The Nifty remained under consistent pressure throughout Friday’s session, as disappointing earnings from heavyweight Tata Consultancy Services (TCS) dampened market sentiment. The index failed to stage any notable rebound from lower levels and ultimately closed below immediate support zones, reinforcing the ongoing bearish tone.

For the third straight session, the Nifty was dragged down by Technology and Auto stocks. After opening lower, the index continued its downward trajectory through the day. As the market failed to hold key support levels, the Nifty ended below the 25,200 mark.

The index eventually closed with a sharp loss of 205 points at 25,149, its lowest closing level since June 24, 2025. On a weekly basis, the Nifty declined 1.22%.

Despite the broader market weakness, Hindustan Unilever, SBI Life, and Sun Pharma emerged as top gainers on the Nifty, showing relative resilience. In contrast, TCS, M&M, and Hero MotoCorp were among the major laggards, bearing the brunt of the sell-off.

The Nifty Midcap and Smallcap indices also witnessed profit booking, mirroring the benchmark’s decline. The Nifty Midcap 100 fell for the sixth consecutive session, down 0.9%, while the Nifty Smallcap 100 dropped 1.02%.

Barring Nifty Pharma and FMCG, all sectoral indices ended in the red. Nifty IT, Auto, Media, and Oil & Gas were among the top losers, with the Nifty IT index falling nearly 2% after TCS reported weaker-than-expected Q1FY26 results.

On the stock-specific front, Glenmark Pharma was the standout performer, surging up to 20% on the back of a cancer drug licensing deal. The company’s subsidiary, Ichnos Glenmark Innovation (IGI), signed an exclusive agreement with AbbVie for ISB-2001.

TCS’s weak Q1 numbers and cautious commentary weighed heavily on market sentiment. A key concern from the results was the 3.3% sequential drop in constant currency revenue. While deal wins stayed within the guided range, they declined versus the March quarter. US Dollar revenue also fell short of expectations, though net profit was supported by higher other income.

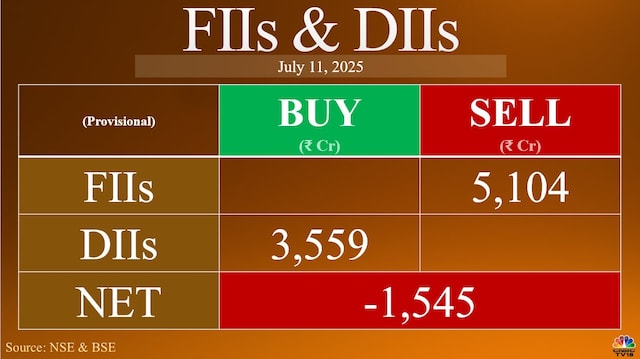

Meanwhile, foreign investors were net sellers in the cash market on Friday, while domestic institutional investors continued to be net buyers.

Looking ahead to Monday, market focus will shift to upcoming earnings reports from HCL Technologies, Ola Electric, Tata Technologies, and Rallis India. Avenue Supermarts, which posted its earnings after market hours on Friday, will also be in focus.

According to Nandish Shah of HDFC Securities, the Nifty broke below key support levels at 25,331 and 25,222 and ended below its 20-day moving average (20-DMA). The short-term trend has turned bearish, with the next support seen in the 24,900-25,000 range. On the upside, the former support level of 25,331 could now act as immediate resistance.

Amol Athawale of Kotak Securities said that as long as the market remains below 25,300/83,000, bearish sentiment is likely to persist. A breach below this level could lead to further downside toward the 50-day SMA around 25,000/82,100 and even further to 24,800-24,650/81,500-81,100. Conversely, a move above 25,300/83,000 may revive sentiment, potentially driving the index toward 25,550-25,650/83,700-84,000.

Rupak De of LKP Securities added that the Nifty remains weak, having slipped below the previous swing low on the hourly chart and below the 21-EMA on the daily timeframe. Momentum indicators such as RSI also suggest short-term weakness.

However, following the recent correction, the index is nearing support at the 200-hourly moving average. A move above 25,150-25,160 in early trade could trigger a short-term rally toward 25,250 and 25,400. Key downside levels to watch are 25,090 and 24,900, De said.

For Bank Nifty, the 20-day SMA and the 56,500 mark are critical supports. A break below these could see it retest the 56,000-55,800 zone. On the upside, a fresh rally is likely only above 57,100, which could then extend gains toward 57,500-57,700-58,000, Athawale said.