With the specter of tariffs (unfortunately) back in the news, it’s time to revisit one of the Trump Administration’s agenda items that combines some of its health care and trade policies. In recent months, the Food and Drug Administration (FDA) has accelerated implementation of the state importation program (SIP) under Section 804 of the Federal Food, Drug, and Cosmetic Act. The SIP, yet-unutilized due to immense bureaucratic requirements, is intended to allow states and tribes to import select prescription drugs at a cheaper price from Canada. This dueling push to impose tariffs on pharmaceuticals and simultaneously promote importation pathways for individuals (while subject to these tariffs) is confounding at best and self-defeating at worst.

The slow adoption of SIPs has frustrated importation advocates. As of July 2025, Florida remains the only state with an approved SIP, although actual drug shipments have not yet commenced. Several other states, though, including Colorado, New Hampshire, and New Mexico, have proposals under review or in development. The FDA has thus taken some notable steps to encourage the submission and implementation of SIPs. Between May and July 2025, it released a series of enhancements and guidance aimed at turning the promise of Canadian drug importation into practice. The May 2025 “enhancements” introduced three major reforms: pre-submission reviews for draft SIP proposals, informal meetings to clarify requirements, and development of a “user-friendly” online application toolkit – all designed to improve proposal quality and shorten review timelines. The agency also relaxed cost-savings calculations, allowing states to use static baseline models if assumptions are well-documented.

This week, the FDA published further official guidance to spur Section 804 work. This guidance offers clear, actionable steps to program sponsors: a full checklist of required elements, a helpful “Tips for SIPs” document, and a small-entity Q&A compliance guide. It also clarifies the evaluation process, noting that the FDA may seek additional information, and that SIP authorization may include extensions of up to two years. The guidance also formalizes states’ ability to request optional informational meetings before and after official proposal submissions, a strategic resource for early regulatory coordination.

In perhaps the most interesting inclusion, the FDA attempted a prebuttal to the mercurial state of tariffs:

States may choose to generally identify tariffs as an area of uncertainty or, as appropriate, may assume that tariffs have a neutral impact for the purpose of section 804 demonstration of cost-savings. For example, states could either assume constant tariff rates or omit consideration of a tariff on section 804 drugs imported from Canada entirely.

In short, the FDA tells states to assume that tariffs don’t matter and have a neutral impact on this program. Hmmm. After Canada has been one of the most consistent recipients of high tariff rates and the president suggested a 200-percent tariff on pharmaceuticals? Interesting. It doesn’t say that SIP drugs are exempt from these tariffs, just that you should pay them and ignore their role in the cost of goods. If cost effectiveness analysis isn’t supposed to include a key variable, then the result probably has some bias (or is outright incorrect). Sure, “neutral.” So, at the same time the president continues to threaten pharmaceutical tariffs to make companies either lower the list prices of their drugs or onshore pharmaceutical manufacturing, the administration is also pursuing a policy that would make patients pay immense costs up front.

A few other hurdles remain to the full adoption of Section 804. Many have expressed reservations about this program and the issues in the drug supply and utilization chain it may cause. Canadian officials have resisted supporting this new market and expressed concerns about drug shortages and ensuring companies uphold their contractual obligations to Health Canada. Some U.S. policymakers and health officials have argued that there are other, more useful drug pricing policies that should be pursued. Patient advocates and prescribers have warned of safety concerns, purity issues, and the increased likelihood patients would be exposed to scams. And then there is the basic issue of patients not being able to procure the drugs they want – either because the system is complicated or the desired drug isn’t allowed to be imported. The FDA itself must also ramp up internal capacity to review proposals, inspect facilities, perform oversight, and manage post-import data.

The July guidance represents a step forward in truly implementing SIP pathways. Translating policy desires into detailed application materials and procedural clarity reduces ambiguity and administrative burdens for states and tribes to participate in the program. With these tools in hand, Section 804 could finally shift from a theoretical pathway to the functional mechanism the president desires. Let’s just hope the opposing tariff and health care policy goals get resolved before patients are on the hook for the administration’s policy incoherence.

Chart Review: Medicare Trustees Report Cites Aging U.S. Population as the Main Driver of Medicare Insolvency

