Liverpool and Newcastle United exist in parallel universes when it comes to PSR – and FSG’s pursuit of Alexander Isak is a wormhole that proves just how different their financial realities really are.

Since the takeover by the Saudi Public Investment Fund in October 2021, the spectre of the Premier League’s Profit and Sustainability Rules has cast a long shadow over St James’ Park.

By contrast, Liverpool have never been remotely close to failing PSR, either at the domestic or European level. That said, FSG have never spent remotely as much as they are right now.

The Premier League champions have blazed through around £185m this summer to lure British-record signing Florian Wirtz away from Bayer Leverkusen, replace Trent Alexander-Arnold with Jeremie Frimpong, and prise Milos Kerkez from Bournemouth.

Hugo Ekitike will join Liverpool soon too, with the French forward’s representatives having engineered a move to Anfield from Eintracht Frankfurt worth £69m, rising to £79m with add-ons.

Liverpool fans were already in pinch-me territory with their dealings in the transfer market before it emerged that the club had approached Newcastle United about a potential deal for Alexander Isak, who is arguably the most sought-after centre-forward in the world.

Liverpool’s imminent capture of Ekitike – who, significantly, was also high up on Newcastle’s list of targets – may have relieved some of the pressure on the Magpies, though TBR Football understands that Isak is now asking for a new contract worth £300,000 per week.

Photo by Serena Taylor/Newcastle United via Getty Images

Photo by Serena Taylor/Newcastle United via Getty Images

And regardless of what transpires this summer, the Swede will remain a priority for Liverpool. In the event that they do secure his signature before the window shuts, the Merseysiders’ total spend could be approaching the £400m mark.

Yes they will have offset that figure with sales, but it still represents a historic outlay for a club whose owners are routinely characterised as conservative, value-focused operators.

175 miles away in the North East, many Newcastle fans are asking how Liverpool are able to spend so much without alerting the Premier League or UEFA’s PSR enforcers.

