Company Logo

Key growth drivers include rising demands for high-sensitivity diagnostics and personalized medicine, advancements in genomics, proteomics, and AI-driven innovations, and notable partnerships enhancing biomarker assay development and precision healthcare across regions.

U.S. Biomarkers Market

U.S. Biomarkers Market

Dublin, July 22, 2025 (GLOBE NEWSWIRE) — The “United States Biomarkers Market Report 2025-2034” has been added to ResearchAndMarkets.com’s offering. The report details market valuation, outlook, driving factors, trends, segment leaders, and dynamic influences shaping the U.S. biomarkers market, while examining unmet needs and strategic maneuvers among key players.

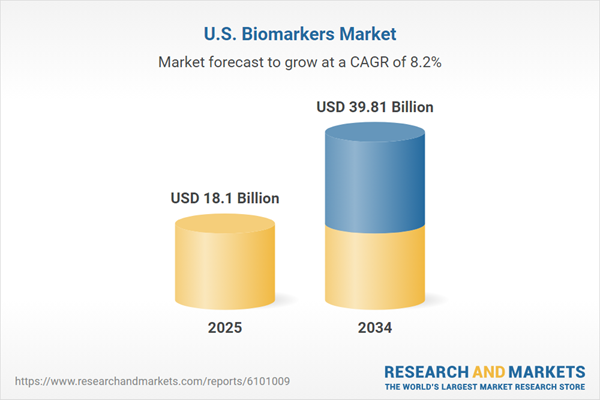

The United States biomarkers market, valued at USD 18.10 billion in 2024, is anticipated to grow significantly due to the increasing inclination towards point of care testing across the region. With an expected CAGR of 8.20% from 2025 to 2034, the market is projected to reach USD 39.81 billion by 2034, driven by the rising demand for high-sensitivity diagnostics and biomarker applications in disease management.

Advances in Clinical Biomarkers

Significant investments in neurodegenerative disease research and protein-based biomarkers enhance market strength. For instance, PTC Therapeutics’ PIVOT-HD trial in June 2024 presented promising clinical value, leveraging biomarkers that effectively monitor therapeutic impacts, essential for treatment development.

Collaborative Innovations

Precision medicine and high-sensitivity diagnostics are promoting partnerships. The ADx NeuroSciences and Alamar Biosciences collaboration in October 2024 exemplifies this, focusing on neurological biomarkers with ultra-sensitive detection technologies, instrumental for advancing U.S. biomarker market innovations.

Growth Trends

Technological advances include AI-powered solutions and the growing inclination towards non-invasive diagnostics. In January 2025, UTHealth Houston studied genes serving as epilepsy biomarkers, published in Nature Communications, possibly revolutionizing the treatment of drug-resistant epilepsy.

AI-driven Innovations

October 2024 saw Aignostics collaborating with Mayo Clinic, procuring USD 34 million for AI advancements in pathology, enhancing diagnostic interpretations, and reinforcing next-gen biomarker tools developments in the U.S. market.

Blood-based Biomarker Advances

The July 2024 Biogen, Beckman Coulter, and Fujirebio collaboration highlights the development of Alzheimer’s tau-specific blood-based biomarkers, fostering early detection and the emergence of targeted drug solutions.

Story Continues

Non-invasive Diagnostics

The ARPA-H OCULAB initiative in October 2024, focusing on tear-based markers for continuous health monitoring, signifies a shift from invasive testing, heralding personalized medicine opportunities, crucial for U.S. biomarker market growth.

Market Segmentation

The report segments the market by product, type, application, technology, disease indication, and end-user, providing comprehensive insights into market dynamics.

The U.S. market sees immunoassays maintaining dominance due to their significant utility.

Regional Analysis

The Northeast, recognized for its innovation and academic research institutions, leads due to initiatives like Enigma Biomedical and Boston University’s partnership in March 2025, dedicated to advancing 4R Tau PET biomarkers, solidifying its market leadership.

Leading Companies

Notable players include Roche, in collaboration with PathAI, enhancing AI-driven diagnostics; Merck KGaA’s strategic AI affiliations; Thermo Fisher Scientific, advancing cancer screening; and QIAGEN’s expanded partnerships for chronic disease therapeutics.

Leading market participants like Abbott, Agilent Technologies, Revvity, Charles River Laboratories, and others continue to revolutionize the landscape with innovative solutions.

Key Attributes

Report Attribute

Details

No. of Pages

250

Forecast Period

2025-2034

Estimated Market Value (USD) in 2025

$18.1 Billion

Forecasted Market Value (USD) by 2034

$39.81 Billion

Compound Annual Growth Rate

8.2%

Regions Covered

United States

Companies Featured

Key Topics Covered

1 Preface

2 Executive Summary

3 Biomarkers Market Overview

4 Vendor Positioning Analysis

-

4.1 Key Vendors

-

4.2 Prospective Leaders

-

4.3 Niche Leaders

-

4.4 Disruptors

5 United States Biomarkers Market Landscape

6 United States Biomarkers Market Dynamics

-

6.1 Market Drivers and Constraints

-

6.2 SWOT Analysis

-

6.3 PESTEL Analysis

-

6.4 Porter’s Five Forces Model

-

6.5 Key Demand Indicators

-

6.6 Key Price Indicators

-

6.7 Industry Events, Initiatives, and Trends

-

6.8 Value Chain Analysis

7 United States Biomarkers Market Segmentation (2018-2034)

-

7.1 United States Biomarkers Market by Product

-

7.2 United States Biomarkers Market by Type

-

7.3 United States Biomarkers Market by Application

-

7.4 United States Biomarkers Market by Technology

-

7.5 United States Biomarkers Market by Disease Indication

-

7.6 United States Biomarkers Market by End User

-

7.7 United States Biomarkers Market by Region

8 Regulatory Framework

9 Patent Analysis

10 Grants Analysis

11 Funding and Investment Analysis

12 Strategic Initiatives

13 Supplier Landscape

14 United States Biomarkers Market – Distribution Model (Additional Insight)

15 Key Opinion Leaders (KOL) Insights (Additional Insight)

For more information about this report visit https://www.researchandmarkets.com/r/l9nwb2

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900