DAVE Ramsey has warned Americans of a common Social Security move that will never work – and how 401k plans could get many free cash.

It comes amid the biggest retirement surge in history – with more than four million Americans turning 65 between 2024 and 2027.

Sign up for the Money newsletter

Thank you!

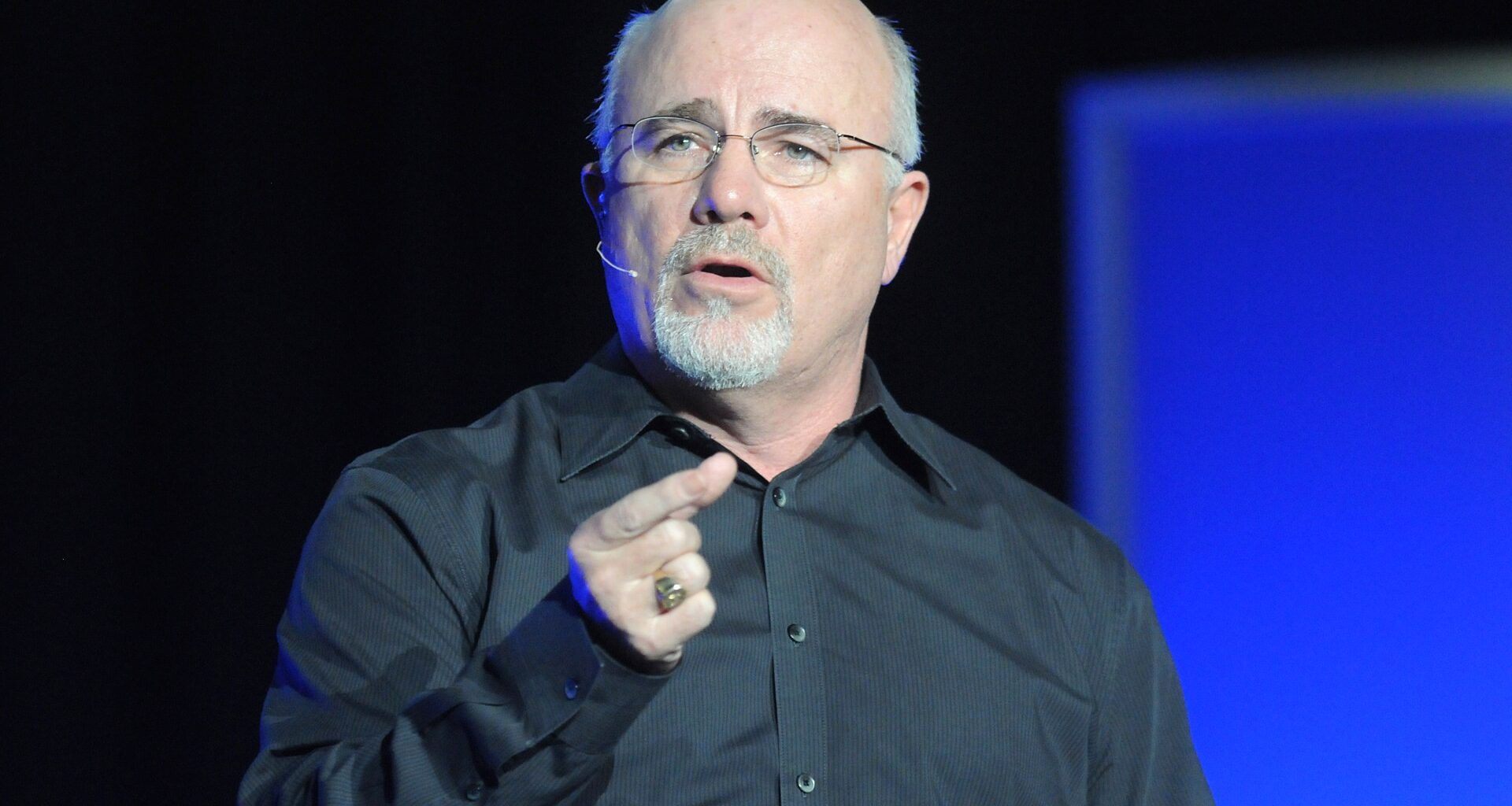

Money Expert Dave Ramsey has warned Americans of a common Social Security moveCredit: Getty

He gave advice to retiring Americans looking to pocket more cashCredit: Getty

Over 11,000 Americans are reaching retirement age – a phenomenon being dubbed “Peak 65”.

And as many look towards retirement at a time of limited nationwide resources, experts are weighing in on how to make the most of your own finances.

Bestselling money author Dave Ramsey has issued a stark warning for Americans planning to rely heavily on Social Security during retirement.

He said: “Social Security will replace a chunk of the income you made throughout your career based on your lifetime earnings.”

HELPING HAND

My ‘poor mindset’ got me into $50k of debt – but an expert says to side hustle

BRAVE DAVE

Dave Ramsey reveals why now is ‘a great time to be in business’ for Americans

According to the Social Security Administration (SSA), in January 2026 the estimated average monthly Social Security retirement benefit is $2,071.

The expert added: “No matter how you slice it, that’s not a lot to live on (even with cost-of-living adjustments every year.”

“Among the elderly, 12% of men and 15% of women rely on Social Security for 90% or more of their income.

“Folks, these payments were always meant to replace some of your income in retirement – not all of it.”

Giving out a key bit of advice, Ramsey urged Americans to make use of their 401k plans.

He strongly advised workers to take advantage of employer-sponsored 401(k) plans – if your company offers one.

Explaining the difference between the two main types of plans, he outlined the traditional 401k as well as the Roth 401k.

The former lets any American save for retirement using pre-tax cash.

The taxes will then be owed later on, both on what they contributed and on any investment gains or employer matches, when they take the funds out.

A Roth 401(k) works the opposite way, with users paying after‑tax money now, and in retirement.

But they can withdraw both their contributions and all the growth in their account completely tax‑free.

Ramsey said: “Many employers will offer a company match – that’s when your company offers to match a percentage of your retirement contributions in your 401(k).

“Translation? Free money!”

As of January 2026, the maximum amount Americans can contribute to a 401(k) per year is $24,500.

Those who are 50 or older can make catch‑up contributions – with their total allowable contribution $32,500 instead.

Withdrawals from a 401(k) are generally not allowed until an account holder reaches 59-and-a-half years old.

Taking out cash before that age results in taxes and an early‑withdrawal penalty from the IRS.

Ramsey pointed to a few reasons why opening an IRA is a smart move.

“If you have money in a retirement plan with a former employer — like a 401(k) — you can roll that money into an IRA so you have more control over your investment options,” Ramsey said.

“IRAs are a great option for saving for retirement if you don’t have access to a workplace retirement plan.”

He continued: “If you need a tax-free investing account to go along with your tax-deferred 401(k) plan a Roth IRA fits the bill.

“An IRA works great alongside your workplace plan as an additional tax-advantaged account that allows you to save even more for retirement.”

Highlighting the flaws of traditional IRAs, he said: “Since you’re not paying taxes on your contributions this year, you’ll have to pay taxes on that money and its growth when you take the money out in retirement (that’s why it’s called tax-deferred growth).

“And who knows what the tax rate will be when you retire?”

Dave Ramsey is a bestselling finance authorCredit: Getty