24/7 Wall St

-

Verizon offers the highest yield at 6.59% with a 0.32 beta and 19 consecutive years of dividend increases.

-

McDonald’s posted a 46.90% operating margin but carries a negative book value of $3.04 per share from buybacks.

-

Johnson & Johnson raised its dividend 4.8% to $1.30 quarterly and lifted fiscal 2026 sales guidance to $93.7B.

-

If you’re thinking about retiring or know someone who is, there are three quick questions causing many Americans to realize they can retire earlier than expected. take 5 minutes to learn more here

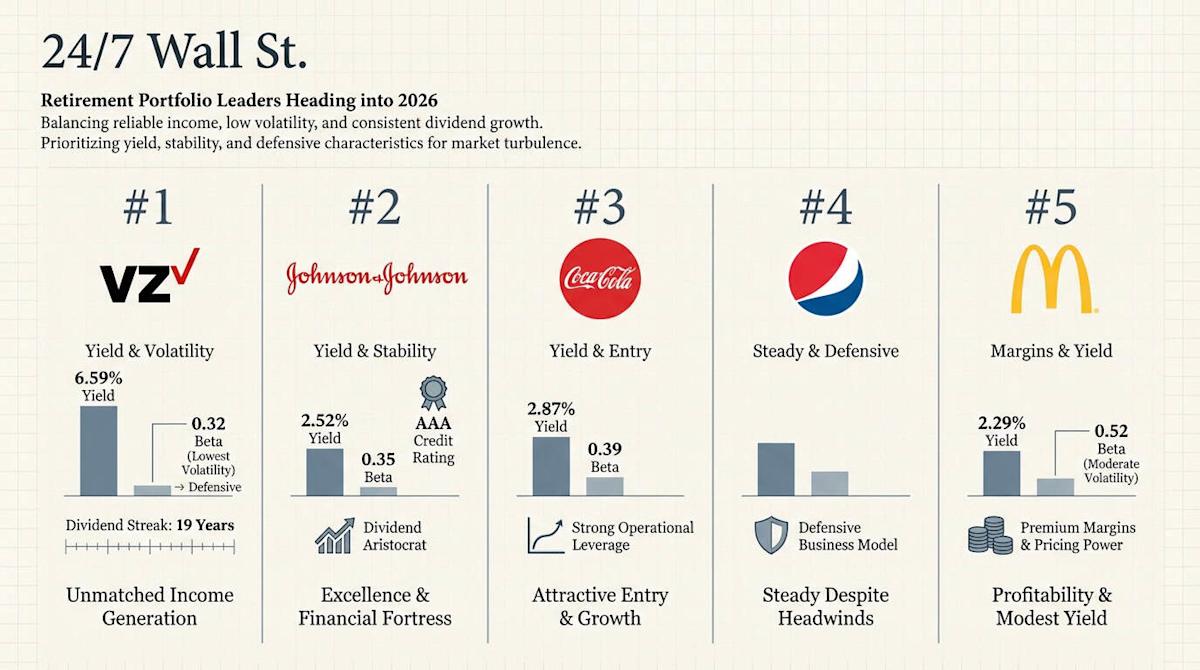

For investors approaching or in retirement, the right stock portfolio balances reliable income, low volatility, and consistent dividend growth. Among six prominent dividend-paying stocks, five stand out for their financial stability, income generation, and defensive characteristics that help retirees navigate market turbulence.

The evaluation prioritized dividend yield, dividend growth consistency, earnings stability, low volatility measured by beta, and strong cash flow generation. Secondary factors included profit margins, debt levels, and market position. Here’s how the top five retirement stocks rank heading into 2026.

McDonald’s claims fifth with a 2.29% dividend yield and $7.08 annual payout per share. The fast-food giant’s beta of 0.52 indicates moderate volatility, making it less defensive than other contenders but still suitable for conservative portfolios.

What sets McDonald’s apart is profitability. The company posted a 46.90% operating margin and 32% profit margin in its most recent results, demonstrating pricing power few restaurant operators can match. Third-quarter 2025 revenue reached $7.08 billion, up 3% year-over-year, while earnings grew 1.60%.

The company’s resilience shines through its pandemic recovery. Revenue climbed from $19.208 billion in 2020 to $25.920 billion in 2024, a 35% increase, while net income nearly doubled from $4.731 billion to $8.223 billion. With a market cap of $221.78 billion and analyst consensus price target of $331.20, Wall Street maintains confidence in McDonald’s stability. However, the company’s negative book value of -$3.04 per share, resulting from aggressive share buybacks and dividend payments, requires monitoring.

