…Investors upbeat on Nigeria’s Eurobond, equities, fixed-income assets

The naira, Eurobonds, equities and fixed-income assets are seeing early gains from the nation’s growing foreign exchange reserves, BusinessDay has learnt.

Data from the Central Bank of Nigeria (CBN) revealed that Nigeria’s foreign currency reserves climbed to $41.07 billion on August 21, 2025, representing a 5.46 percent or $2.13 billion increase compared to $38.94 billion recorded on August 22, 2022 prior to the appointment of Olayemi Cardoso, current CBN governor.

Cardoso was appointed CBN governor on September 15, 2023.

Fifteen months later (December 2024), foreign reserves reached a high of $40.88 billion from a prolonged decline in reserves throughout 2022 and 2023 – when levels struggled to remain above $38bn.

Read also: Naira ends week steady at N1,535 amid rising FX reserves

Equities market

The growing reserves have had spin-off effects on the Nigerian financial markets. In combination with high interest rates and reforms, foreign investors have poured into the Nigerian financial markets on the back of stronger reserves which can guarantee their principals and returns.

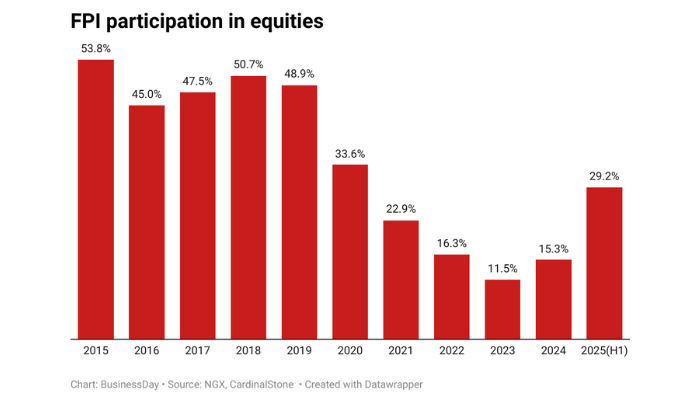

In the first half (H1) of 2025, foreign portfolio inflows into the equities market accounted for 29.2 percent of total market activity, up from 20.4 percent in the previous year.

Foreign transactions in the equities market in H1 of 2024 had stood at N540.48 billion, indicating a 273 percent increase from N145.08 billion seen in the corresponding period of 2023.

“We expect this renewed momentum in FPI activities to continue for the rest of 2025, supported by Nigeria’s relatively strong macro narrative, especially improving FX liquidity, and declining inflation,” analysts at CardinalStone stated in the second half (H2) 2025 outlook report.

The Nigerian Exchange Limited (NGX) All Share Index closed 2023 and 2024 with an annual growth of 46 percent and 37.65 percent respectively as against 20 percent in 2022.

Portfolio investors put their money in Nigerian equities and fixed income securities such as treasury bills, corporate bonds and commercial papers. They also invest in money market via the open market operations (OMO) as well as in Eurobonds.

Funmi Adebowale, head of research, Parthian Securities Limited, said higher reserves indicate improved dollar liquidity, which flows into various investment options including stocks, thereby boosting market activity and investor interest, potentially sparking a rally.

“We have seen the impact of this on the market in the last two months, as it rallied for 26 consecutive days between July and mid- August,” she noted.

She however said that “emphasis should be on attracting more stable funds like FDIs and export earnings.”

Naira and naira cards

Higher reserves levels have enhanced the CBN’s ability to defend the naira, easing fears of another devaluation and helping to anchor inflation expectations. A more stable currency outlook also bodes well for foreign investors in Eurobonds, who benefit from reduced exchange rate risk.

The currency has shown relative stability in the official FX market, with improved liquidity allowing commercial banks to resume international transactions using naira-denominated cards, a sign of growing market confidence.

Read also: How CBN likely rate cuts will impact inflows, naira

GTBank last week set its FX rate for international transactions at N1,545 per dollar, matching the parallel market rate. By Friday, the rate had eased slightly to N1,542, down from N1,543 on Thursday and N1,545 earlier in the week.

Other deposit money banks (DMBs) also recently reinstated international spending on naira cards, albeit with daily and monthly limits, as FX availability improves. Banks have also resumed selling personal travel allowance (PTA) and business travel allowance (BTA), reversing previous suspensions triggered by dollar shortages.