Nicolas Montenegro, Health Policy Intern

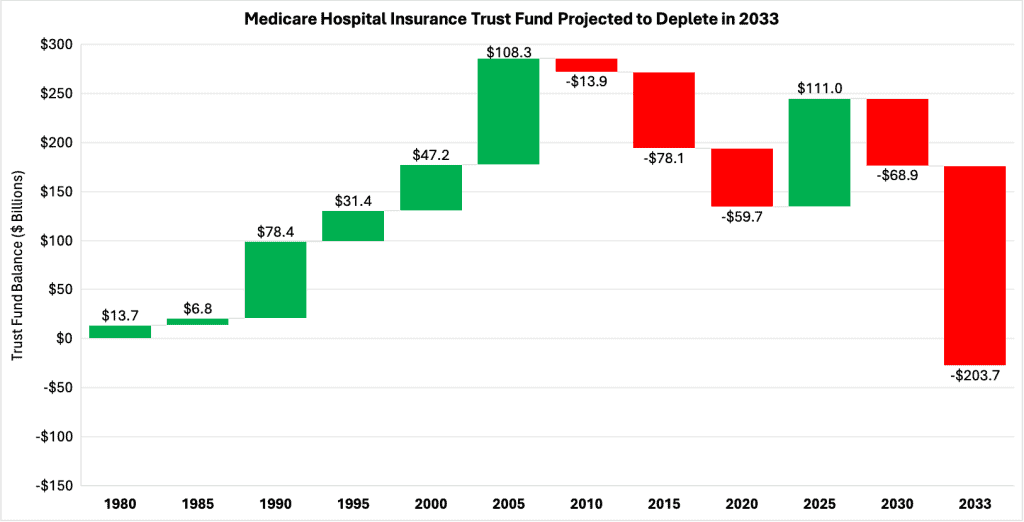

The latest Medicare Trustees report has renewed concerns about the program’s long-term solvency under current law, projecting that the Hospital Insurance (HI) Trust Fund will be fully depleted three years earlier than previously estimated. Although the fund’s expected insolvency has accelerated since the last report, the underlying problem remains the same: Revenue generated by payroll taxes is not keeping pace with the rising health care expenditures of Medicare beneficiaries. This shortfall stems from several factors, most notably the country’s aging population and strong annual growth in the cost and utilization of health care services.

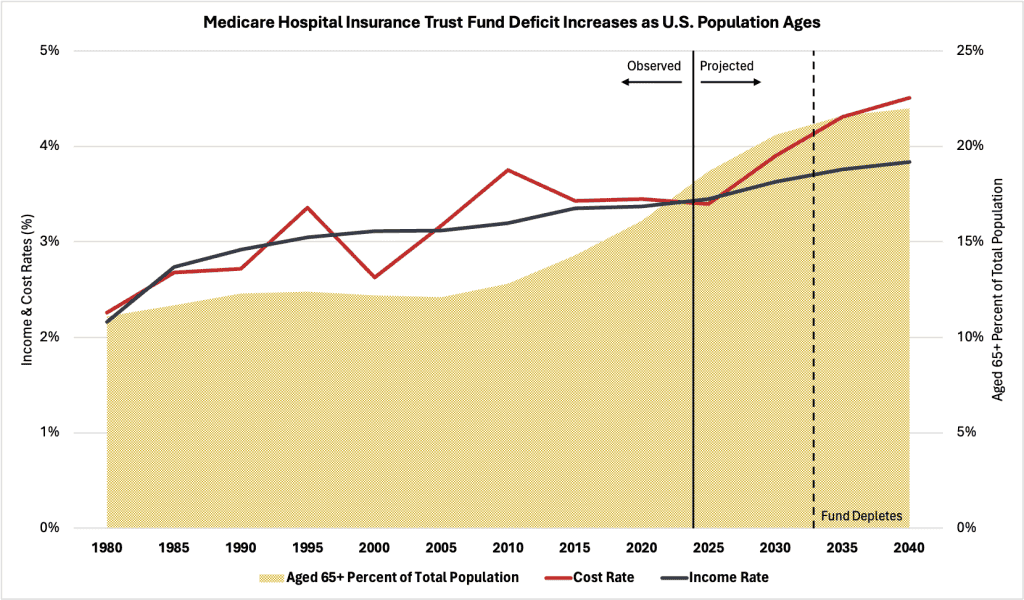

The Medicare age-eligible share of the total U.S. population has increased considerably over the past two decades, from about 12 percent in 2005 to over 18 percent in 2024 (see chart below). This growth was especially strong in 2011, when the first wave of the baby boomer generation began turning 65 years old. The surge in population growth from this generation caused drastic shifts in age demographics and employment over time that haven’t occurred in subsequent generations. As this population exits the workforce and enrolls in Medicare, fewer people are left contributing payroll taxes to the trust fund, while more people are drawing benefits. These interconnected factors impact both the income and cost rates of the HI trust fund, creating a financial imbalance that will compromise program solvency.

Illustrated by the blue line in the chart below is the income rate of the HI trust fund – which represents the fund’s revenue (income) as a percentage of the total taxable earnings (payroll) from covered employment. The red line represents the cost rate of the HI trust fund – that is, the fund’s expenditures (cost) as a percentage of the same taxable earnings. According to the Trustees Report, beginning in 2027, the fund’s cost rate (projected at 3.89 percent annually) will sharply exceed the income rate (projected at 3.63 percent annually) until the fund depletes entirely by 2033, at which point more than one in five Americans will be eligible for Medicare under current law. Underscoring these projections is the expectation that personal health care prices will surpass core inflation in the future, suggesting growth in economic output and real wages (the source of payroll taxes) will not keep pace with expected per-beneficiary Medicare expenditures.

While the HI trust fund has experienced cash-flow deficits in the past, its net asset balance has always remained positive. The projected deficits starting in 2027 are expected to drain the fund of more than $280 billion by 2033, when the trust becomes insolvent. To compensate for this tremendous decline in the trust fund’s balance, Part A beneficiaries will see their benefits slashed, which may lead to worse health care outcomes for millions of Americans who depend on the program. this potentially disastrous outcome, lawmakers will need to make substantial reforms to Medicare.