PepsiCo ranks fourth despite facing headwinds that would concern growth investors. Third-quarter 2025 results showed revenue of $23.94 billion, beating estimates of $23.85 billion, with earnings per share of $2.29 topping expectations of $2.26. However, net income declined 11.16% year-over-year, the most significant earnings weakness among these six stocks.

Story Continues

What keeps PepsiCo relevant for retirees is its defensive business model and dividend commitment. The company distributed $7.6 billion in dividends during 2025, maintaining payments through the earnings decline. Recent Reddit sentiment from dividend-focused investment communities remains bullish at 74 out of 100.

PepsiCo’s outlook calls for low-single-digit organic revenue growth in 2025, a modest projection that reflects consumer spending challenges but sets achievable expectations. The company’s portfolio of essential food and beverage brands generates consistent cash flow regardless of economic conditions.

Coca-Cola secures third with a 2.87% dividend yield, paying $2.015 annually per share. The beverage giant’s beta of 0.39 ranks among the lowest in this group, moving just 39% as much as the broader market during fluctuations.

Third-quarter 2025 results demonstrated strength, with revenue of $12.46 billion beating estimates of $12.41 billion and earnings per share of $0.86 surpassing expectations of $0.78. Revenue grew 5.07% year-over-year while net income jumped 29.78%, showing operational leverage. Management expects 5-6% organic revenue growth for full-year 2025.

Technical indicators suggest an attractive entry opportunity. Coca-Cola’s Relative Strength Index sits at 48.91, in neutral territory after recovering from deeply oversold conditions in September when the RSI dropped to the 32-36 range. The stock trades near historical support levels around $140, having pulled back from October highs when the RSI peaked at 73.

Johnson & Johnson claims second as a true Dividend Aristocrat, offering a 2.52% yield with $5.08 in annual dividends per share. The healthcare giant’s beta of 0.35 provides exceptional stability, while its AAA credit rating signals fortress-like financial strength.

Recent performance justifies confidence. Third-quarter 2025 revenue reached $23.99 billion, beating estimates of $23.76 billion, with earnings per share of $2.80 topping expectations of $2.76. Revenue grew 6.77% year-over-year while net income surged 91.24%, reflecting improved profitability. Management raised fiscal 2026 sales guidance to $93.7 billion.

Johnson & Johnson’s dividend track record stands out. The company increased its quarterly payout to $1.30 in the second quarter of 2025, a 4.8% raise from $1.24. Over the past five years, dividends grew at a 6.5% compound annual rate, comfortably outpacing inflation. The 10-year growth rate of 8.5% demonstrates sustainable increases backed by diversified healthcare revenue streams.

Verizon takes the top spot for retirement investors seeking maximum current income, delivering a 6.59% dividend yield with $2.723 in annual dividends per share. The telecommunications giant’s beta of 0.32 is the lowest among all six stocks, providing unparalleled stability.

The company’s dividend credentials are impeccable. Verizon has raised its dividend for 19 consecutive years, most recently increasing the quarterly payout to $0.69 in the fourth quarter of 2025, a 1.9% bump from $0.6775. While the five-year compound annual growth rate of approximately 3.4% trails inflation, the high starting yield more than compensates.

Third-quarter 2025 results showed revenue of $33.82 billion, missing estimates of $35.31 billion, while earnings per share of $1.21 met expectations of $1.22. Despite the revenue miss, net income grew 50% year-over-year. Management expects 2-2.8% wireless service revenue growth ahead.

The primary concern is Verizon’s $170.45 billion debt load, which requires careful monitoring. However, the company’s essential telecommunications services generate predictable cash flow that has supported uninterrupted dividend payments through multiple economic cycles. For retirees prioritizing immediate income over growth, Verizon’s combination of a 6.59% yield, ultra-low volatility, and 19-year dividend growth streak makes it the standout retirement stock among these six blue-chip options.

You may think retirement is about picking the best stocks or ETFs, but you’d be wrong. Even great investments can be a liability in retirement. It’s a simple difference between accumulating vs distributing, and it makes all the difference.

The good news? After answering three quick questions many Americans are reworking their portfolios and finding they can retire earlier than expected. If you’re thinking about retiring or know someone who is, take 5 minutes to learn more here.