American Jennifer Doudna and Frenchwoman Emmanuelle Charpentier won the 2020 Nobel Prize for discovering the CRISPR/Cas9 genetic scissors. With these revolutionary tools, researchers can edit DNA sequences in living cells, with profound implications for the future of research, medicine, and agriculture.

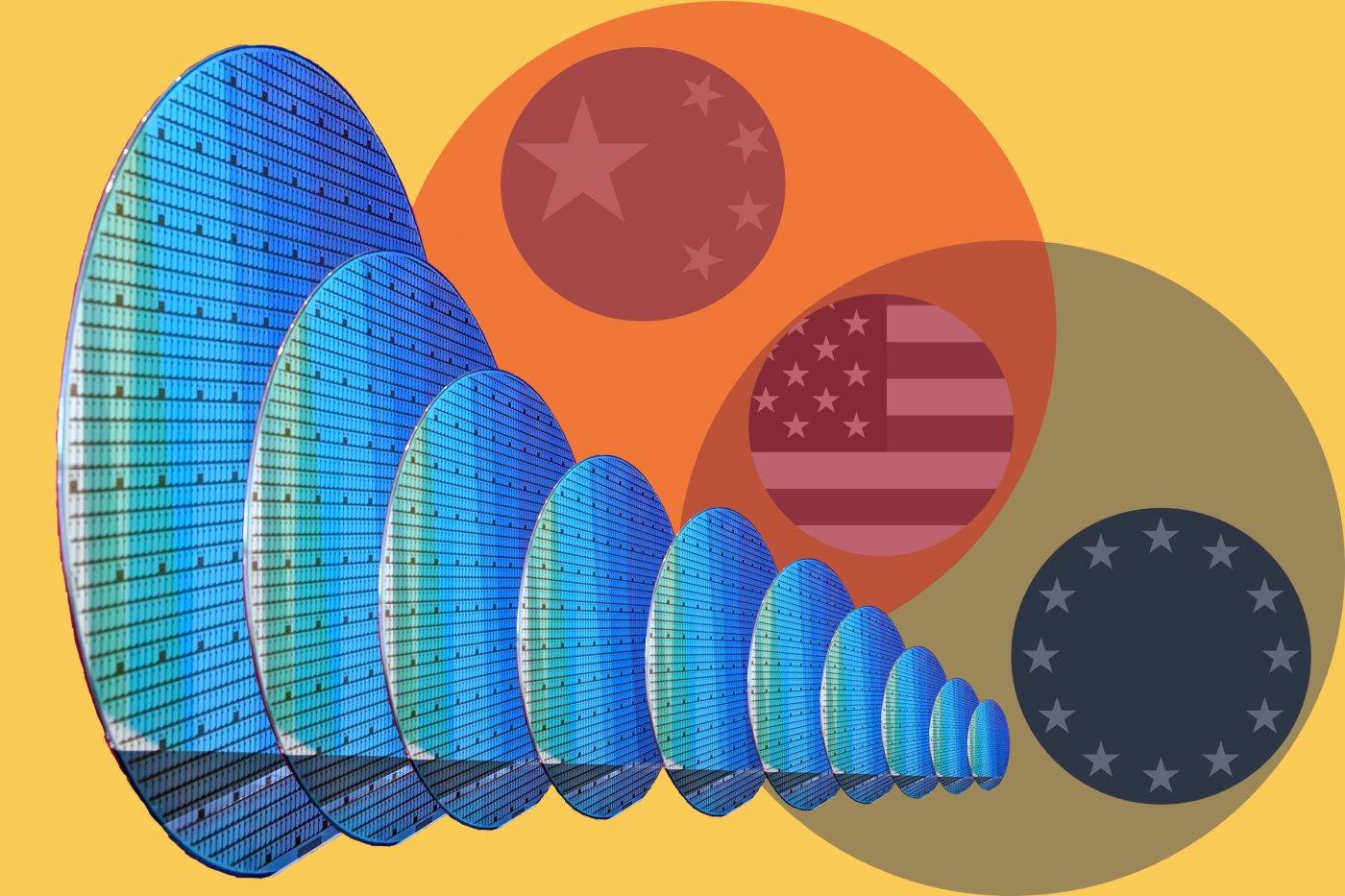

But it is not the US or Europe that is making the most of this breakthrough. China is. Over the past two decades, China has gone from a peripheral player to a frontrunner in synthetic biology, AI-enhanced drug discovery, and genomic data infrastructure.

Between 2007 and 2017, China’s biotech publications grew at an average annual rate of 20%. In 2020, Chinese research surpassed that of Germany and the United Kingdom in quality, as measured by the Nature Index. In biotechnology patents, China’s global share rose from just 1% in 2000 to 28% in 2019, while the American share declined from 45% to 27%. Today, China is responsible for 40% of the global production of active pharmaceutical ingredients.

While the US remains a biotech superpower, its lead is no longer secure. In China, government funding provides a strong and steady stream of investment, compared to the US and Europe, which rely on private R&D and venture capital. The US Congress has yet to craft a unified biotechnology strategy. Venture capital funding, while robust, remains volatile.

Meanwhile, China’s model—top-down, long-term, and state-backed—is gaining ground. Beijing has declared synthetic biology a strategic priority, woven it into successive Five-Year Plans, and funneled billions into genome sequencing, bio-manufacturing, and AI-enhanced drug development. In 2023 alone, China spent $15 billion on biopharmaceutical R&D, up from just $35 million in 2015.

Admittedly, the US remains the undisputed global biotech nation, thanks to premier research institutions and strong private R&D investment. The US continues its lead in biotech patents, with 39% of total biotech patents in 2020, followed by the European Union with 18% share, and China at 10%.

