The bold effort by Dallas’ new Texas Stock Exchange to take on the New York Stock Exchange and Nasdaq duopoly has been framed initially as a race for prestigious corporate listings—or dual listings, at least. But a key advisor to TXSE says the upstart venture also will be waging a battle to list exchange traded funds, which have boomed in recent years.

Over the last two years more than $2 trillion in investor cash has reportedly poured into ETFs, which are baskets of securities that focus on particular markets, like AI or cryptocurrency, and trade during the day like stocks. NYSE says it currently lists nearly 80% of all ETFs.

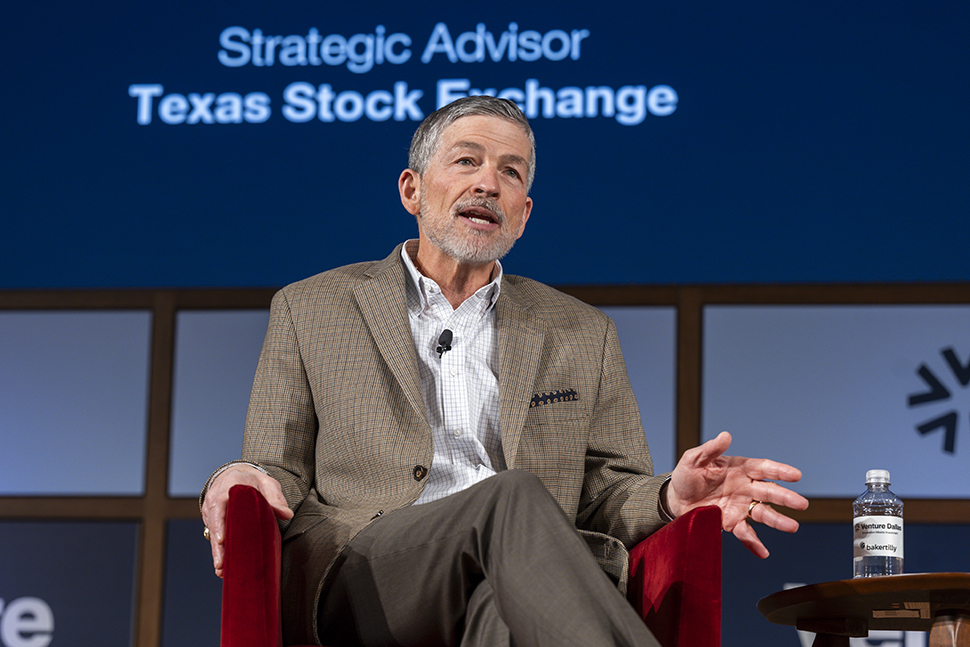

While some companies may want to list or dual-list on TXSE, “I would say what’s really attractive is the exchange traded products. That’s exploding,” TXSE strategic advisor Jeb Hensarling told Dallas Innovates during a brief interview at last week’s 2025 Venture Dallas conference in Dallas. “That’s not where you’re talking somebody into necessarily leaving NYSE or Nasdaq, or even co-listing. We’ve got a whole new player here, and they’re looking, ‘Where is it best for my ETP to trade?’ And we think a whole lot of them are going to conclude that it’s ‘Tex-see.’ That’s a big revenue center.”

Jeb Hensaling and moderator Ylan Mui of the Penta Group onstage at Venture Dallas. [Photo: Grant Miller Photography/Venture Dallas]

Hensarling, a former GOP congressman from Dallas and ex-chairman of the House Financial Services Committee, said that, in addition to revenue captured between the trading day’s “opening and close,” companies also benefit from stock exchange data, licensing, and software offerings. TXSE hasn’t been shy about touting its budding expertise in those areas, or in its “state-of-the-art trading engine,” which Hensarling said is now in testing, five months ahead of schedule.

The engine was “built from the bottom up,” rather than bolted onto old technology, and is designed to meet or exceed its rivals’ standards, Hensarling said onstage at Venture Dallas. “There may be eight, nine, 10 people who have the expertise, the experience, and gravitas to really design a world-class trading engine for equities, and three of them work at TXSE,” he said.

The new exchange’s parent company, TXSE Group Inc., also launched in September a security-first, AI-native market intelligence platform for U.S. Securities and Exchange Commission compliance and data analytics called Oculon Intelligence. But interestingly, Oculon’s integrated suite of software products “wasn’t the idea of the TXSE group,” Hensarling told the conference attendees. “They were approached by major market players who said, ‘We know you have the capability to do this. There is a need in the marketplace, and we are turning to you to do it.’”

