Veteran analyst drops bold new call on Nvidia stock originally appeared on TheStreet.

You can’t talk about artificial intelligence without running into Nvidia (NVDA) .

It’s wild how a gaming chipmaker is now basically the face that runs the show in AI.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰💵

From data centers to cloud platforms, and from edge devices to the conversations shaping the future of tech, it’s Nvidia all the way.

Nvidia’s ubiquitous GPUs are at the heart of training large language models (LLMs) and accelerating robotics, dominating the most mission-critical chips on the planet.

Trillions in market cap later, Nvidia is still getting the love from Wall Street. Sure, Nvidia stock has wobbled, but a new forecast suggests there’s still a ton of firepower ahead.

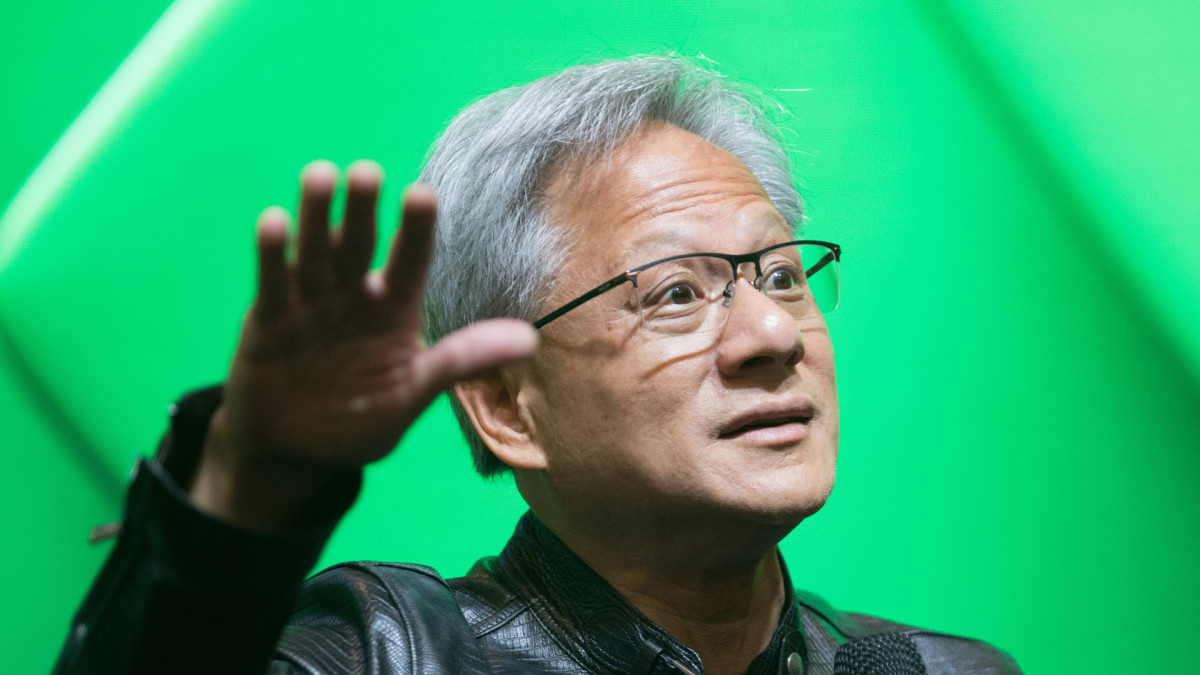

AI strength keeps Nvidia stock in focus.Image source: Morris/Bloomberg via Getty Images

Nvidia has effectively become the engine room of the AI frenzy. Its GPUs run roughly 90% of the world’s AI data centers, and tech giants including Amazon, Microsoft, Google, and Meta continue gravitating to its silicon architectures.

Moreover, its competitive edge in AI goes beyond chips. Its powerful CUDA platform, for instance, is arguably the backbone of AI software, locking in millions of developers looking to optimize their work for Nvidia chips.

On the model side, tools such as TensorRT and NeMo help developers run AI systems easily and efficiently.

Also, for businesses looking to avoid building massive infrastructure, Nvidia offers DGX Cloud, fully loaded AI clusters you can rent on demand.

Related: Veteran Wall Street firm makes surprise call on tech stocks

An AI powerhouse like CoreWeave helps run it, with analysts predicting it could be a $10 billion long-term revenue stream. Hence, this end-to-end stack allows Nvidia to dominate the AI value chain.

It’s also why hyperscalers shell out a ton of money on their Nvidia budgets, knowing an alternative path would fracture their entire pipeline.

So it’s no surprise that Nvidia stock has gone parabolic over the past few years. For context, its share price surged from $24 at the end of January 2022 to about $134.27 by December 31, 2024, an astonishing 449% gain.

This breakneck surge mirrors the explosive growth of its AI-led data-center business. In the fourth quarter of FY 2022, its data center sales were at $3.3 billion.

By Q4 FY 2024, though, it stood at an eye-popping $18.4 billion — a 458% jump in just a couple of years. And as we look ahead, it seems the AI buildout is just getting started.

McKinsey sees global AI and data-center investment hitting $5.2 trillion by 2030, on the back of a double-digit bump in AI-ready capacity.

Story Continues

Related: Gemini, ChatGPT may lose the AI war to deep-pocketed rival

In Q1 2025 alone, cloud infrastructure spending hit $90.9 billion, up 21% year-over-year, according to Canalys.

Nvidia hogged the spotlight Wednesday after Loop Capital jacked up its price target in a big way.

In setting a new Wall Street high for Nvidia, Loop Capital analyst Ananda Baruah raised his price target to $250 from $175.

He feels hyperscaler and AI spending could hit $2 trillion by 2028, with Nvidia riding that wave to a $6 trillion market cap.

More Tech Stock News:

He added that Nvidia owns “critical tech” and has the pricing power to match, as hyperscaler continues to grow over time.

Loop Capital’s new $250 target is nothing short of extraordinary. When stacked against Wall Street’s $172.60 consensus target, that implies a roughly 44% premium, towering even higher than the current “high” estimate of $220.

So far this year, Nvidia stock has quietly gained nearly 10%, starting the year in the high $130s and climbing to the low $150s by late June.

It has continued to crush expectations in its data-center division, with more than 70% year-over-year growth in Q1, while next-gen chip pre-orders pile up.

Add in software momentum, and analysts say there is still plenty of upside remaining in this AI bellwether.

Related: Circle stock goes parabolic after Capitol Hill surprise

Veteran analyst drops bold new call on Nvidia stock first appeared on TheStreet on Jun 26, 2025

This story was originally reported by TheStreet on Jun 26, 2025, where it first appeared.