Were you a New York resident who filed Form IT-201 with your state resident income tax return for 2023?

If so, state officials announced Thursday, you could be in for New York’s first inflation refund check.

The 2025-26 state budget will provide for one-time payments to New Yorkers who paid increased sales tax due to inflation. Better still, you don’t need to do anything to qualify for a payment of up to $400.

The state said the checks would be in the mail beginning in mid-October.

Gov. Kathy Hochul wanted “to put money back in New Yorkers’ pockets. These checks will ease the burden of rising costs for millions of people across the state,” Hochul press secretary Gordon Tepper said in an email Thursday.

Here’s how you qualify, according to the New York State Department of Taxation and Finance. You need to have filed Form IT-201 for the 2023 tax year and you must have reported income within certain qualifying thresholds. And you can’t have been claimed as a dependent on another taxpayer’s return.

Here are the thresholds:

- Those filing under single status with an income of $75,000 or less will receive a refund of $200, while those with an income between $75,000 and $150,000 will receive $150.

- Those married and filing joint returns claiming an income of $150,000 or less will receive $400, while those with that filing status earning between $150,000 and $300,000 will receive $300.

- Married and filing separate returns? Those with $75,000 income or less will get $200; income between $75,000 and $150,000, you’ll get $150;

- For head of household status, those with $75,000 income or less will get $200. If your income is between $75,000 and $150,000, you’ll get $150.

- For a qualified surviving spouse, you’ll get a check for $400 if you claimed income of $150,000 or less — and $300 if you claimed income between $150,000 and $300,000.

The state’s announcement said more than 8 million New Yorkers would receive the one-time refunds, which would be mailed out over “a multiple-week period” beginning in mid-October.

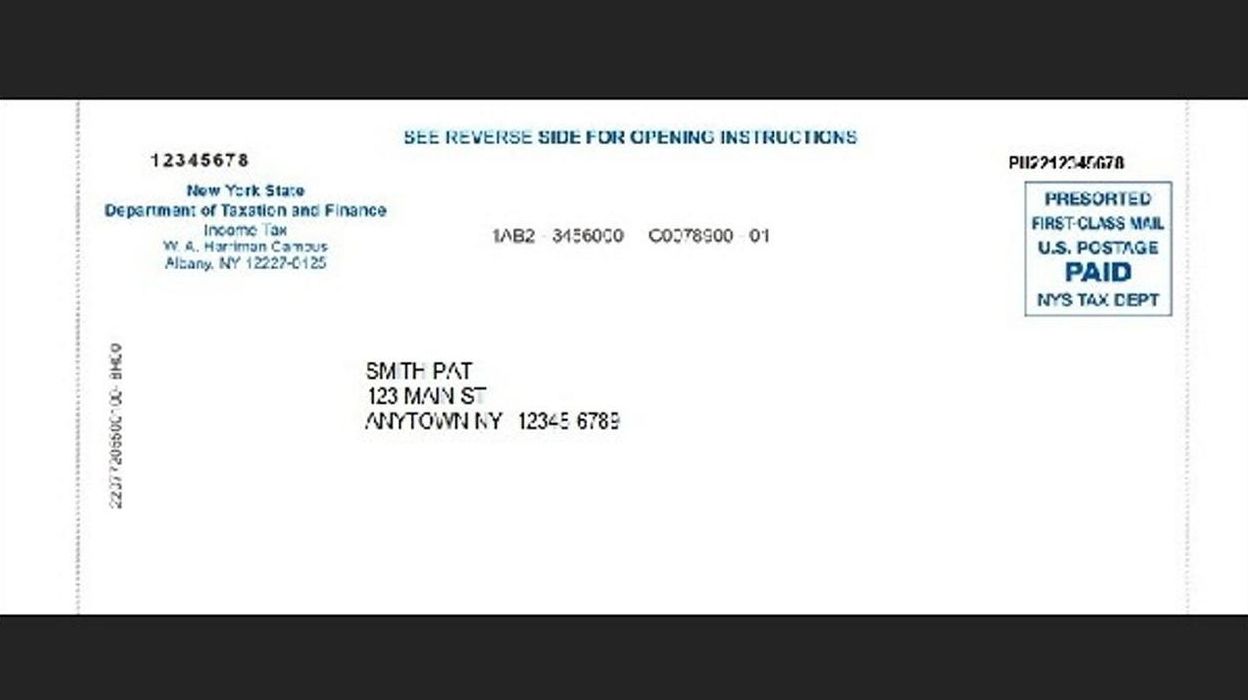

If you are eligible, the inflation refund check will be mailed to the address associated with your most recently filed tax return.

If you did not file a return for the 2023 tax year or did not file Form IT-201, you will not receive a refund check.

John Valenti, a reporter at Newsday since 1981, has been honored nationally by the Associated Press and Society of the Silurians for investigative, enterprise and breaking news reporting, as well as column writing, and is the author of “Swee’pea,” a book about former New York playground basketball star Lloyd Daniels. Valenti is featured in the Emmy Award-winning ESPN 30-for-30 film “Big Shot.”