article

article

Residential apartment buildings on 6th Avenue in New York, US, on Thursday, July 3, 2025. Tenants in New York City’s roughly 1 million rent-stabilized apartments will face a fourth straight year of price hikes. Photographer: Michael Nagle/Bloomberg v

NEW YORK – The FARE Act went into effect one month ago, ending broker fees in New York City – the effect on the rental market has been minimal, according to StreetEasy.

The effect of the FARE Act

What we know:

The FARE Act, which went into effect on June 11, prohibits brokers who represent landlords from charging broker fees to tenants. The law also requires landlords to explicitly disclose all fees that tenants must pay before tenants sign a rental agreement.

In this context, a broker is an agent hired by a landlord to secure tenants – prior to the FARE Act’s passing, landlords could pass these fees on to their prospective tenants.

Critics of the act, like the Real Estate Board of New York (REBNY), argued that renters would ultimately pay the price.

“New Yorkers will soon realize the negative impacts of the FARE Act when listings become scarce, and rents rise,” REBNY President James Whelan said in response to the act’s passing.

However, a new report released by online listings platform StreetEasy finds that has not been the case, at least as of today.

By the numbers:

Data obtained by StreetEasy reveals that the number of rental listings has stabilized after a momentary dip a few weeks ago.

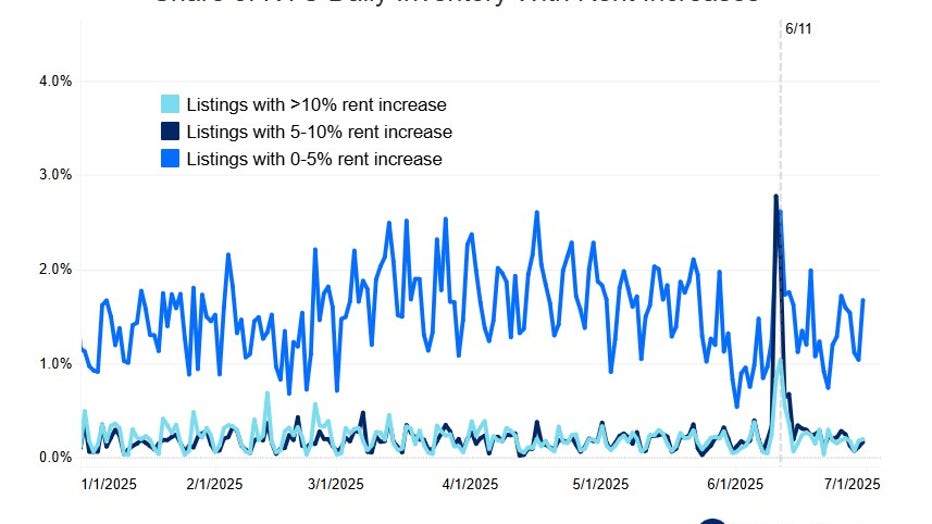

StreetEasy also determined that rent growth has remained fairly stable since the act was passed.

“Listings that charged a broker fee prior to the FARE Act’s implementation saw an average annualized rent increase of 5.3 percent,” which is less than one percent above the average rent growth for rentals that did not have a broker’s fee before the act.

Less than 2 percent of rentals have raised rent by over 10 percent following the passing of the FARE Act.

The Source: This article includes reporting from StreetEasy.