Unlike a year ago, homebuyers in Fort Worth might spot a few additions to “For Sale” signs in front of homes that say “price reduced” or “new price.”

Paul Epperley, Greater Fort Worth Association of Realtors president and a Realtor at Century 21 Judge Fite, has noticed a few of those signs too, but he doesn’t want buyers to get the impression that things have shifted too much.

“There is a curve in the road right now, for sure, I think we’re getting back to a stable market,” Epperley said. “I wouldn’t say that it’s flipped in favor of the buyer. We need a few more things to happen or inventory to increase for that to happen.”

But some of the more competitive prices on homes is a sign things have changed since a year or so ago, he said.

“Then, you could charge whatever you wanted, and somebody would buy it within a day, because that’s just the way things were going,” he said.

As head of the local Realtors’ association, Epperley says this market shift is proving to be a “teaching moment” for many of the younger Realtors out there.

“A lot of our Realtors haven’t lived through a buyer’s market,” he said. “It’s been a seller’s market so long that they’re not really prepared. They haven’t fine tuned that tool yet to get a seller to price the house a little bit more competitively. That’s something some of them just haven’t seen before.”

The market stabilization in the Fort Worth region is a welcome sight, Epperley said.

“The market is becoming more balanced, which allows home buyers to take their time when they are looking for a home during the summer season,” he said. “We experienced a higher-than-normal sales volume in the past few years, and the balanced market will allow for more people to find and afford a home.”

Fort Worth proper, however, clearly remains a seller’s market with the highest number of sales at 1,001 homes and just over 4.2 months of inventory, indicating a high demand for quick sales, according to the Realtor association.

When compared with Dallas, which has 5.4 months of inventory, Fort Worth has a tighter housing market.

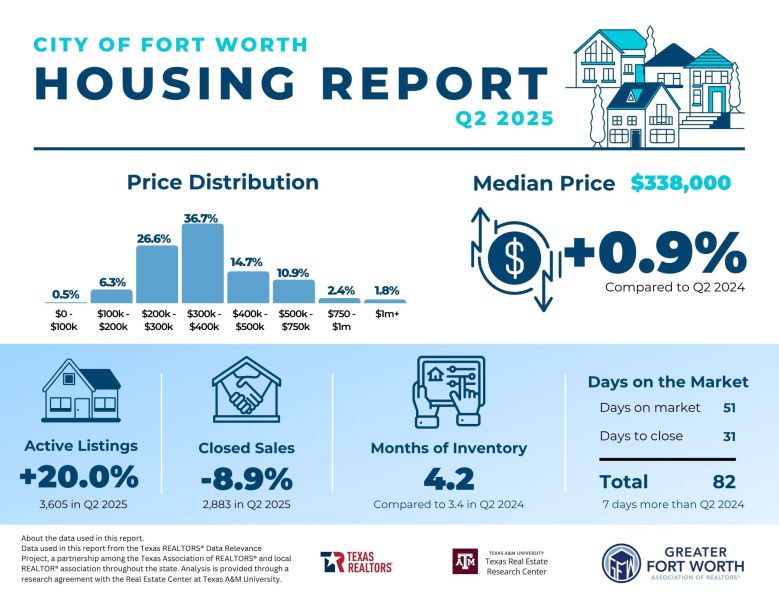

Fort Worth housing report for the second quarter of 2025 from the Greater Fort Worth Association of Realtors. (Courtesy image | Greater Fort Worth Association of Realtors)

Fort Worth housing report for the second quarter of 2025 from the Greater Fort Worth Association of Realtors. (Courtesy image | Greater Fort Worth Association of Realtors)

“If you’re willing to go a little bit outside Fort Worth, you may find some deals, but a lot of people coming from California or New York, they’re not going to know Haltom City or Burleson, they won’t know to look there,” Epperley said.

Realtors are learning to market those areas to play up the Fort Worth connection because they are close to the city and may make sense to the buyer, he said.

“You’ve got to let your buyers know about those options, because someone from outside the area probably won’t know that,” he said.

Some buyers may want to look outside Tarrant County, where the housing markets are more in balance, Epperley said.

