Stephen Lovekin / Shutterstock for AWNewYork / Shutterstock.com

Commitment to Our Readers

GOBankingRates’ editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services – our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Trusted by

Millions of Readers

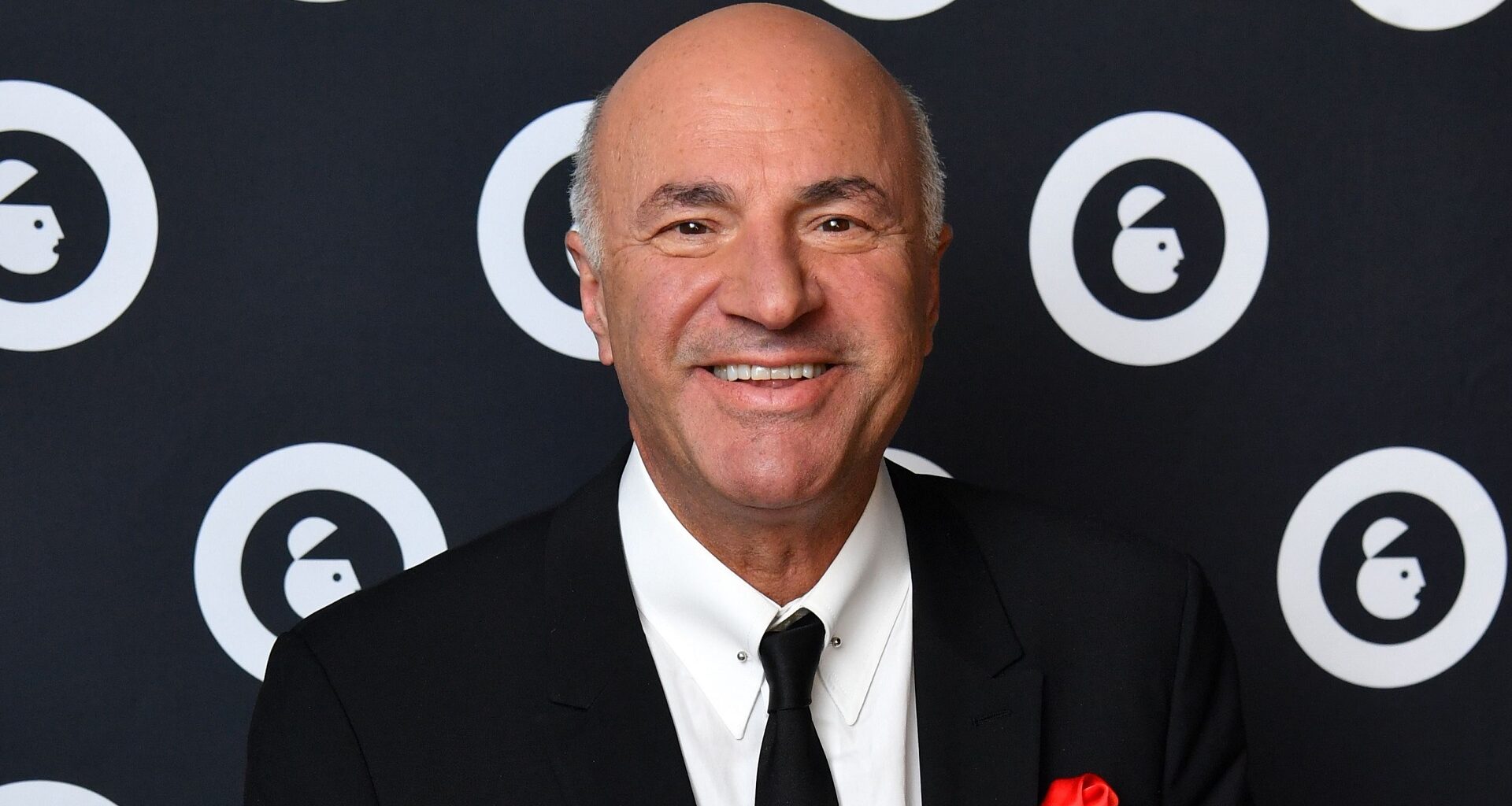

The word “retirement” on its own can be scary to think about. Luckily there is something that could help establish a way to start saving and be ready for retirement — entrepreneur Kevin O’Leary’s “90-Day Number.”

GOBankingRates breaks down what his method is and how it can boost your retirement saving strategy.

Being Ready For Retirement

Relying on Social Security alone is not a stable retirement plan. However, options like 401(k) plans and IRAs can help.

O’Leary explained that 401(k) plans are automatically withdrawn through an individual’s paycheck but IRA’s require the individual to directly open an account and contribute funds or set up auto contributions.

He called attention to the fact that many people spend more money than their paycheck allows and find it tough to put any extra money towards their 401(k) plans. To be able to increase retirement savings, O’Leary advises that individuals use a strategy called the 90-Day Number.

The 90-Day Number

O’Leary believes one of the smartest ways to understand where an individual stands financially starts with a simple 90-Day Number.

According to The Street, he recommends breaking money management down to one number based on total earnings over a three-month window, which he refers to as the 90-Day Number.

This short-term approach can help lead to better budgeting decisions and long-lasting financial results.

Finding the 90-Day Number

Finding a person’s 90-Day Number helps them know how much money they have available to put toward their 401(k) plan or IRA. This is achieved by looking at all sources of income and then listing all expenses separately including debt payments, car loans, rent and bills.

The main idea is to subtract the total expenses from the total income over three months, and if the answer is a positive number, then the person can consider contributing extra money towards their 401(k) plan or IRA.

If the answer is a negative number, then re-evaluation is needed to see how much spending goes beyond the amount of earnings and being sure to set up a plan for a budget to get finances back on track. Once that is accomplished, try again to find a suitable amount to contribute to retirement accounts.

Saving For Retirement

Using O’Leary’s 90-Day Number can help an individual know how much money they have available to put towards saving more for retirement, but here are a few more things to consider.

- Have a goal in mind about the amount to save for each month but also look at the current salary and future lifestyle expectations to help determine the right amount. Saving at least 15% of pre-tax income each year is usually the rule of thumb, but depending on the situation, more might be appropriate, per First Citizens Bank.

- Choose the retirement account that is best suited to the individual. Take a careful look at the different types of IRA’s and employer-sponsored retirement plans.

- Consider risk tolerance when investing and how much it could change over time.

- Maximize retirement savings by saving early and setting up auto contributions. If income increases, then increase the retirement contribution and take advantage of employer matching if available.

- Adjust strategies over time as needed.

- Catch up on retirement savings if starting late by considering extra income, reducing expenses, redirecting savings, taking advantage of the catch-up contributions for 401(k)s and IRA’s or delaying retirement for a few years in order to add more to savings.