The federal government is still shut down. A major sticking point between Republicans and Democrats is, of course, health care.

Congressional Democrats are refusing to endorse a temporary spending bill that allows Affordable Care Act health insurance subsidies to expire, a concern recently echoed by Rep. Marjorie Taylor Greene. Open enrollment for ACA plans is less than a month away, so there’s a lot immediately at stake for the over 24 million people who get their health care through the ACA. That’s especially true for those who get assistance to pay for that insurance.

Cynthia Cox is vice president and director of the Program on the Affordable Care Act at KFF. She recently joined “Marketplace Morning Report” host Sabri Ben-Achour to explain how the subsidies could impact both people who get health insurance through the ACA marketplace and those who get insurance through their work. The following is an edited transcript of their conversation.

Sabri Ben-Achour: These enhanced subsidies are set to expire at the end of this year. The open enrollment period begins Nov. 1. What happens if these enhanced tax credits are not approved before people start enrolling?

Cynthia Cox: If Congress doesn’t act soon, then what’s going to happen is people are going to log on to shop on Nov. 1, and they’re going to see that their premium payments are doubling or more, on average. At KFF, we’ve estimated that premium payments will increase by 114% if Congress does not extend the enhanced premium tax credits.

Ben-Achour: Since these enhanced subsidies for health insurance went into effect in 2021, enrollment has exploded from 11 million to 24 million people. Who would be hit hardest if these benefits expire?

Cox: It’s probably actually a lot of Republican voters who are going to be affected. That’s because when we look at where all this growth has been concentrated, more than half of it is in Texas, Florida, Georgia, and North Carolina. Big Southern Red states are going to be really affected. And then when you look at the demographics of the people who are buying their own health insurance, and especially those who would lose subsidies altogether, they’re disproportionately small business owners. They’re older adults, early retirees, or pre-retirees. And also, a lot of farmers actually get their health insurance through the ACA marketplaces.

Ben-Achour: If we get millions of people who find out that they cannot pay for ACA health insurance, and they get off of these plans, does that affect the broader insurance pool? You know, like, for example, people who get their health insurance through their jobs.

Cox: There are potentially some ripple effects. You know, health insurance companies are saying, “Well, we think that this market, the people who buy their own health insurance, is going to be sicker next year, because healthier people are going to see this premium spike and they’re going to drop out of the market.” So then that means that insurance companies, — again, just for people who buy their own health insurance — are going to start charging even higher premiums than they otherwise would. So this could affect people who buy their own insurance — even if they don’t get a subsidy, even if they don’t get financial help at all.

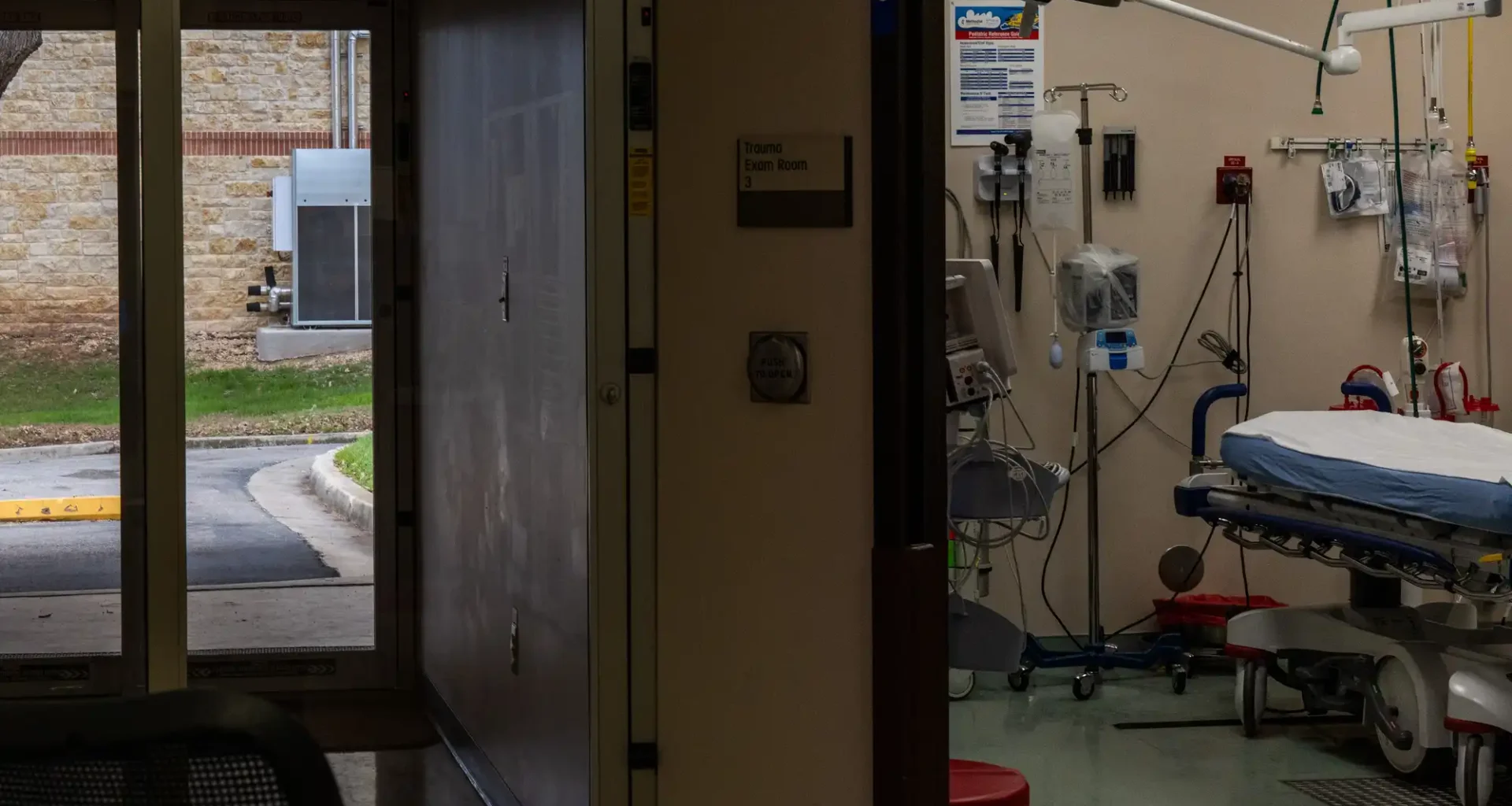

Now, the other issue here is that when more people are uninsured, then they might still need emergency care. So the concern is that this could affect hospitals’ finances — and especially maybe in rural areas or places where hospitals are already struggling financially. You know, having a big influx of uninsured people could be enough to, you know, get that hospital to have to cut some services or even shut down.

Related Topics