ETP listings in 2Q 2026

Another leg up for TXSE, he said, will be its continued strong advocacy for a competitive regional business environment, following a “capital markets package” passed recently by the state Legislature. That package included measures making Texas more competitive than Delaware for incorporation and raising thresholds for shareholder proposals and proxies, thereby curbing frivolous shareholder proposals. To fully realize the advantages, Hensarling said, companies need a Texas nexus including Texas incorporation—and listing and trading on a Texas stock exchange.

Jeb Hensarling [Photo: Grant Miller Photography/Venture Dallas]

Having secured SEC registration approval and total capitalization of $250 million from heavyweight players including J.P. Morgan, BlackRock, and Charles Schwab, TXSE said it will announce the location of its new permanent headquarters in Dallas by year’s end. Hensarling said training on the trading engine should happen in the first quarter of 2026, “going then to listings of ETPs probably in the second quarter of next year, with listings in corporates to follow.”

At Venture Dallas, moderator Ylan Mui of the Penta Group research and consulting firm asked Hensarling whether he was worried about the recent incursions into Texas by NYSE and Nasdaq. The former launched NYSE Texas this year, reincorporating its NYSE Chicago here, while Nasdaq announced in March that it would open a new regional headquarters in the Dallas area. Both moves were widely seen as responses to TXSE’s plan for its new exchange, which Hensarling said was inspired by Gov. Greg Abbott’s push to make Texas the best location to start a business and go public.

The TXSE advisor wryly said the rivals’ moves didn’t bother him. “It’s going to happen here, but I will say this: We’ve been around since 1836, so they’ve had plenty of time to get here.” Still, Hensarling said, “We welcome them. You get better with competition.”

Jeb Hensarling (left) and Ylan Mui [Photo: Grant Miller Photography/Venture Dallas]

‘The bull market is coming home’

That competition will improve all three exchanges, he said—and ultimately make it easier for companies to go public. That’s important, he said, because the number of public companies has been cut in half since 2000, in part due to higher listing prices and current exchange regulations that have companies “checking the boxes” and “playing defense.”

In contrast, “TXSE is going to be an advocate for issuers and companies,” Hensarling said.

He predicted that in 10 or 15 years, TXSE will become nothing less than an economic center of gravity.

“The history of Texas’ economy continues to be written. There’s a chapter on the Chisholm Trail, there’s a chapter on Spindletop, there’s a chapter on Texas Instruments and the integrated circuit,” Hensarling said. “But one day they’re going to write a chapter, and it’s going to be about the Texas Stock Exchange and how Texas became the center for capital markets in America. And it starts now, because, yes, the bull market is coming home.”

Meantime, TXSE’s competitors aren’t exactly sitting on their hands.

At the Venture Dallas conference, NYSE Texas disclosed that it already had secured more than 90 dual listings. Included in that number were powerhouse local companies like AT&T, Cinemark, and D.R. Horton. In July, NYSE Texas also debuted its first exchange traded funds, with Strive Asset Management dual-listing 13 ETFs. And Nasdaq, for its part, recently said it filed with the SEC to create a structured regulatory opportunity to trade tokens tied to stocks and ETPs.

Quincy Preston contributed to this report.

Don’t miss what’s next. Subscribe to Dallas Innovates.

Track Dallas-Fort Worth’s business and innovation landscape with our curated news in your inbox Tuesday-Thursday.

R E A D N E X T

-

North Texas has plenty to see, hear, and watch. Here are our editors’ picks. Plus, you’ll find more selections to “save the date.”

-

Cait Brumme says the event at Dallas’ Pegasus Park on Nov. 6 will explore the technologies and economic forces defining the future for entrepreneurs and innovators.

-

AI seem overwhelming? Just go to office hours.

-

Top executives at Nasdaq and Susser Bank celebrated high-growth potential companies contributing to region’s rise in entrepreneurship and innovation

-

You’ll find deadlines coming up for a new accelerator program; and many more opportunities.

![Jeb Hensarling [Photo: Grant Miller Photograhy/Venture Dallas]](https://www.europesays.com/us/wp-content/uploads/2025/11/20251030VentureDallasConference-DSC_6240.jpg)