Park South Family YMCA, The Shops at RedBird, and Southside on Lamar were all projects that were made possible with Historic Tax Credits and New Market Tax Credits. [Photos: YMCA, Shops at Redbird, Dave Hensley/CC]

When public vision meets private capital, the result can extend beyond profit, driving long-term benefits for communities and investors. That is the mission behind Galvanize Sustainable Capital, a company dedicated to helping projects unlock the potential of Historic Tax Credits, New Markets Tax Credit (NMTC), and other community development financing and investment tools in Dallas-Fort Worth.

Founded in Pittsburgh in 2021 by Katie Hall and Tom Steyer, Galvanize recruited Mandy Price as a partner to lead and expand the firm’s presence statewide. Price has a background in mergers & acquisitions, private equity, venture capital, and corporate governance, and is well-known in the Dallas region.

Mandy Price

Galvanize has a proven track record in project finance consulting and fund management. Strategic growth in the Lone Star State enables the firm to capitalize on growing demand in the region, where impactful investments are driving community revitalization, generating scalable returns, and creating new opportunities for layered incentives. Examples include Historic Tax Credits, NMTC, and other investment programs.

“What we do is turn promising concepts into bankable projects,” said Price.

Galvanize structures complete capital stacks, pairing incentives with debt and equity to ensure that developments serving employers, families, and neighborhoods move from vision to reality. Guided by its mission to help bring these projects to life, it provides support from initial assessment through closing, investor placement, compliance, and exit.

Tax credits driving community impact

Historic Tax Credits incentivize the rehabilitation of older buildings, mills, schools, warehouses, and other types of properties. At the federal level, the credit typically equals 20% of qualified rehabilitation costs. This amount is realized over five years after the building is placed in service. In Texas, an additional 25% state credit is available.

Galvanize helps turn these credits into cash, which can turn a compelling vision into a bankable plan. To qualify, designs must meet historic guidelines, and approval should be secured before major construction decisions are made.

Joshua Lavrinc

Joshua Lavrinc, a partner at Galvanize, recently spoke at the Dallas Regional Chamber’s Southern Dallas County Task Force Meeting at Jubilee Park and Community Center. He discussed how Historic Tax Credits and NMTC work as tools for both investors and community development projects. Investors can purchase these credits at a discount, typically around 80 cents for every dollar of tax liability, and then apply them directly to their tax bill.

“This creates a double bottom line: financial and social returns,” said Lavrinc.

As communities look to preserve their history while creating spaces for future generations, tax credit programs like these have become a common financing tool. By aligning investor incentives with community outcomes, the programs transform underused properties. They become opportunities for long-term growth and revitalization for generations to come.

NMTCs prove their value in Dallas

Dallas has history with leveraging NMTC to drive impactful community development. For example, The Shops at RedBird repurposed a historic mall with community-focused tenants, attracting private investment. Similarly, the Park South Family YMCA, supported by NMTC allocations from the Texas Mezzanine Fund and Dallas Development Fund, delivered a 41,000-square-foot facility that includes childcare, health, and community spaces, to close the financing gap and create jobs while strengthening local food access.

Dallas has history with leveraging NMTC to drive impactful community development. For example, The Shops at RedBird repurposed a historic mall with community-focused tenants, attracting private investment. Similarly, the Park South Family YMCA, supported by NMTC allocations from the Texas Mezzanine Fund and Dallas Development Fund, delivered a 41,000-square-foot facility that includes childcare, health, and community spaces, to close the financing gap and create jobs while strengthening local food access.

In Southern Dallas County, NMTC continues to serve as a catalyst for job creation and community reinvestment. Alongside them, Low-Income Housing Tax Credits are enabling the development and preservation of affordable rental housing in markets where construction costs exceed achievable rents, ensuring that economic growth remains both inclusive and sustainable.

“The ripple effect of investment can be seen with South Side on Lamar—none of the subsequent development would have happened without it,” said Price. “That initial project paved the way for other condos, the Alamo Drafthouse, and additional development.”

South Side on Lamar combined Historic and New Markets Tax Credit, she noted.

