Council vote halts effort to change high-value real estate tax ahead of June election.

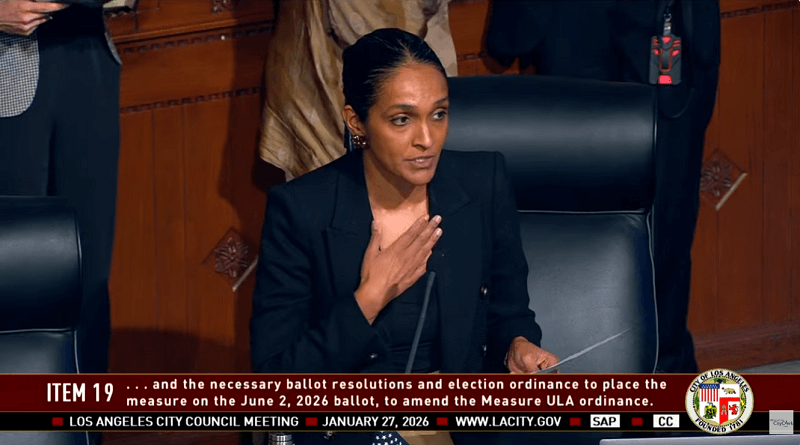

Los Angeles city leaders voted against a last-minute proposal to reconsider the city’s high-value real estate transfer tax, blocking an effort to place changes to the measure on the June 2026 local ballot.

The motion, which was put into committee, would provide those trying to rebuild in the Pacific Palisades with a exemption from paying ULA tax with proof of hardship through a natural disaster and would be retroactive to January 2025. Multifamily properties would be redefined as any building with four or more units and commercial properties as any property that is not for residential use.

Measure ULA imposes a 4% tax on property sales between $5 million and $10 million and a 5.5% tax on transactions above $10 million.

Because the measure was approved by voters, any amendments would require voter approval. The council’s action ensures that no such vote will take place in the next election.

CD 11 City Councilwoman Traci Park said, in her weekly newsletter, “At the same time, pressure continues to build around Measure ULA, which has exacerbated our housing crisis and made the cost of living in LA even higher. Worse, it’s out of step with the realities facing families trying to rebuild. The need for drastic reform is no longer theoretical – it’s necessary. This week, the Council declined to advance a measure to reform ULA to the June ballot, and instead held it for further debate and potential referral for the November election. I am going to keep pushing this forward.”

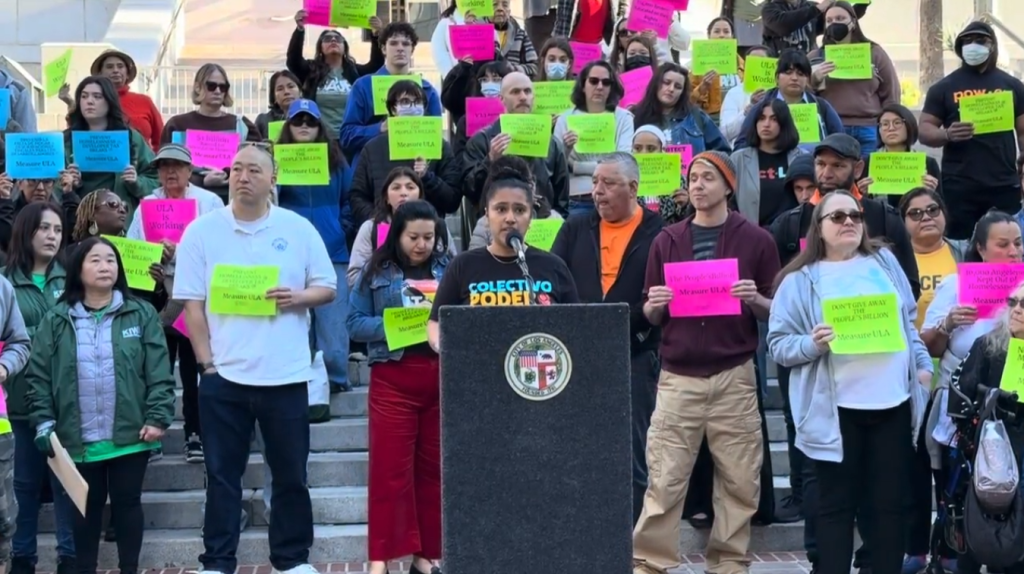

Yvonne Wheeler, President of the Los Angeles County Federation of Labor, AFL-CIO, said at a press conference, “United to House LA was not written in a back room. It was written out of lived experience – by housing advocates, policy experts, and working people who see the human cost of this crisis every single day. And then it was overwhelmingly approved by the voters of this city. Construction workers voted for it. Homecare workers voted for it. Teachers voted for it. Nurses, janitors, grocery workers – the very people who keep Los Angeles running – voted for it.”

The issue is unfolding against the backdrop of a proposed statewide ballot measure that would sharply limit municipal transfer taxes and restrict other local revenue tools. That campaign is being organized by the Howard Jarvis Taxpayers Association, which is collecting signatures ahead of a late February deadline to qualify the initiative for the November 2026 ballot.

Some Democratic lawmakers and housing advocates argue that opposition to Measure ULA has fueled support for the statewide proposal, which they warn could significantly constrain local governments’ ability to fund housing and public services.