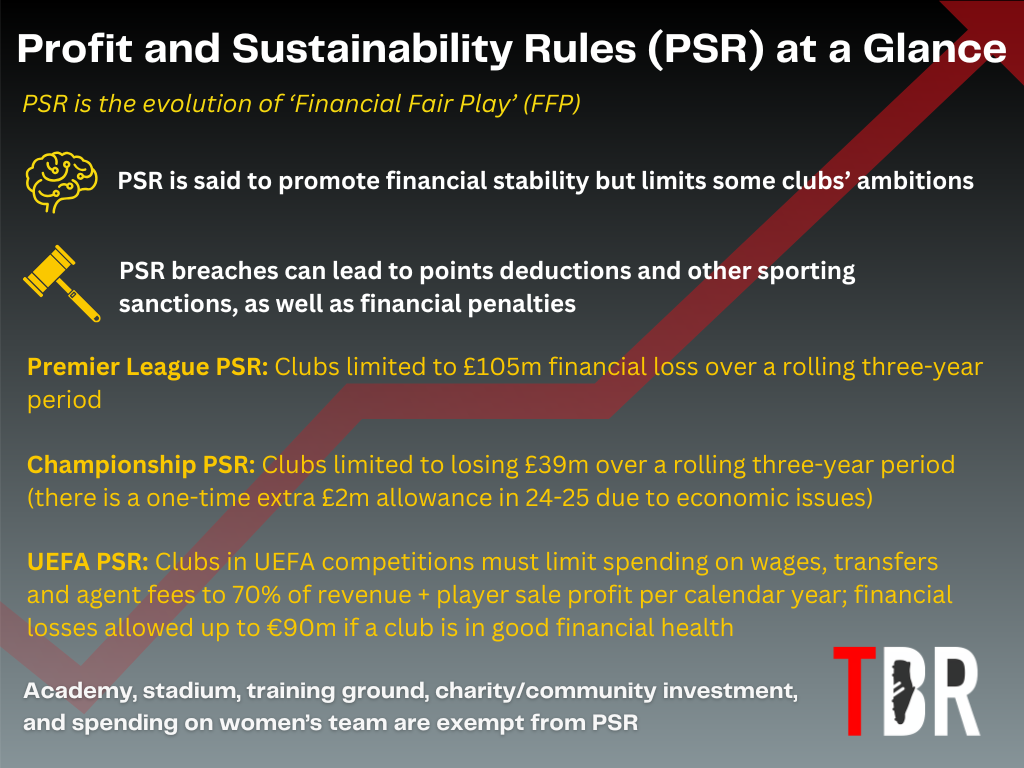

PSR infographic. Credit: Adam Williams, GRV Media

PSR infographic. Credit: Adam Williams, GRV Media

This summer, Eddie Howe and his deputies on Tyneside aren’t as preoccupied with PSR as they have been previously thanks to a season of relative restraint in 2024-25 and Champions League revenue guaranteed this term. However, with PIF committed to spending the maximum allowed under the rules, PSR is always going to be an issue on Tyneside.

But Liverpool? Their PSR position is even stronger than many realise, according to the latest information received by TBR Football.

FSG have given Liverpool £90m extra PSR headroom with finance facility as Alexander Isak saga evolves

By now, most readers will be familiar with the concept of transfer fee amortisation.

If Liverpool sign Isak this summer for, say, £150m this summer, only £30m will hit the profit-and-loss account in 2025-26. That would be his fee amortised over five years, which is the maximum allowable under Premier League and UEFA PSR. Even if their spending eclipsed £400m, their amortisation would only rise by £80m in the present financial year.

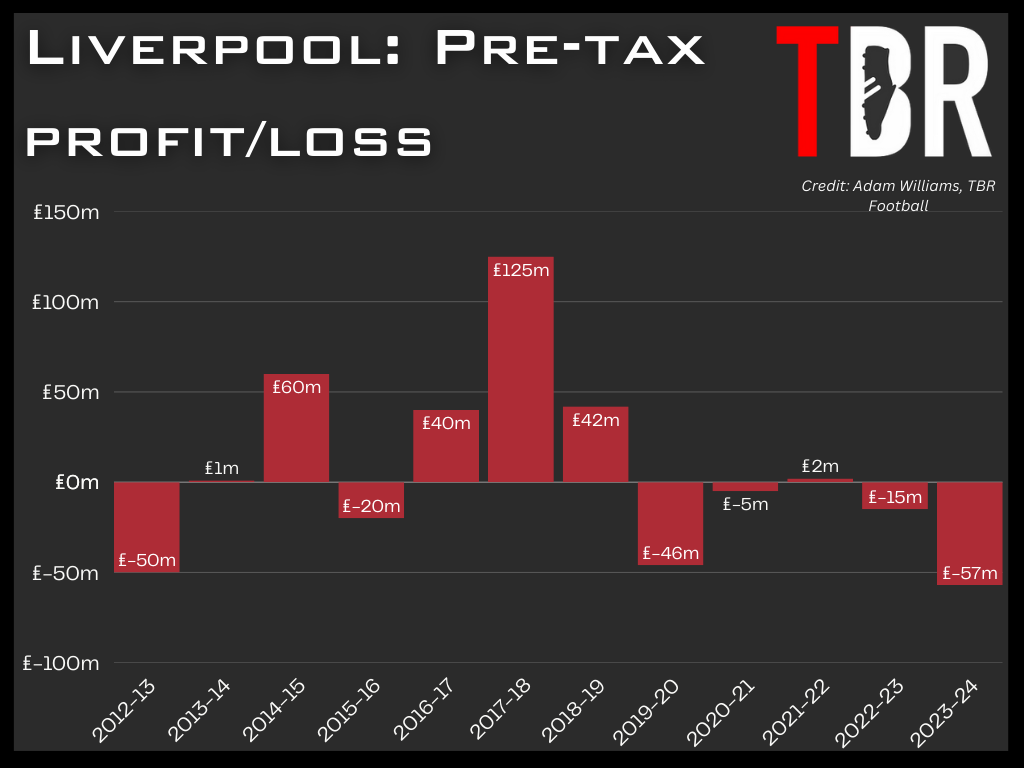

Amortisation impacts Liverpool’s bottom line, which is how the Premier League assesses PSR and UEFA test clubs based on their Football Earnings rule.