But China is catching up fast. Chinese companies such as BGI Genomics and Sinovac Biotech are globally recognized. BGI played a central role in sequencing the SARS-CoV-2 genome in record time, catalyzing vaccine development. Others, like Ping An Good Doctor, apply AI to diagnostic support and telemedicine, expanding access in underserved regions. Chinese researchers have used synthetic biology to engineer yeast for pharmaceuticals and crops for resilience, while tech giants Tencent, Baidu, and Alibaba invest heavily in AI-driven healthcare.

Gene-editing tools like CRISPR-Cas9 are flourishing in China. In 2018, a Chinese scientist successfully edited embryos to resist HIV using CRISPR. While this gene editing experiment on humans (though successful) was highly controversial globally as well as in China, it revealed a stark asymmetry: Chinese scientists are pushing the envelope where others hesitate.

In contrast, American and European researchers face regulatory gridlock, an anti-science backlash, and a lack of sustained funding. In the US, religious and ethical concerns are also a significant hurdle. The Dickey-Wicker Amendment, enacted in 1996, prohibits the use of federal funds for research that involves the creation or destruction of human embryos. Consistent with this restriction, the National Institute of Health will not support any research involving gene editing in human embryos.

The new Trump Administration looks set to expand these restrictions. Robert Kennedy Jr., the Secretary of Health and Human Services, is a vocal champion of “natural” approaches to health. His skepticism of what he sees as “unnatural” interventions shapes his opposition to technologies such as CRISPR and genetically modified crops.

CRISPR-edited crops have also become a casualty of Europe’s fear and wariness toward genetic modification. In 2018, the European Court of Justice ruled that crops created using new gene-editing tools like CRISPR should be regulated as GMOs. That decision has all but barred them from the European market.

Get the Latest

Sign up to receive regular Bandwidth emails and stay informed about CEPA’s work.

Complicated pricing and regulatory frameworks represent additional hurdles. New medicines take longer to get approved in the European Union than in other regions, with the average approval time at 430 days as of 2022. After a drug is approved, each of the 27 EU countries has its own process to decide whether to buy the medicine, and at what price.

In contrast, medicines made in China, or not yet approved abroad, are fast-tracked for review. Companies enjoy long data exclusivity—protection from generic competition—if clinical trials are done in China and the drug hasn’t been approved in other countries.

A similar dynamic plays out with another leading biotech innovation: CAR-T therapy, which reprograms immune cells to target cancers. American labs pioneered the field and launched their first commercial drugs. Yet China now leads in the number of approved CAR-T therapies and clinical trials, benefiting from fast-tracked regulatory approvals, vast patient datasets, and government-subsidized innovation hubs.

The US created the AI biotech revolution. In 2020, Google DeepMind’s AlphaFold solved the “protein folding problem,” explaining how a string of amino acids twists itself into the intricate three-dimensional shape of a functioning protein. For decades, unlocking this mystery required years of painstaking lab work. DeepMind’s AlphaFold cracked the code with AI, allowing it to predict a protein’s 3D structure in minutes. AlphaFold is now a backbone of precision medicine, speeding up drug discovery, aiding vaccine development, and enabling the design of therapies tailored to an individual’s molecular makeup.

Multinational pharmaceutical companies are investing record sums in early-stage medicines from Chinese biotech firms. Chinese companies account for 18% of global licensing deals. These agreements typically grant foreign firms rights to develop and sell Chinese-discovered therapies abroad, with Chinese companies earning more as drugs advance through trials.

Beneath these scientific advances lies a foundational resource: genomic data—the most valuable commodity in biomedical research. By analyzing genetic variations across massive populations, AI systems detect disease patterns, design targeted therapies, and predict adverse drug reactions.

Through initiatives like Made in China 2025 and a $9 billion precision medicine project, Chinese companies are collecting, processing, and analyzing genetic data at scale. During the COVID-19 pandemic, China’s BGI Genomics distributed testing kits to 180 countries and established labs in 18 countries, creating global channels for data acquisition.

Through a series of cyber breaches, China has acquired personal and health information on hundreds of millions of people around the globe. Under Chinese law, firms must share any collected data with the state. There is no opt-out. That makes Chinese companies not just market actors, but potential instruments of state power.

Imagine a cancer patient in the US whose best hope for survival lies in a personalized therapy developed by a Chinese biotech company. The treatment requires sharing the patient’s genetic information. The patient, desperate for a cure, consents.

Americans might be willing to share their most intimate biological and genetic information to save their lives—even if that data becomes part of a strategic asset, potentially owned and controlled by a geopolitical rival. In such scenarios, national security concerns could become personal.

The US and Europe must act to ensure their biotech leadership. They should fund early-stage AI-driven startups and ensure ethical guardrails evolve alongside scientific advances. Immigration policy must also attract and keep skilled talent.

At stake is more than a contest over patents or profits. It is a struggle over who gets to define the boundaries of the bioeconomy. If the US and Europe fail to lead, the next generation of breakthrough therapies may not emerge from Boston or Basel—but from Beijing or Shenzhen.

Elly Rostoum is a Google Public Policy Fellow with the Center for European Policy Analysis (CEPA). She is a Lecturer at Johns Hopkins University. You can find out more about her work here: www.EllyRostoum.com

Bandwidth is CEPA’s online journal dedicated to advancing transatlantic cooperation on tech policy. All opinions expressed on Bandwidth are those of the author alone and may not represent those of the institutions they represent or the Center for European Policy Analysis. CEPA maintains a strict intellectual independence policy across all its projects and publications.

Read More From Bandwidth

CEPA’s online journal dedicated to advancing transatlantic cooperation on tech policy.