A surplus of Tk3,042 crore remains in govt accounts

02 February, 2026, 07:40 am

Last modified: 02 February, 2026, 09:47 am

Illustration: TBS

“>

Illustration: TBS

Highlights:

- DMTCL halted metro tenders after bids nearly doubled estimates

- MRT-1 and MRT-5 costs rose 90–100 percent

- Restricted Jica-funded processes limited competition, driving inflated bids

- Fresh international assessments and revised DPPs planned

- Officials say overpricing starts at feasibility stage

- Re-tendering, local capacity, smart financing seen as solutions

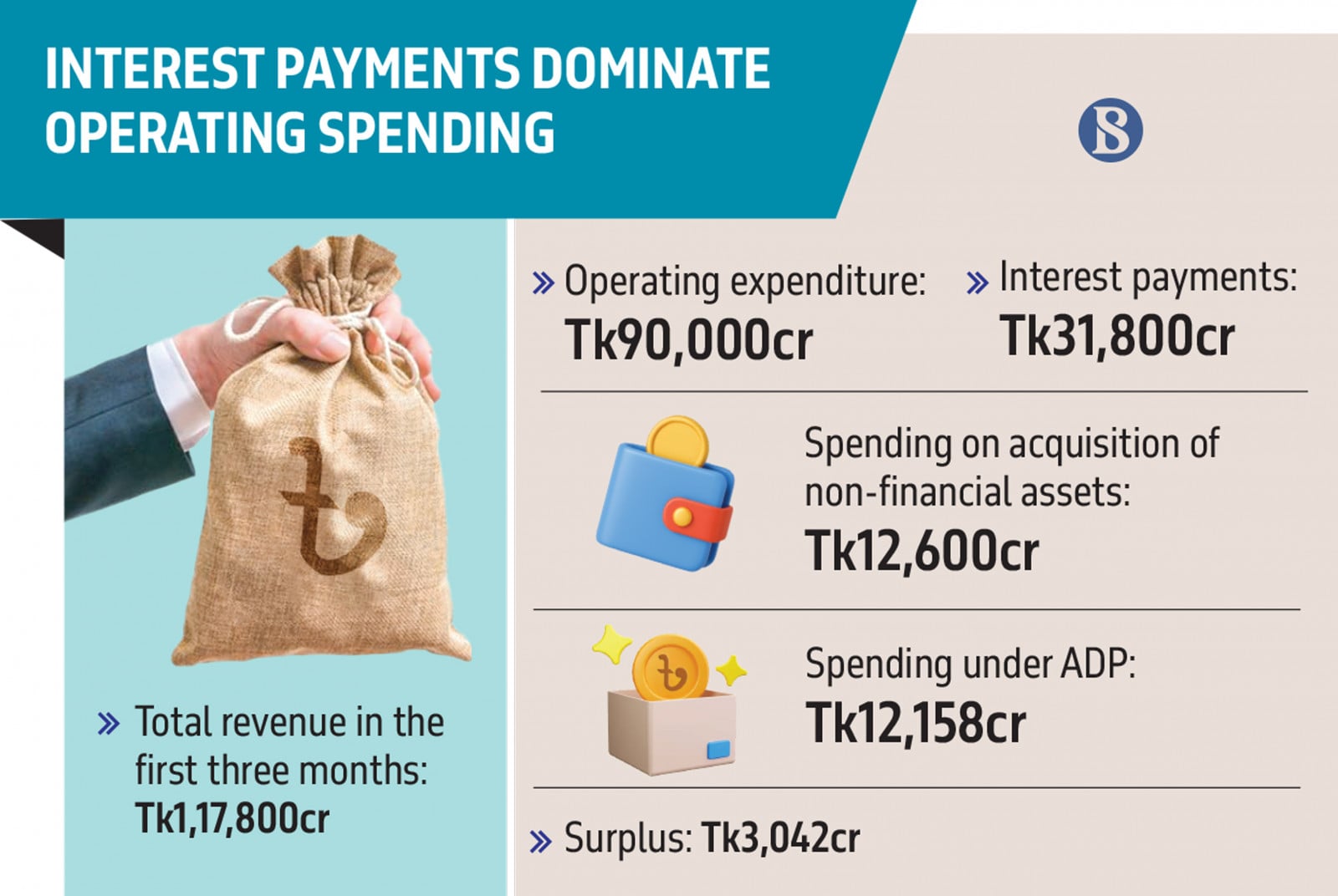

In the first three months of the 2025–26 fiscal year, 35.33% – or Tk31,800 crore – of the government’s operating expenditure was spent on servicing debt interest.

This was the single largest item of spending, covering interest payments on both domestic and external debt. Notably, interest payments also account for the largest allocation within the operating budget.

Keep updated, follow The Business Standard’s Google news channel

For the current fiscal year, the government has adopted a budget of Tk7.9 lakh crore in total expenditure, of which Tk5.4 lakh crore has been allocated to the operating budget. Of this operating budget, 22% – or Tk1.22 lakh crore – has been earmarked for interest payments, including Tk1 lakh crore for domestic debt interest and Tk22,000 crore for foreign debt interest.

These figures were highlighted in the Government Finance Statistics report for the first three months (July to September) of the 2025–26 fiscal year, published by the Office of the Comptroller General of Accounts.

Infograph: TBS

“>

Infograph: TBS

According to the report, the government spent a total of Tk90,000 crore during the first three months. Of this, Tk16,900 crore was spent on salaries, allowances and pensions for government employees. In addition, Tk5,300 crore was spent on goods and services, Tk15,800 crore on subsidies, Tk8,400 crore on grants, and Tk8,700 crore on social safety net programmes. Expenditure in other sectors amounted to Tk3,100 crore. The government also spent Tk12,600 crore on the acquisition of non-financial assets.

Meanwhile, data from the Implementation Monitoring and Evaluation Division (IMED) of the Planning Commission show that development expenditure during the first three months of the fiscal year stood at Tk12,158 crore.

