RECAP: Asian shares eased back on Friday, with Japanese markets retreating from a record peak, as investors locked in profits ahead of a crucial week that includes US President Donald Trump’s tariff deadline.

Trading in Thailand was also subdued, as investors monitored the growing border conflict with Cambodia and waited for news on the trade and tariff front.

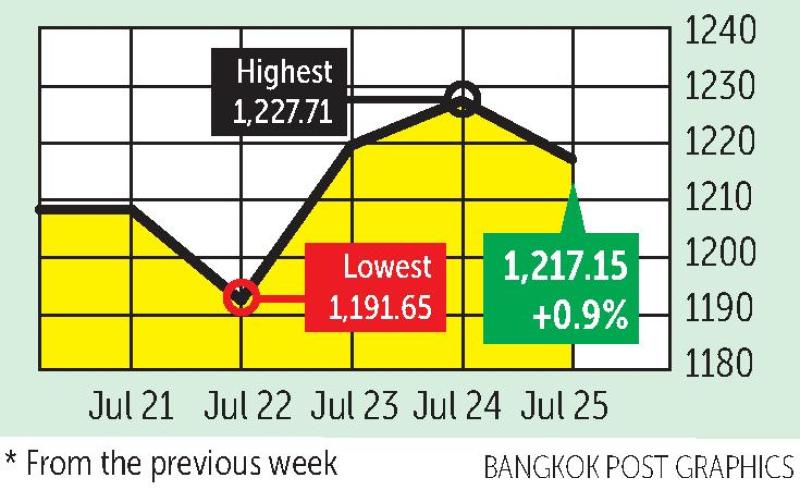

The SET index moved in a range of 1,191.65 and 1,227.71 points this week, before closing on Friday at 1,217.15, up 0.9% from the previous week, with daily turnover averaging 41.5 billion baht.

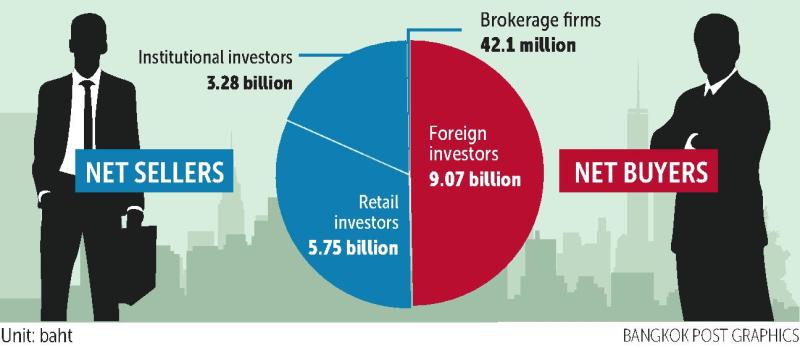

Foreign investors were net buyers of 9.07 billion baht. Retail investors were net sellers of 5.75 billion baht, followed by institutional investors a 3.28 billion, and brokerage firms at 42.1 million.

NEWSMAKERS: President Donald Trump announced a “massive” trade deal with Japan that would include a 15% tariff on imports. Under the deal, Japan will invest $550 billion into the US, which Trump said would receive 90% of the profits.

Trump also agreed to reduce threatened tariffs on the Philippines, but only by one percentage point to 19%, while Manila would open up completely to US goods, he said after meeting with counterpart Ferdinand Marcos at the White House.

US Treasury Secretary Scott Bessent signalled a 90-day extension of the trade “truce” with China, saying he would meet his Chinese counterparts in Stockholm next week for tariff talks, paving the way for continued trade negotiations and keeping triple-digit tariffs on hold.

The EU is preparing to impose counter-tariffs on $117 billion worth of American products, including aircraft, automobiles and bourbon whiskey, if trade talks fail and Washington proceeds with threats to impose 30% tariffs on EU imports starting Aug 1.

The European Central Bank kept interest rates unchanged for the first time in more than a year as it looks for clarity on EU trade with the US. President Christine Lagarde said the bank was now in a “wait-and-see” mode, with inflation at the 2% goal and the economy performing in line with or better than expectations.

China’s yuan hit an eight-month high against the dollar on Thursday, after the People’s Bank of China set the midpoint rate at 7.1385 per dollar, its strongest since Nov 6.

Trump downplayed his clash with Fed chairman Jerome Powell over cost overruns during a tour of the central bank’s renovation project, making it clear that he saw lower interest rates as a more pressing concern.

The EU announced a new sanctions package against Russia, its most severe yet, cutting the Russian crude oil price cap to $47.50 a barrel from $60, imposing sanctions on “shadow fleets” transporting Russian oil, and an expanded scope that includes banking and military industrial sectors.

Nvidia is reportedly facing difficulty delivering its H20 AI chips to China despite recently announcing plans to resume sales, as it had earlier returned production quotas booked with Taiwan Semiconductor Manufacturing Co following a US government ban in April. It may take up to nine months to resume production.

Japanese government bonds (JGBs) have been one of the world’s most stable securities for decades. However, the 30-year JGB yield this week rose to 3%, the highest since the 2008 subprime crisis, reflecting massive selling. This may raise concern over a new round of financial crisis.

South Korea’s economy grew 0.5% year-on-year in the second quarter, the central bank said, driven by stronger private consumption and 4.2% export growth, the best in nearly five years.

Tesla chief executive Elon Musk said reductions in US government support for EV makers could lead to a “few rough quarters”. His company reported a second-quarter profit of $1.2 billion, down from $1.4 billion a year earlier, as sales fell to $22.5 billion from $25.5 billion.