Galvanize: Driving strategic investment for local growth

Galvanize principals bring decades of experience managing investment funds for low-income communities, including several strategies that were successful in the greater Pittsburgh region. The firm brings together “civic leadership capital,” uniting leading corporate, philanthropic, and civic partners to focus on targeted community development.

Galvanize collaborates with local stakeholders to identify community needs, whether through place-based initiatives or program-specific efforts, and raises and manages capital to reinvest in the region, fostering long-term economic growth and prosperity. There is a driving desire to create the same development opportunities here in Dallas.

“We work with real estate developers, project sponsors, investors, non-profits, and different types of organizations that can use tax credits,” said Price. “The critical factor is structuring projects so that the community, stakeholders, and investors all achieve their goals and we help ensure that it comes to life.”

Through partnerships with local developers and investors, Galvanize is helping lay the groundwork for neighborhood revitalization and a model for Dallas’ long-term growth.

Voices contributor Makayla Rosales is Coordinator for Opportunity and Impact at the Dallas Regional Chamber.

Don’t miss what’s next. Subscribe to Dallas Innovates.

Track Dallas-Fort Worth’s business and innovation landscape with our curated news in your inbox Tuesday-Thursday.

R E A D N E X T

-

North Texas has plenty to see, hear, and watch. Here are our editors’ picks. Plus, you’ll find more selections to “save the date.”

-

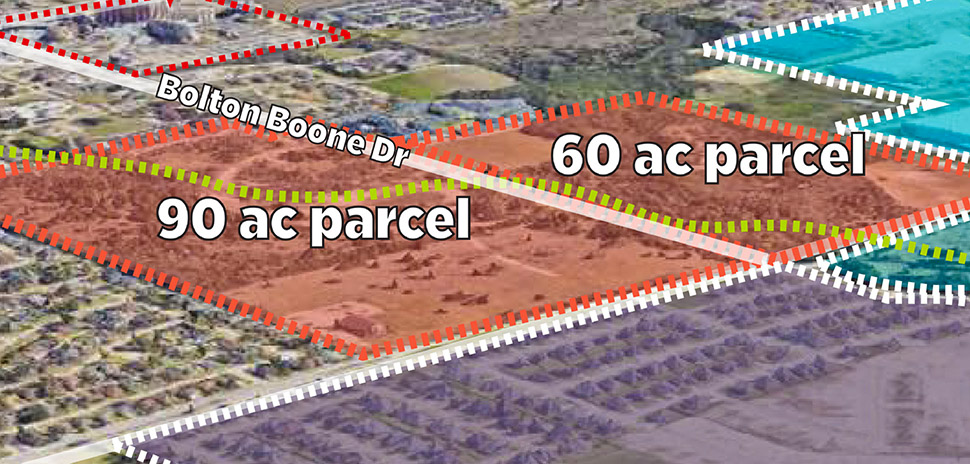

The southern half of Dallas County is home to just over 1.05 million residents. That’s about 40% of the total number of people who call Dallas County home—and roughly 200,000 more than the entire population of San Francisco. Coupled with the fact that Dallas-Fort Worth is emerging as a top life science market, as documented in a 2023 CBRE report, you can see why the DeSoto Development Corp. is including an 80-acre Life Sciences Innovation Core among its major projects. “In terms of economic development, research shows that it’s more effective when it happens regionally,” says Matt Carlson, DDC’s chief…

-

![Social entrepreneur Byron Sanders, a former nonprofit exec, is CEO of Arete Health, launched in January 2025. [Photo: Michael Samples]](https://www.europesays.com/us/wp-content/uploads/2025/10/27_ByronSanders-STEM-STEAM-STREAM-970_courtesy_Oct2019-1.jpg)

Creatives Care Dallas brings virtual care, behavioral health, 2,000+ medications with zero copay, and more to Dallas County’s gig workers. The community initiative is powered by Arete Health Shield in partnership with the Dallas Music Office.

-

D CEO and Dallas Innovates have expanded The Innovation Awards 2026 with more individual and company categories this year. Now is your chance to be part of the region’s defining recognition for innovators.

-

A familiar figure in Dallas arts, civic innovation, and public service, Cuellar will succeed longtime CEO Tony Fleo following a months-long search as Social Venture Partners Dallas plans its next 25 years.