money if nothing changes. “Depending on what Congress does (or doesn’t do), future retirees might need to prepare for the possibility of reduced benefits, and workers might see a hike in Social Security taxes,” added Ramsey.

Bottom line – we can’t count on the government to take care of us in retirement. And to be honest, you don’t want to put your retirement hopes and dreams in the hands of the government. Look, if you get benefits when you retire, that’s great. But if your goal is to make Social Security your key source of income, you really are setting yourself up for disaster.

At the moment, more than four million Americans are turning 65 between now and 2027. “That’s over 11,000 people hitting this milestone every single day. The program’s cash surplus is expected to run out in less than a decade,” according to NPR.

That also means that when more people go to retire, they’ll be met with limited resources from Social Security. With that being the case, many of us need to figure out how to make the most of our finances to have a safe, healthy retirement.

Max out your contributions to retirement accounts if you can.

Accounts with tax advantages – 401(k)s, IRAs, health savings accounts, etc. – are great ways to save and invest for the future. In many cases, contributions to these accounts can help cut your taxable income for the 2025 tax season. You have until April 15, 2026, to contribute the maximum amount for it to apply to your 2025 taxes.

Also, if your employer offers a match program, contribute enough to receive the highest employer match possible. You can also max out your health savings account if you have one. Let’s say your employer will match up to 6% of your salary; maximize that.

Consider this. Let’s say you earn $100,000 a year and that your employer will match 50% of your contributions up to 5% of your salary or $5,000. With your contribution and the employer match, $7,500 is saved every year. Over 30 to 40 years of that, you’ll have a solid balance.

Put extra money on hand into retirement instead of just spending it on anything.

You should be setting aside 15% of your household income for retirement if you can, said Ramsey.

He recommends investing 15% of gross household income into tax-advantaged retirement accounts (401(k)s, Roth IRAs) to build wealth, with debt under control and with an emergency fund established.

“An example from Ramsey Solutions highlights how people under 40 can save $1 million for retirement. If someone is making $80,000 annually, they would need to invest $1,000 per month to reach that 15%. Putting that into “good growth stock mutual funds” could bring in more than $1.5 million in a retirement nest egg by age 65. Holding off retirement another five years could result in $2.8 million,” added Benzinga.com.

For many of us, getting out of debt is easier said than done.

According to Dave Ramsey, focus on the smaller balances first. That way, you free up even more cash for the heavier debt. Then, once the smaller debts are paid off, you now have new cash flow to tackle to make extra payments on higher interest balances.

Then, as noted by Ramsey Solutions, “Make minimum payments on all debts except the smallest—throwing as much money as you can at that one. Once that debt is gone, take its payment and apply it to the next smallest debt (while continuing to make minimum payments on your other debts).”

Then, repeat that over and over again until you drive down your overall debt.

Or, you could make just minimum payments on all of your debt and put a chunk into the expense with the most interest. Or three, you could take out a consolidation loan, wipe out all of the outstanding debt, and have one balance. Not only could this allow you to manage your debt a bit better, but it may also allow you to put extra funds into an emergency account.

For more than a decade, the investing advice aimed at everyday Americans followed a familiar script: automate everything, keep costs low, and don’t touch a thing. And increasingly, investors are realizing that being completely hands-off also means being completely disengaged.

That realization hits like a lightning bolt when you realize not just how much better your returns could be, but that there are amazing offers like one app where new self-directed investing accounts funded with as little as $50 can receive stock worth up to $1,000.

Take back your investing and start earning real returns, your way.