(Bloomberg) — US equity-index futures advanced, signaling renewed sentiment after the Federal Reserve’s interest-rate cut, even as questions lingered over the pace of future policy easing.

Contracts for the S&P 500 advanced 0.5% while those for the Nasdaq 100 gained 0.7%, after the underlying benchmarks posted minor declines following the Fed’s decision on Wednesday. Treasuries recouped some of their losses, while a gauge of the dollar rose for a second day as Fed Chair Jerome Powell termed the move a “risk-management cut.” Shares in Japan, China and South Korea rose.

Oil held a decline as traders weighed the rate cut and an increase in US fuel inventories. New Zealand’s bonds gained and the currency fell after softer economic data fueled speculation of an outsized rate cut.

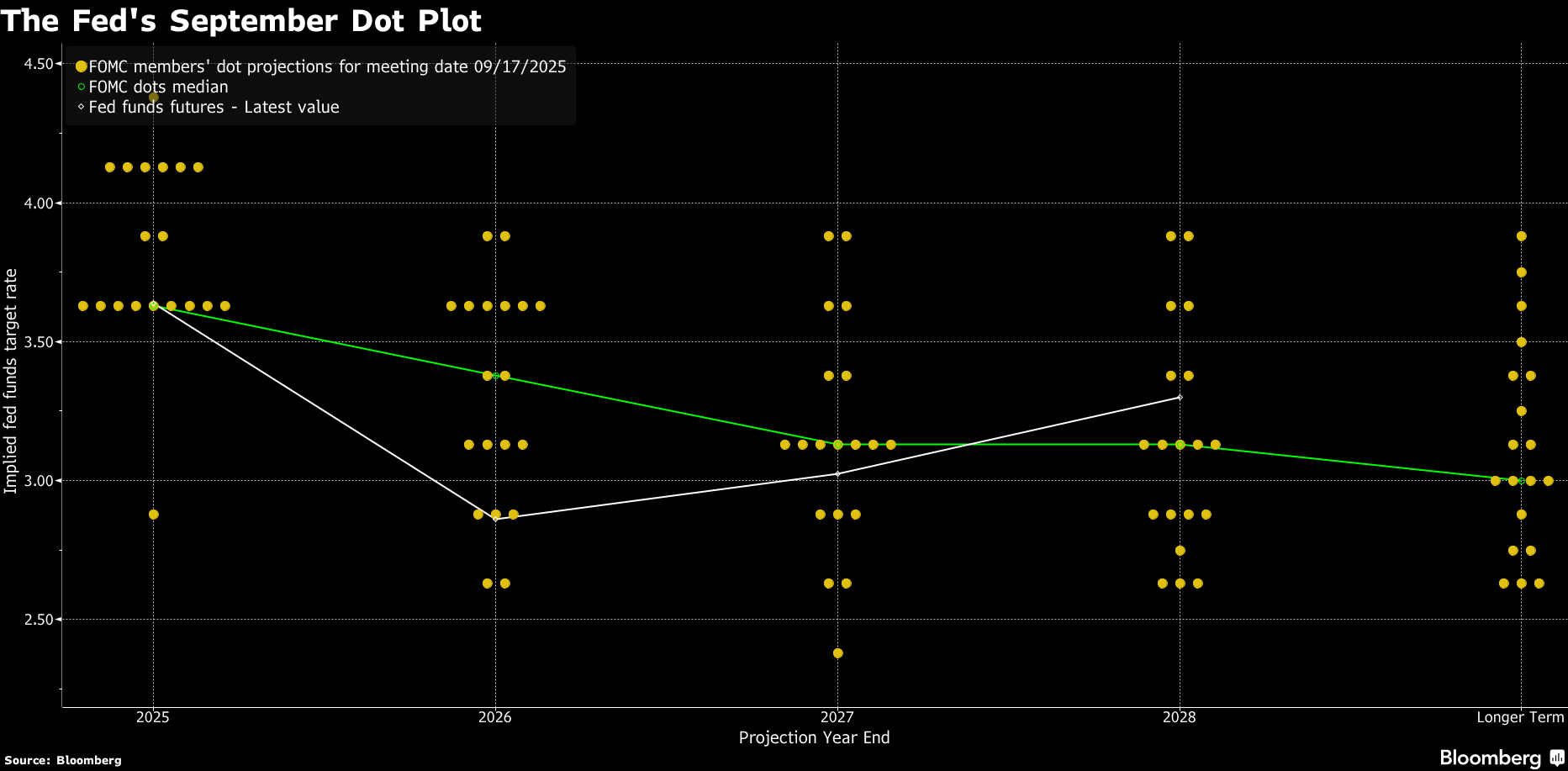

An index of global stocks climbed to a record high this week as investors priced in a 25-basis-point cut ahead of the Fed meeting. While the central bank followed through with a cut, officials stressed future policy will be decided “meeting by meeting” and warned “there’s no risk-free path.” Even so, policymakers now see two additional quarter-point cuts this year, one more than was projected in June.

