Seniors are about to put about $300 on average back into their pockets with a brand new massive New York state law that will affect many eligible elderly.

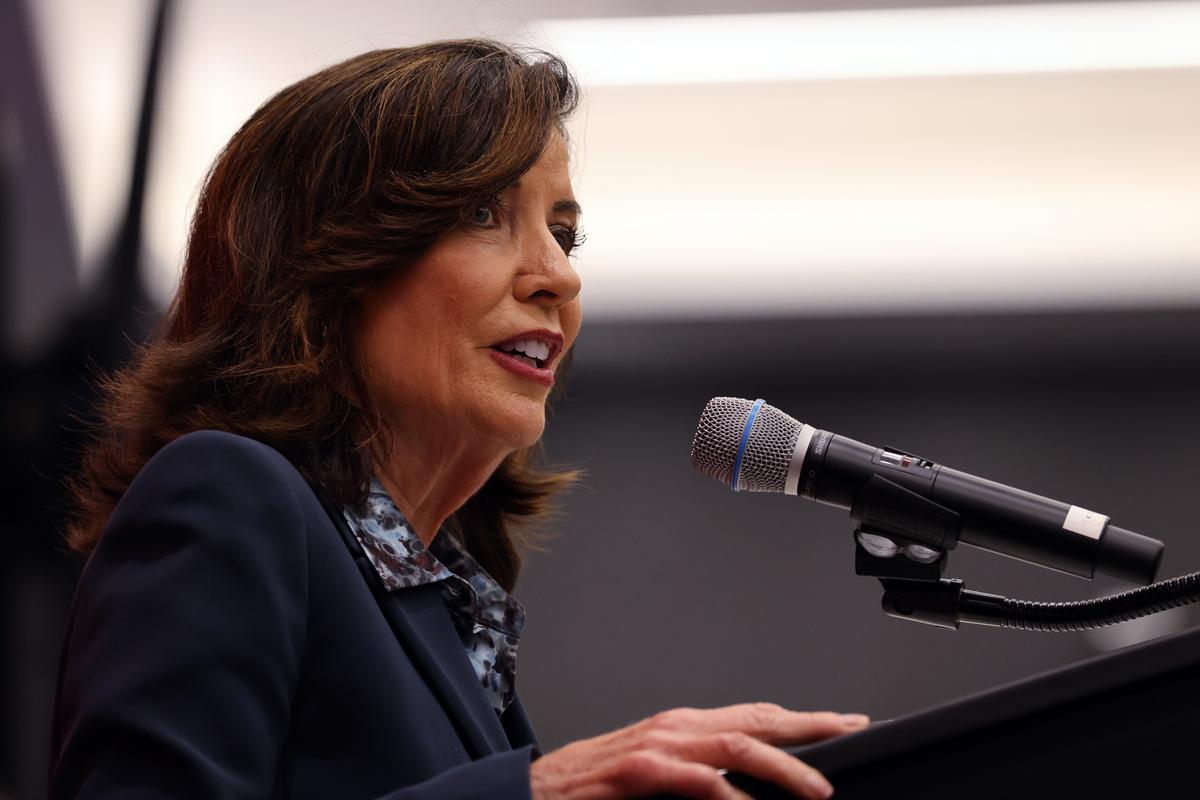

Governor Kathy Hochul just signed a new law in New York state providing local municipalities the opportunity to give property tax exemptions for up to 65%. Right now New York State caps the property tax exemption to 50%. so this is quite the jump for many seniors living in New York state. Many that are on a fixed income have concerns about affording their home when the taxes from towns and villages keeps increasing but the income coming in does not.

“No New York senior should lose their home because they can no longer afford their property taxes,” Governor Hochul said in a release. “By signing this legislation, we are working to make New York more affordable for our seniors on fixed incomes and empowering them to age in place, at home, in the communities they know and love”, according to WGRZ.

It is important to note that localities will have the option to adopt the higher exemption level based on the income eligibility standards they set.*

There are many other laws that are going to be changing in New York state come 2026. One of the big ones financially and for businesses will be that the minimum wage is going to be increasing to $17 per hour around the New York City area and $16 per hour for the rest of New York State.