During this period, the government earned total revenue of Tk1,17,800 crore. Of this, Tk92,100 crore came from tax revenue collected by the National Board of Revenue (NBR) and other taxes. Grants amounted to Tk700 crore, while non-tax revenue and other income totalled Tk25,000 crore.

The report states that the government did not need to borrow to meet operating expenditure during the first three months of the fiscal year. After covering operating expenditure and spending on non-financial asset acquisition from total revenue, the government had a surplus of Tk15,200 crore. Even after meeting development expenditure, a surplus of Tk3,042 crore remained in government accounts.

An official from the Finance Division, speaking on condition of anonymity, said the surplus appeared mainly because development expenditure was low. Under the current government, fewer new projects have been taken up, and spending on ongoing projects has also been limited.

The official added that in the first three months of the current fiscal year, the National Board of Revenue collected more than 20% higher revenue compared to the same period of the previous fiscal year, but development spending did not increase accordingly.

When asked about the issue, Towfiqul Islam Khan, Additional Director (Research) at the private research organisation Centre for Policy Dialogue (CPD), told The Business Standard, “Allocations for interest servicing and salaries and allowances are always fixed in the budget, as interest on past borrowing must be paid. As a result, there is little scope to adjust these expenditures. Because spending in other areas that was expected at the start of the fiscal year did not take place, a large share of expenditure appears to have gone towards interest payments.”

He noted that it would not be possible to exit this situation quickly.

“If the government can increase revenue collection and avoid high-interest borrowing, pressure from debt servicing could ease. However, in recent fiscal years, borrowing has been used to finance operating expenditure. Ideally, borrowing should be directed towards sectors where the resulting asset creation generates returns greater than the loan principal and interest,” he said.

Towfiqul added that there was a time when deficit budgets were not a major concern, but that framework has now broken down. As a result, Bangladesh faces rising debt risks, and the budget structure itself has come under strain. An elected government, he said, must undertake a deep review of the situation and take informed decisions.