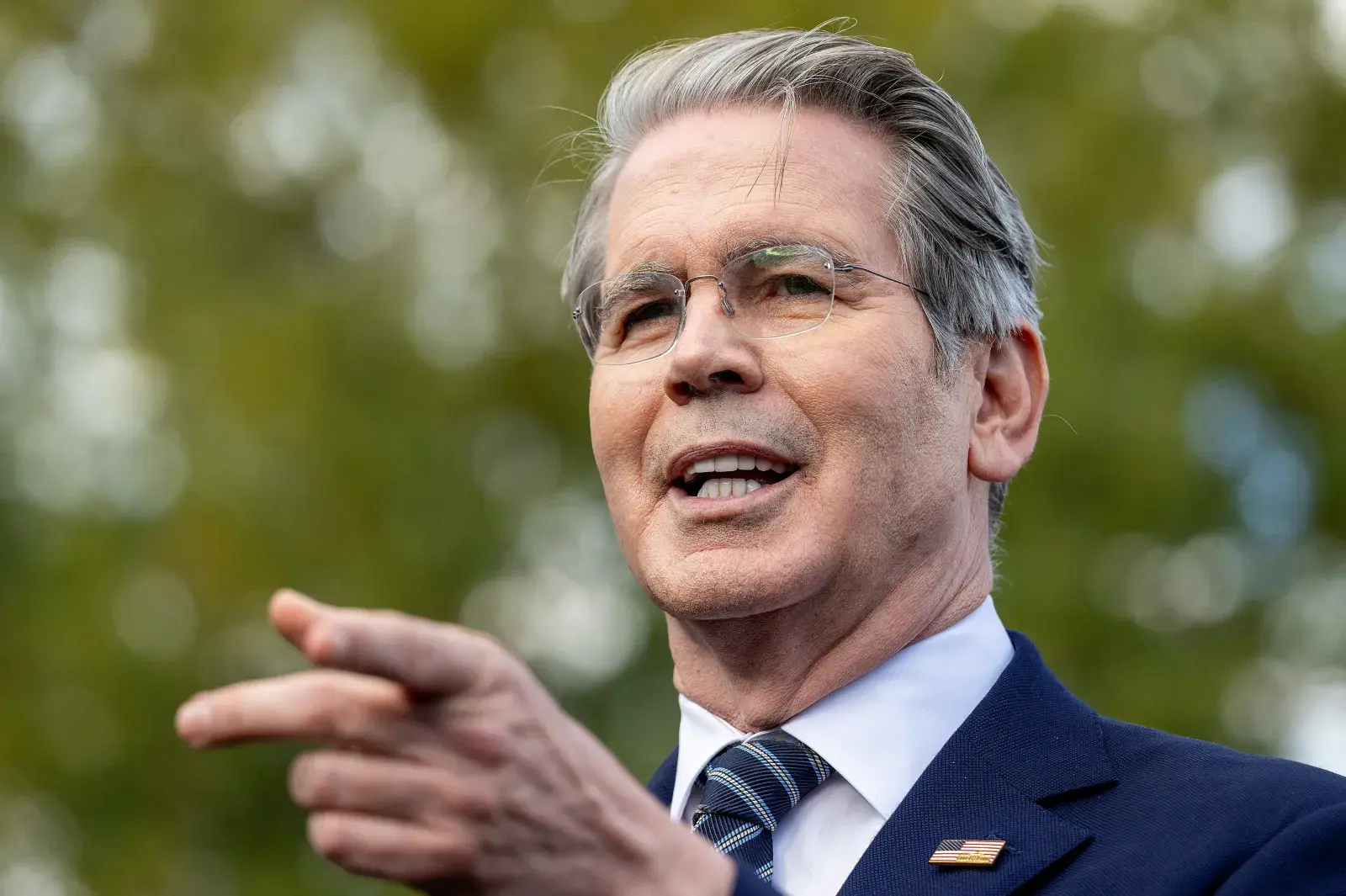

The housing market, together with other parts of the country’s economy, could already be in a recession, U.S. Treasury Secretary Scott Bessent warned on Sunday.

“I think that we are in good shape, but I think that there are sectors of the economy that are in recession,” Bessent said during an interview for CNN’s ‘State of the Union.’

The blame, the Trump-appointed treasury secretary said, should be put on the U.S. central bank. “The Fed has caused a lot of distributional problems with their policies,” he told CNN.

“We have seen the biggest hindrance for housing here, that is mortgage rates. So, if the Fed brings down mortgage rates, then they can end this housing recession.”

Is The Housing Market in a Recession?

A recession, by definition, is a widespread decline in economic activity that lasts for longer than a few months.

While home prices are still rising at the national level, with the median sale price of a typical U.S. home at $435,285 last month, up 1.7 percent compared to a year earlier, the U.S. housing market has slowed to a crawl this summer, reporting six months of year-over-year declines in sales since January, according to Redfin.

Demand has shrunk in recent months because of ongoing affordability issues keeping homebuyers to the sidelines of the market, including stubbornly elevated borrowing costs, high prices and property taxes, and rising home insurance premiums and homeowners associations (HOA) fees.

In response to slower demand, developers in the country have slowed down new construction activity and cut down on residential building permits, in a move that Moody’s Analytics chief economist Mark Zandi described as a troubling sign for the U.S. economy.

In a previous interview with Newsweek, Zandi said that the U.S. housing market has “been troubled since mortgage rates went up” following the Federal Reserve’s 2022 aggressive rate-hiking campaign to combat the rise of inflation.

“Most of the problems have been with regard to sales. They’ve been very depressed because of the interest rate lock, the housing lock. But the thing that’s going to be problematic, and this adds to the concerns about a recession here in the second half the year going into next, is homebuilding.”

Now that builders have realized this is not a good time to put more properties on the market because of depressed demand, Zandi thinks that “homebuilding is gonna weaken here very significantly,” he said.

“And that’s just another reason to be nervous about the economy’s staying power and getting through this without going into recession.”

Zandi said that the entire U.S. economy might slip into a recession by the end of 2025.

While he has not explicitly said that the U.S. housing market is in a recession, another expert, real estate analyst Nick Gerli, has spoken of the U.S. housing market being stuck in a “disinflation and deflationary vortex” which could signal “the precipice of a big decline.”

Can the Fed Be Blamed for It?

In his blaming of the Fed, Bessent was echoing President Donald Trump’s grief at the central bank, which he has accused of failing to lower costs for Americans and preventing him from keeping one of his campaign promises.

For much of the year, Trump complained about the Federal Reserve’s reluctance to cut interest rates despite the economy remaining fairly strong—a move the bank only took in September for the first time since December 2024 after the jobs market showed clear signs of weakening.

But last month the Fed, which had previously suggested it might cut its key rate twice more before the end of the year, cast doubt over whether it will do so considering the evolving economic situation in the country, which remains in a federal shutdown.

In an interview with the New York Times published on Sunday, Federal Reserve Governor Stephen Miran said that the Fed risks triggering a recession if it does not quickly lower interest rates.

Miran is the newest member of the central bank’s Board of Governors and is on temporary leave from his post as chairman of the White House Council of Economic Advisers, where he will return in January.

“If you keep policy this tight for a long period of time, then you run the risk that monetary policy itself is inducing a recession,” Miran told the newspaper. “I don’t see a reason to run that risk if I’m not concerned about inflation on the upside.”

Bessent made a similar remark to CNN, saying: “If we are contracting spending, then I would think inflation would be dropping. If inflation is dropping, then the Fed should be cutting rates.”

But the Fed remains careful, especially as the shutdown is forcing it to drive in the dark, delaying key reports on how the economy is doing.