At a glance

A San Diego mother shares her strategy for feeding a family on a strict weekly budget. We break down the economics of grocery pricing and offer tips for navigating the city’s high cost of living.

A few years ago, Alli Powell was the prototypical modern mom. She had two young kids, a full-time job and a house in Santee.

And, like so many of us, she was watching her bills go up and up. High on the list was the monthly food bill.

“I was going to the grocery store without a plan,” Powell said in a recent interview with KPBS. “We were eating out a lot, and it just got overwhelming. I realized how much money I was spending.”

She was spending more than $200 per week on groceries in 2017. In 2025 dollars, that’s about $267.50. They were also ordering takeout and going out to eat.

Powell wanted to make a change. So she started small, planning three home-cooked dinners a week. Two were crockpot meals that didn’t require much work.

Now, she plans five to seven dinners a week. She shares her weekly grocery hauls on an Instagram account called “Grocery Getting Girl.”

The weekly game plan

Before going to the store, Powell takes stock of the perishable items at home. This week, she’ll use a tub of yogurt in a chicken recipe. Two bell peppers that are starting to wilt will become part of a stir fry.

“Fridge, pantry and freezer. Everything is checked,” she said. “The least shelf stable items take priority. So anything in the produce drawer is going to be my first priority to use up. Freezer is going to be last.”

Powell’s budget is $150 per week at the grocery store – often Food 4 Less – and $250 every four to six weeks at Costco. If she’s under budget at the grocery store, that money goes into the Costco budget.

“I’m usually always under budget at the grocery store, but that’s not usually the case at Costco,” she said.

Powell usually buys meat at Costco and freezes some of it. She also gets snacks, milk and household products there. She sticks to Food 4 Less for fresh produce and bread. She keeps an eye out for sales, as long as the items are frequently on her shopping list.

One other tip she shares? Leave the family at home when you go shopping.

“I always like to shop alone,” Powell said. “When your kids and your significant other come along, that bill starts going up because they’re throwing things in the cart.”

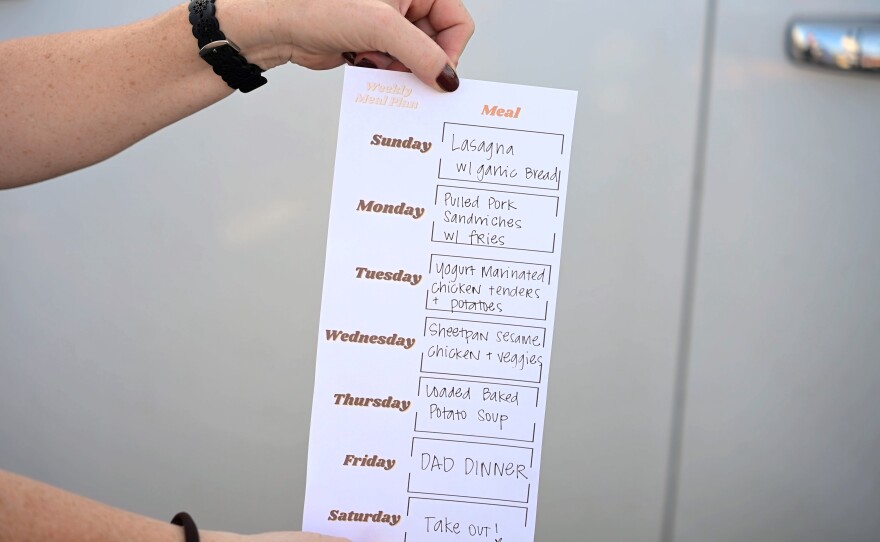

Powell typically cooks five to seven dinners a week for her family. She plans them around the perishable ingredients in her refrigerator first, then looks at what she has in the freezer and pantry before making her grocery shopping list. She held her meal list outside the Santee Food 4 Less on Friday, Dec. 12, 2025.

Years of inflation

Like pretty much everything else, grocery prices in San Diego started skyrocketing during the pandemic. Price increases have also been influenced by the bird flu, Trump’s tariffs and even the weather.

But don’t put too much blame on grocery stores, said Mike Palazzolo, an associate professor of marketing at UC Davis. He studies how consumers make financial decisions, especially when it comes to groceries.

Grocery stores get one or two cents of profit per dollar spent there, he said. The rest goes to things like manufacturers and employee wages.

“Grocery retailers don’t have a whole lot of power to set prices,” he said. “A lot of their profit comes from volume as a result.”

Selling a larger volume gives bigger grocery stories some power. Costco, for example, offers a small set of products they can change out anytime.

“Costco is able to keep prices down because at any moment they’re willing to just tell a manufacturer, ‘We’re not carrying your product anymore. Sorry,’” he said.

Buying in bulk can get you a lower price per item. But not all families can afford to, Palazzolo said.

“Lower income households may not have the liquidity necessary to take advantage of some of the things we might take for granted, like buying a 36-pack of toilet paper, which will get you a cheaper price per roll but will require you to shell out maybe $30 all at once for something that may last you four or five months,” he said.

While wealthier families are more likely to buy in bulk, middle income families are more likely to use coupons, Palazzolo said. Families with lower incomes may have less time to search for coupons or compare different stores’ prices.

In April, the San Diego City Council adopted an ordinance banning digital-only coupons within the city. Proponents said those coupons aren’t always accessible for seniors or English language learners.

Palazzalo said this kind of policy might make better deals accessible to more people, but they might not last.

“Often the reason these coupons are given is that the retailers want to encourage app downloads,” he said. “If they can’t encourage app downloads with these bigger coupons, they may just stop giving away those bigger coupons altogether.”

Back in Santee, Powell says going to the store with a plan can keep your grocery bill in check.

“I had to take it in baby steps and what worked for me and my lifestyle at the time,” she said. “Plan it out when you have the time, when it’s convenient to you, when you don’t feel rushed.”

San Diego’s cost of living is roughly 50% higher than the national average. While the median household income is around $104,321, the income needed to afford a median-priced home ($920k+) is now estimated at over $260,000.