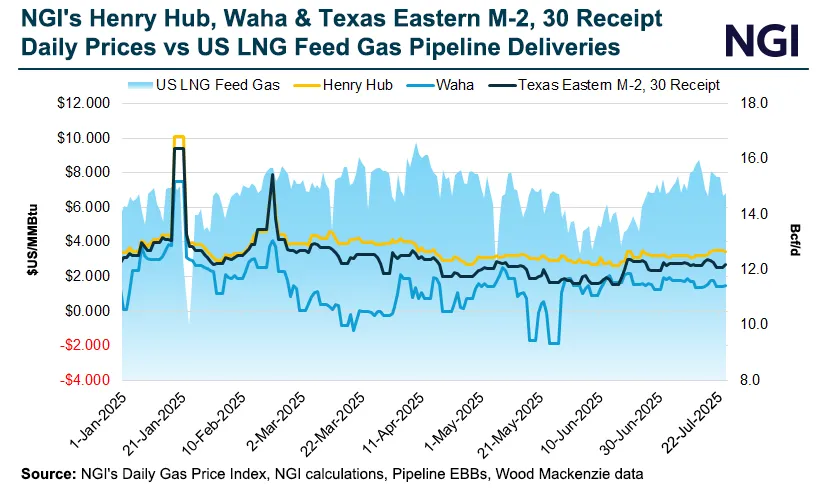

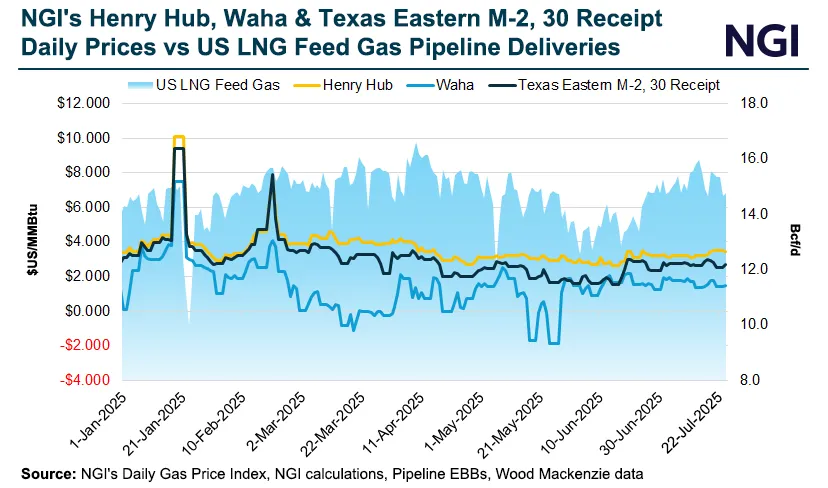

Natural gas production is set for a steady but measured climb through early 2026 as climbing LNG feed gas demand creates a counterbalance against sluggish prices and hefty storage injections this summer.

Expand

During the first six months of the year, the market was largely colored by the faster-than-expected commissioning of modular blocks at Venture Global Inc.’s Plaquemines LNG and incremental demand boosts from Cheniere Energy Inc.’s Corpus Christi Stage 3 expansion. The added pull on domestic supply sparked a temperate resurgence in rigs and gas volumes, mostly in the western Haynesville Shale.

East Daley Analytics’ Jack Weixel, senior director of energy analysis, said ramping feed gas demand brought balance to a market that has been oversupplied for several seasons, pushing production to around 107 Bcf/d in July.