CNBC’s Jim Cramer on Thursday expressed concerns about the “experiential economy,” businesses related to travel and leisure.

“I’m a lot more worried about the experiential economy than I was a month ago, thanks to a combination of weaker macro data and some discouraging earnings reports,” he said. “While I’m not yet calling the whole theme dead, I’ll certainly be watching this space closely going forward, because it’s clearly in a precarious place for the moment.”

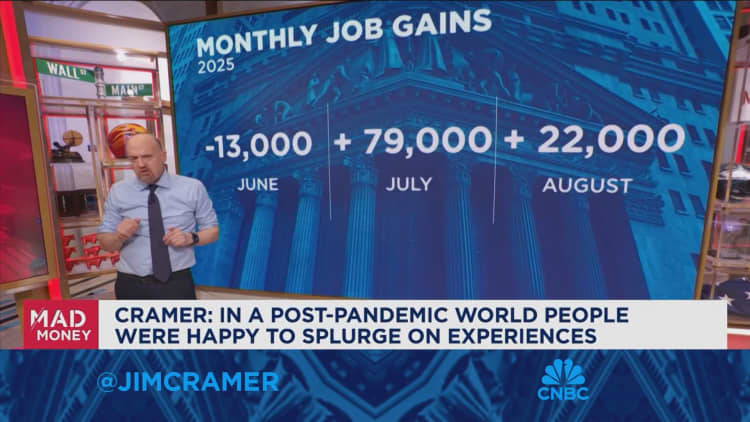

The leisure industry saw a huge post-Covid boom as consumers were eager to splurge on travel, theme parks, concerts and restaurants, Cramer suggested. But now the consumer might not be willing to spend in the same way, he indicated. While the macroeconomic landscape is uncertain without federal data, he said it’s clear the labor market is weakening. It was “already anemic” before the shutdown, and recent reports from major payroll processer ADP show job losses in October, Cramer explained. He also said the Federal Reserve might be hesitant to cut rates despite signs of softer employment because of broad uncertainty, and it seems inflation is still creeping higher.

Lackluster earnings from fast causal names Chipotle, Cava and Sweetgreen worried Cramer, and he noted that all three said younger customers are cutting back on meals away from home. He said Royal Caribbean‘s revenue outlook was a little disappointing and suggested Wall Street is growing wary about cruise lines in general. Live Nation‘s stock plunged earlier this weak after it failed to meet earnings and revenue expectations, citing a shortfall in the concerts business, he continued. Cramer also pointed to Walt Disney‘s Thursday revenue miss — the entertainment giant saw weakness in its parks and cruises arm, and management indicated weaker growth in the segment during the second half of the year.

While much of this data paints a negative picture of the experiential economy, Cramer pointed out that American Express, a credit card giant known for travel perks, is seeing continued success. He also said there could be an opportunity for value in many of these leisure stocks because they have come down so much. If their shares keep falling, the Fed might have to cut rates, Cramer added, which could help revive the sector.

“Hopefully, the end of the government shutdown will breathe new life into a group that I have pushed since Covid was over,” he said. “But maybe it won’t be enough.”

Jim Cramer’s Guide to Investing

Jim Cramer’s Guide to Investing

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market.

Disclaimer The CNBC Investing Club Charitable Trust owns shares of Walt Disney.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com