Liverpool profit and loss graph

Liverpool profit and loss graph

Credit: Adam Williams/TBR Football/GRV Media

Under the domestic system, Premier League clubs are allowed to lose £105m over a rolling three-year period. For UEFA, the threshold is set lower – up to a maximum of £75m, depending on whether or not the club is deemed in good financial health.

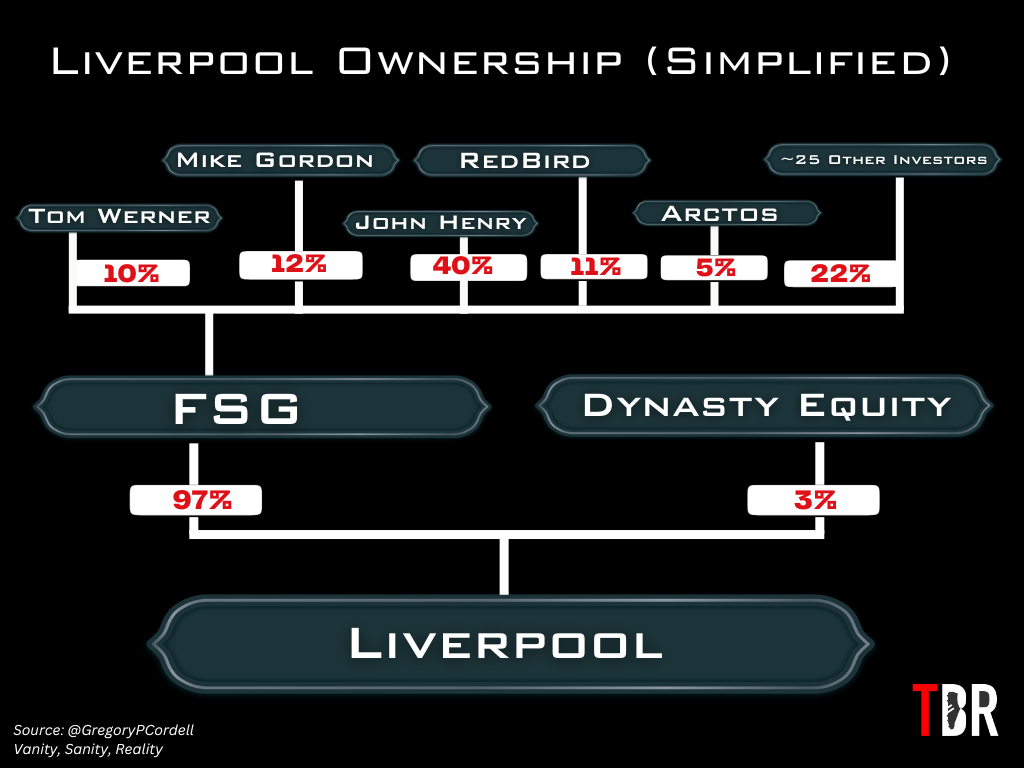

Crucially, the bulk of the losses must be covered by an owner. It has been widely presumed by football finance experts and the media alike that ‘secure funding’ relates to equity funding, i.e., cash invested in the club in exchange for new shares.

If this was the case, Liverpool’s maximum allowed PSR loss for the current three-year cycle would be £15m, not £105m, as FSG have not issued any shares in that time.

Liverpool ownership diagram

Liverpool ownership diagram

Credit: Adam Williams/TBR Football/GRV Media

However, TBR Football has now been told that the Premier League’s definition of ‘secure funding’ is actually much wider and includes revolving credit facilities among other sources. A revolving credit facility is essentially a club’s overdraft.

For Liverpool, this is significant as it means the £350m revolving credit facility that was due to expire at the end of July this year before it was renewed in September 2024 has unlocked the full PSR allowance.

John Henry and his peers at FSG chose to extend the facility by £50m last year despite having not drawn down any of their permitted allowance. In so doing, the Boston-headquartered ownership regime has freed up even more PSR headroom without even opening their own wallets.