Some areas are going to be priced differently and it takes someone with market savvy, like a trained Realtor, to understand that, he said.

“Real estate is always local, but right now it’s micro-local, you have to look at the fine details. You need somebody who can really help you with that, who knows those small subdivisions where things might be shifting. Southlake is not the same as Burleson,” Epperley said.

June 2025 Median Home Prices at a Glance

- Fort Worth: $339,740

- Johnson County: $355,000

- Parker County: $476,245

- Tarrant County: $355,000

Tarrant County leads in sales volume at 2,043, indicating strong buyer activity despite a slight 2.3% year-over-year sales decline.

Tarrant County’s homes are also selling quickly, with only 46 days on market and just four months of inventory, showcasing the area’s competitive home buying conditions.

Parker County, for instance, has a more balanced home buying and selling market, with 6.3 months of inventory and homes staying on the market for an average of 69 days.

Johnson County is edging toward a balanced housing market, with 5.2 months of inventory and homes staying on the market for an average of 63 days. Closed sales for Johnson County increased by 9.2% year-over-year, indicating strong demand despite a longer time on the market.

Stubborn mortgage rates

Current 30-year average mortgage rates stand at 6.796%. Looking ahead, both Fannie Mae and the Mortgage Bankers Association forecast gradual decreases through early 2026, but analysts don’t expect the return of 3% mortgage rates in the foreseeable future.

“Thirty-year fixed mortgage rates are not coming down as far as fast as everybody would like them to,” said Steve Cotton, president of Addison-based Cotton Wealth Management Associates.

Cotton notes that there are some provisions in the recent One Big Beautiful Bill Act that aim to address housing affordability for lower and middle income homebuyers, but interest rates remain stubbornly high.

“Six (percent) to seven percent mortgage rates are proving to be a little bit of a disincentive for buyers,” he said.

The No. 1 request from buyers is concessions to buy the rate down, Epperley said. In that case, sellers pay an upfront fee to a lender to lower the interest rate on a mortgage, either temporarily or permanently. This reduces the monthly mortgage payment for a set period or for the life of the loan.

“At the end of the day, that is a benefit for both the buyer and the seller,” he said. “If a seller were to give a $10,000 concession versus knocking the price of the house down $10,000, with closing costs, and all the adjustments that are made, the seller actually ends up a little bit ahead of the game in the end. It’s a win-win.”

Epperley noted that a year ago, Realtors were advising clients to wait and see what interest rates would do.

“We told clients then to ‘marry the house, date the rate,’ meaning to negotiate a new rate when rates fall,” he said. “Well, now it’s ‘marry the house, marry the rate’ because rates aren’t falling. That’s where we are now.”

Tariff impact?

While home prices have shown some stabilization, Cotton said Trump’s July 8 announcement of a 50% tariff on copper imports could increase prices of the metal, a large component in new homes, and raise the cost of homes.

“My concern is, if you do get long-term mortgage rates down, yet the cost of materials and copper and wiring is going up, that’s going to offset that,” he said.

That could also impact new home construction and further reduce the already low inventory in the area.

The demand for housing in Dallas and Fort Worth remains high, but inventory is still not expanding enough to keep up with supply, Cotton said.

Dallas and Fort Worth are ranked No. 3 in terms of new units per 1,000 homes, according to the National Association of Home Builders Housing Market Index. The amount of housing units approved in 2024 was down 7.9% from 2022.

“It’s not a blessing for home buyers, because this is a seller’s market, and it’s not a home buyers market, because supply is constricted, and prices remain elevated and interest rates remain elevated,” said Cotton. “I think we’ll get there eventually, but I don’t think those numbers will get better quick.”

Bob Francis is business editor for the Fort Worth Report. Contact him at bob.francis@fortworthreport.org.

At the Fort Worth Report, news decisions are made independently of our board members and financial supporters. Read more about our editorial independence policy here.

Related

Fort Worth Report is certified by the Journalism Trust Initiative for adhering to standards for ethical journalism.

Republish This Story

Republishing is free for noncommercial entities. Commercial entities are prohibited without a licensing agreement. Contact us for details.