THE automotive industry is reaching a breaking point, and its startling similarities to a time just before major financial collapse should have consumers worried.

A new report highlights both the unbelievable amount of automotive debt Americans are currently shouldering, and what it could say for the immediate future.

2

Contemporary car owners are under more financial stress than ever beforeCredit: Getty

2

Rising costs of ownership are also influenced by regular maintenance and unpredictable repairsCredit: Getty

The Consumer Federation of America (CFA) released a new report which found that Americans owe a record-breaking $1.66 trillion in automotive debt alone.

The CFA’s report furthered that it could be a warning of significant economic downturn thanks to the current industry’s commonalities with its condition just before the Great Recession.

“Delinquencies, defaults, and repossessions have shot up in recent years and look alarmingly similar to trends that were apparent before the Great Recession,” the report specified.

Other experts are asserting that recent factors in the industry, such as the COVID-19 pandemic and President Donald Trump’s tariffs on imported vehicles, could spark transcendental change.

Read More Auto Industry News

“What we’re seeing now is a structural shift, driven by policy, that’s likely to be long-lasting,” said Boston Consulting Group’s global lead of automotive and mobility Felix Stellmaszek to CNBC.

“This may well be the most consequential year for the auto industry in history – not just because of immediate cost pressures, but because it’s forcing fundamental change in how and where the industry builds,” he elaborated.

In the immediate aftermath of these changes, consumers are being saddled with the burden, often finding themselves in possession of financed vehicles which have negative equity.

Towards the end of 2024, more than one of every five used vehicle trade-ins carried negative equity of $10,000 or more, according to Edmunds.

The average trade-in age in 2024 was also only 3.7 years old, further highlighting the significance of these fairly new vehicles going underwater in value so quickly.

On average, vehicles traded in last year had over $6,000 in negative equity, debt which purchasers must carry with them into their next vehicle purchase.

Trump slaps 25% tariffs on ALL cars imported to US in huge blow to auto industry

“Consumers owing a grand or two more than their cars are worth isn’t the end of the world, but seeing such a notable share of individuals at the $10,000 or even $15,000 level is nothing short of alarming,” said Jessica Caldwell, head of insights at Edmunds, per CNBC.

Negative equity further exacerbates the record-high costs of new vehicles, with the average price of a brand-new car now just under $50,000.

Monthly payments currently average roughly $745, with loan balances averaging above $41,000 and continuing to climb.

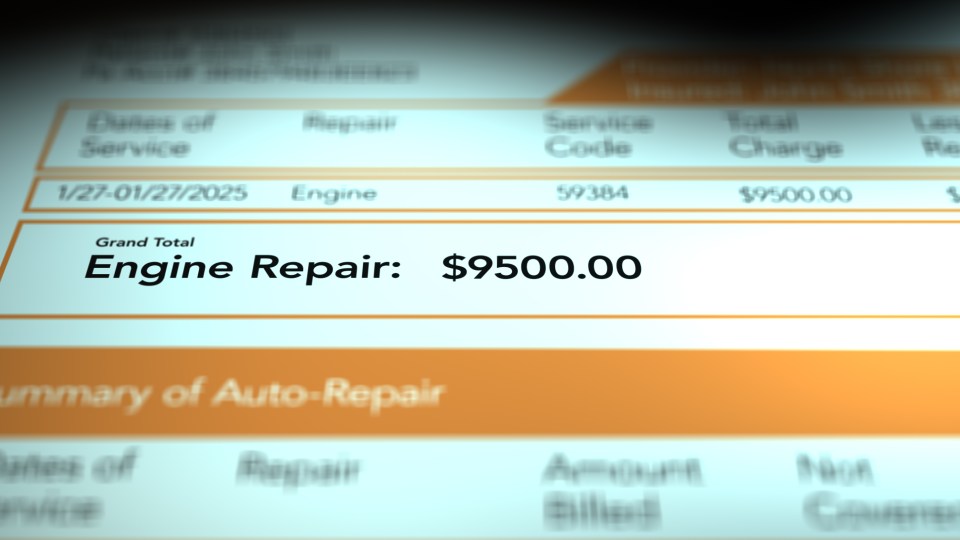

Additional costs like monthly insurance payments, regular and significant maintenance and repair costs, and gas prices are further complicating contemporary car ownership.

Dealership Tips

Here are some expert tips when purchasing a car from a dealership lot:

- 1. Set your price: Ensure you’ve calculated your monthly budget before going to the lot. You should include the car’s loan payment, insurance costs, fuel, and regular maintenance.

- 2. Research: Make sure you know which cars you’re interested in test driving before you reach the dealership.

- 3. Pre-approval: Secure financing before you go to the dealership. Dealerships may give you a better interest rate if they are competing with an outside bank.

- 4. Test away: Get behind the wheel before making any payments. A car purchase will be worth thousands of dollars – drivers should ensure they like the drivetrain, steering feel, and comfort of the car before taking it off the lot

- 5. Haggle: Drivers should always try to negotiate the price. There are so many good cars on the American market – buyers have a strong hand when negotiating price.

Source: Kelley Blue Book

While the used car market is also rising in cost, these price increases are much less significant than what the new car market is experiencing, making it potentially preferable for some purchasers.

Even if consumers choose to buy new, there are still some ways to save money and ensure they don’t overspend.

Sticking to a predetermined budget, refinancing to lower interest rates, and regularly comparing insurance quotes from multiple providers to ensure the best deal possible can all help mitigate new car costs.

DEVILISH DEALERSHIP TACTICS

While the overall economy and auto industry facing a crisis, dealerships aren’t helping with dodgy tactics that can cause customers’ livelihoods to be ruined.

In May, an Ohio dealership was charged with committing several counts of odometer fraud, often reducing the mileage to nearly half its true value.

A Florida dealership even went as far as to repurpose one car’s title for another in a scam that almost went unnoticed by the purchaser.