Photo credit should read OLI SCARFF/AFP via Getty Images

Photo credit should read OLI SCARFF/AFP via Getty Images

Even without the full allowance, Liverpool’s profit-and-loss figures for 2023-24 and 2024-25 mean they had very little to fear with respect to the spending rules anyway. But the fact they theoretically have an extra £90m to play with hammers home just how little they are constrained.

Liverpool revenue to reach dizzy new heights with Adidas kit deal

In 2025, commercial strategy is invariably a consideration in any blue-chip transfer.

And while the fact that Isak is an Adidas athlete certainly wouldn’t be one of the main drivers of a move to Anfield, it would be a sweetener for FSG.

From 1 August when their kit manufacturer deal with Nike expires, Liverpool will officially be an Adidas club. They have signed a contract worth a reported £60m per year with the German sportswear giants.

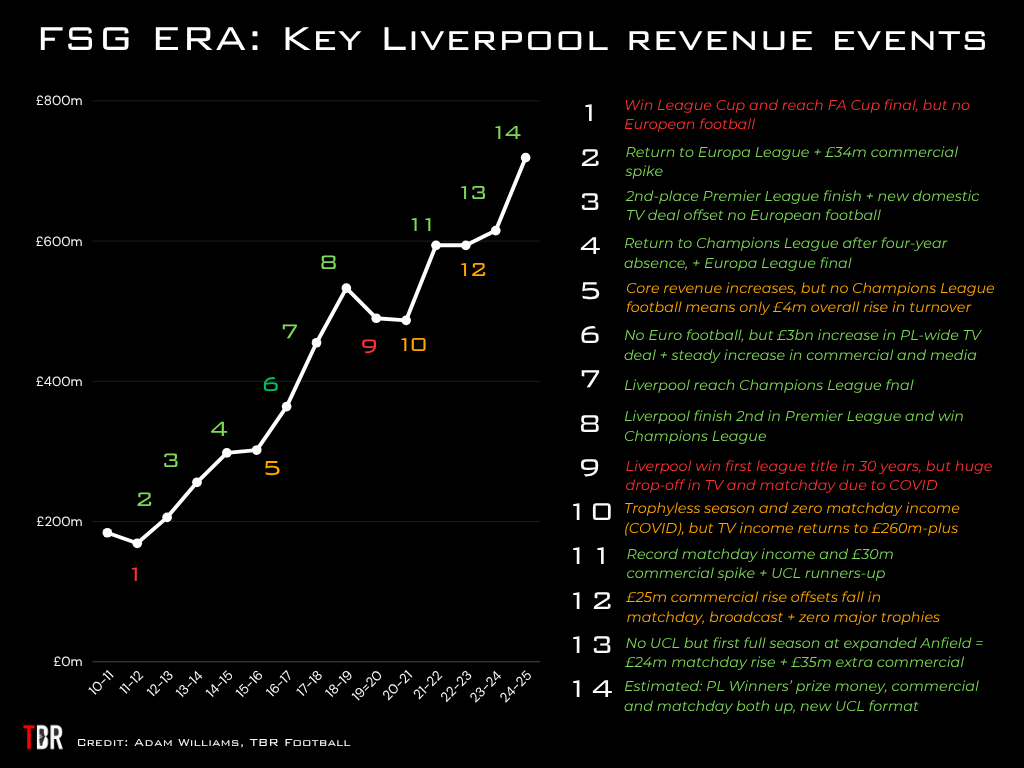

The previous agreement with Nike was weighted more towards a royalty figure on sales rather than the upfront fee. In 2024-25, when shirts flew off the shelves in reaction to Arne Slot’s side’s title triumph, that will have helped deliver club-record revenues well in excess of £700m.

Liverpool key revenue events in FSG era

Liverpool key revenue events in FSG era

Credit: Adam Williams/TBR Football/GRV Media

In 2025-26, they will likely surpass that figure, creating even more PSR leeway.

For FSG, who have historically increased the wage and player amortisation base in line with revenue, that makes the decision to capitalise on their Premier League victory last season even more expedient.