The return of these services reflects confidence in FX conditions under CBN’s reforms. Notably, since May 2025, FX inflows into Nigeria have averaged $5.96 billion per month, according to the CBN data.

Under Cardoso, the CBN has opened up multiple FX channels to boost dollar supply, support manufacturers, and meet retail demand. These include new remittance products, licensing of additional international money transfer operators (IMTOs), adoption of a willing buyer-willing seller FX model, and ensuring timely naira liquidity for IMTOs. These reforms aim to streamline FX access across the financial system.

“The external reserves are at the highest level since December 6, 2021 almost four years now,” said Ayodele Akinwunmi, chief economist at United Capital Plc. “At the current level of reserves, the risk of naira depreciation is minimal. With the currency likely to remain stable or even appreciate in the coming weeks, foreign investors’ appetite for the Nigerian equity and bond markets will increase, leading to higher demand and price appreciation.”

Akinwunmi noted that increased demand for Eurobonds would also push prices up and yields down, making it cheaper for both the federal government and corporates to raise capital, thereby stimulating economic growth.

“There is a structural change in the Nigerian economy that should support increases in both oil and non-oil exports, foreign investments, and diaspora remittances,” he said.

Ayokunle Olubunmi, head of Financial Institutions Ratings at Agusto & Co, said the rising external reserves will further support the naira as it symbolises stronger firepower by the CBN.

“The inflows of foreign portfolio investors, supported by a more stable exchange rate, could further drive a bullish run at the stock exchange.”

Adebowale, earlier quoted, said Nigeria operates a managed floating exchange rate system, which allows the central bank some control over currency movements, noting that as external reserves increase, the CBN is better positioned to support the FX market and maintain currency stability.

She said the naira has been relatively stable in the last few months, trading lower than N1,600 to a dollar, as economic reforms bolsters investor confidence and boosts dollar inflows into the economy, as evidenced by the accretion in the external reserves.

Eurobond effect

Nigeria faces a $1.1 billion Eurobond maturity in November 2025. With gross foreign reserves at over $41 billion, investors are aware that the government has adequate capacity to meet this obligation without depending on new borrowings.

“This provides room for the proceeds from any fresh issuance to be directed toward broader budgetary needs rather than to liability management,” analysts at CSL Stockbrokers said.

Read also: FX scarcity, naira volatility drive Nigeria’s $22bn stablecoin boom

The interest cost of issuing US dollar bonds is now lower as Nigeria’s average Eurobond yields declined 20 basis points in the previous week to 7.78 percent, levels last seen three years ago, from 9.51 percent at the beginning of the year, and even over 11 percent at the peak of the global tariff war.

At the compressed levels of seven percent, Nigeria is positioned to issue Eurobond at a much lower cost than its peers such as the Ivory Coast, Benin Republic, and South Africa.

Adebowale said, “For Eurobonds, stronger reserves enhance investor confidence in Nigeria’s debt repayment capacity, increasing the country’s ability to raise money in the international debt market. It will also lower risk premium, reducing borrowing costs.”

OMO bills

Foreign investors dominated March 1 and March 6, 2024 bids for Nigeria’s open market operations (OMO) and treasury bills by 75 percent, the CBN said.

Also, the CBN raised N3.58 trillion through the Nigerian Treasury Bills (NTBs) and OMO in May 2025, according to a CBN report.

This represented about 75 percent rise from N2.05 trillion raised in April 2025. Only banks and foreign investors participate in OMO bids.

Data from the CBN show that total OMO bill sales reached N13.5 trillion in 2024, a massive increase from N723 billion in 2023. At a single auction on November 11, 2024, the CBN sold over N1.4 trillion in 365-day OMO paper, nearly double the total sales made in all of 2023.

Crude oil exports, which account for 80–90 percent of Nigeria’s foreign exchange earnings, remain the main source of external reserves. Other sources include non-oil exports, diaspora remittances, portfolio and direct investments, Eurobond issuances, foreign loans, as well as grants and aid.

According to a recent report by the Nigerian Economic Summit Group (NESG), foreign portfolio investment (FPI) accounted for the bulk of recent capital inflows, reflecting investors’ strong preference for Nigeria’s money market instruments.