“It’s going to be very much business as usual,” said Andrew Jackson, head of Japan equity strategy at Ortus Advisors. The market will continue “to chase upside in tech and AI with very little profit taking emerging from the Fed event, despite most indices at or close to their record highs.”

The Fed cut its benchmark interest rate by a quarter percentage point and penciled in two more reductions this year following months of intense pressure from the White House to slash borrowing costs. The Federal Open Market Committee voted 11-1 to lower the target range for the federal funds rate to a range of 4% to 4.25%.

The lone dissent came from Fed Governor Stephen Miran, a close ally of Donald Trump who favored a larger reduction. Governors Christopher Waller and Michelle Bowman, who in July dissented in favor of a rate cut, supported this week’s move.

What Bloomberg strategists say…

“The US dollar should enjoy today’s respite as it will be short-lived. Next week Fed speakers will be back in full force and they could sound more dovish than was implied during this week’s policy decision. Stephen Miran called for a 50-bp cut this week and others may follow to speed up the process of lowering rates through next year.”

—Mark Cranfield, MLIV strategist.

UBS’s Arend Kapteyn joins Bloomberg TV to discuss the factors the Fed needs to consider.Source: Bloomberg

UBS’s Arend Kapteyn joins Bloomberg TV to discuss the factors the Fed needs to consider.Source: Bloomberg

Powell pointed to growing signs of weakness in the labor market to explain why officials decided it was time to cut rates after keeping them on hold since December amid concerns over tariff-driven inflation.

Investors, and also the Fed, are now back to being data dependent, said Jack McIntyre, portfolio manager at Brandywine Global, on Bloomberg Television.

“The Fed finally pulled the trigger, but the market’s reaction was anything but straightforward,” said Armina Rosenberg, co-founder and co-portfolio manager at Minotaur Capital in Sydney. “The cut itself wasn’t a huge surprise, though the combination of a dovish move with still-cautious guidance left investors in two minds.”

Powell pushed back against bond traders betting the Fed would sweep in with a series of aggressive rate cuts to prevent the US economy from stalling. The Fed chair indicated he’s not abandoning his cautious approach, still mindful of the risks of inflation.

“Today’s news met expectations,” said Larry Hatheway, global investment strategist at Franklin Templeton Institute. “But the challenge for investors is a Fed that is not yet willing to endorse their discounted future path of much lower interest rates.”

With the Fed meeting out of the way, investors will now turn their attention to policy decisions by the Bank of England Thursday and the Bank of Japan on Friday.

Elsewhere in Asia, Chinese semiconductor makers rose after China’s ban on importing an Nvidia Corp. chip, a move that may boost the outlook for local competitors. Still, the restriction may impact product developments for AI-related firms in China, analysts say.

Also, Huawei Technologies Co. unveiled its latest solution to bundle more AI chips together and boost computing power in a bid to challenge Nvidia.

Corporate News:

- Santos Ltd. shares dropped as much as 14% at the start of Sydney trading after a group led by Abu Dhabi National Oil Co. walked away from a $19 billion takeover bid.

- Tesla Inc. is working on a redesign of its door handles, which have drawn scrutiny over safety incidents that trapped passengers inside their vehicles.

- Meta Platforms Inc., seeking to turn its smart glasses lineup into a must-have product, on Wednesday unveiled its first version with a built-in screen.

- Cracker Barrel Old Country Store Inc. fell sharply after offering sales guidance that missed expectations, showing the brand is still dealing with the fallout from its controversial and short-lived logo change.

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.5% as of 12:57 p.m. Tokyo time

- Japan’s Topix rose 0.5%

- Australia’s S&P/ASX 200 fell 0.6%

- Hong Kong’s Hang Seng fell 0.2%

- The Shanghai Composite rose 0.5%

- Euro Stoxx 50 futures rose 0.5%

Currencies

- The Bloomberg Dollar Spot Index rose 0.1%

- The euro was little changed at $1.1814

- The Japanese yen was little changed at 147.03 per dollar

- The offshore yuan was little changed at 7.1047 per dollar

Cryptocurrencies

- Bitcoin rose 1.7% to $117,625.55

- Ether rose 2.5% to $4,616.06

Bonds

- The yield on 10-year Treasuries declined two basis points to 4.07%

- Japan’s 10-year yield advanced one basis point to 1.600%

- Australia’s 10-year yield declined one basis point to 4.21%

Commodities

- West Texas Intermediate crude fell 0.2% to $63.92 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.