Google’s parent Alphabet said 2025 capital expenditures will be $85 billion, or $10 billion greater than an earlier forecast. Its sales climbed to $81.7 billion, slightly above projections, while second-quarter profit of $28.2 billion also beat expectations.

Malaysia reported second-quarter GDP growth of 4.5% year-on-year, better than the market consensus of 4.2% and up from 4.4% in the previous quarter.

Finance Minister Pichai Chunhavajira says the United States has now looked at 90% of Thailand’s new trade proposals and is expected to give a clear answer before Aug 1. Thailand hopes to receive a reduction in its tariff rate from 36% to below 20%, or similar to the rates in other Asean countries.

Deputy Finance Minister Paopoom Rojanasakul says negotiations with the US will not include full opening of markets for US goods with zero tariffs, as seen in other countries that have reached agreements, due to concerns about domestic economic impact, especially on agricultural products.

The cabinet approved the nomination of Vitai Ratanakorn as the next governor of the Bank of Thailand. The president of the Government Savings Bank was chosen over BoT deputy governor Roong Mallikamas. Finance Minister Pichai said he hopes to see monetary and fiscal policies moving in the same direction to address challenges.

The Board of Investment said the value of applications in the first six months rose 139% from a year earlier to a record 1.06 trillion baht ($32.5 billion), led by a 20-fold increase to 523 billion baht in digital sector pledges, electrical and electronic goods and rail infrastructure.

Car production in Thailand rose for a second straight month in June, up 12% from a year earlier to 130,223 units, the Federation of Thai Industries said. The increase followed a rise of 10.3% in May, after nearly two years of contraction.

The Ministry of Finance is studying the imposition of a higher excise tax on imported electric vehicles that use a low proportion of local content.

The dollar value of Thai exports rose 15.5% year-on-year in June, reflecting the continued front-loading of shipments in anticipation of higher US tariffs in the second half of this year.

The House of Representatives approved amendments to the National Savings Fund Act to allow the sale of “retirement lottery” tickets as an alternative for people to save money and create a sustainable savings system. Tickets would be issued weekly with a cap on purchases at 3,000 baht per month.

Suvarnabhumi Airport has more airlines serving it — 113 — than any other airport in the world, according to data reviewed by FlightConnections as of April 16 this year.

The Tourism Authority of Thailand has set a revenue target for 2026 of 2.8 trillion baht, up 5% from this year, while acknowledging risk factors that could repeat some negative trends seen in 2025, such as a 33% decline in Chinese arrivals.

Gulf Development, Thailand’s largest energy company by market value, has purchased the entire shareholding of the Pak Lay hydropower project in Laos for $128 million.

The Government Savings Bank is preparing to launch G-token savings bonds worth 5 billion baht, offering higher returns than market interest rates due to lower issuance costs. These will be sold alongside regular bonds worth 25 billion baht, expected to begin in late August.

Real estate developers propose amending property rights laws to promote optimal land utilisation, support foreign investment and megaprojects. They suggest extending long-term land lease rights to 50-60 years from 30 and reducing social risks.

The Bank of Thailand issued a warning letter following the cabinet approval of the Financial Hub Bill draft, emphasising the need to manage money laundering and terrorism financing risks, and ensure business separation from mainstream financial system operations.

COMING UP: On Monday, Canada releases monthly wholesale sales. On Tuesday the US releases consumer confidence, job openings and weekly crude oil stocks. Wednesday brings German, euro zone and US GDP data; US Federal Reserve and Bank of Japan rate decisions, and Chinese manufacturing PMI.

On Thursday, Germany releases an inflation update and the US releases core personal consumption expenditures, the Fed’s preferred inflation gauge. On Friday, the euro zone releases an inflation update and the US releases July nonfarm payrolls and unemployment data.

Locally, the Thai General Insurance Association presents an industry outlook. On Friday, the Bangkok Post Forum 2025, “Shaping the Future Economy in the New Global Order”, takes place.

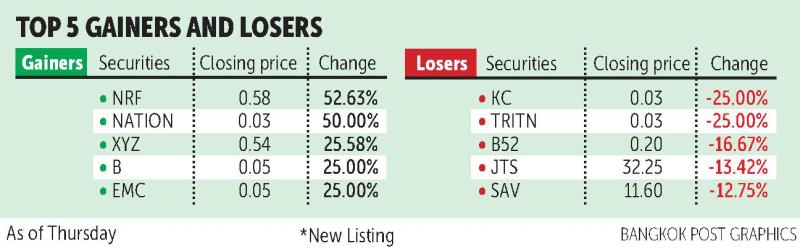

STOCKS TO WATCH: The Thai-Cambodian conflict has had a significant impact on listed companies with exposure in Cambodia, says Krungsri Securities. SAV is the most heavily affected as 100% of its revenue is derived from Cambodia. This is followed by CBG at 13%. Other companies with moderate exposure include: OSP (5%), OR (4%), BDMS (3.7%), MAJOR (3%), BH (3%). Lower exposure is seen in BCH (1.7%), CHG, PTT (1% each). Companies with minimal exposure (less than 1%) include TOP, PTTGC, IRPC, CPF and TFG.

Key Q2 earnings to watch next week: SCC, MINT and ADVANC are among the biggest names on the calendar. Large-cap stocks, especially in banking and energy, are expected to attract continued fund inflows. Recommended picks include ADVANC, AMATA and SCB.

InnovestX Securities also highlights sustained foreign fund inflows into the region, which are likely to benefit the Thai market. However, short-term sentiment could be weighed down by tariff uncertainties and the Thai-Cambodian border situation. Top stock picks are BCPG, HMPRO and CHG.

TECHNICAL VIEW: Krungsri Securities sees support at 1,185 points and resistance at 1,250. InnovestX Securities sees support at 1,175 and resistance at 1,250.