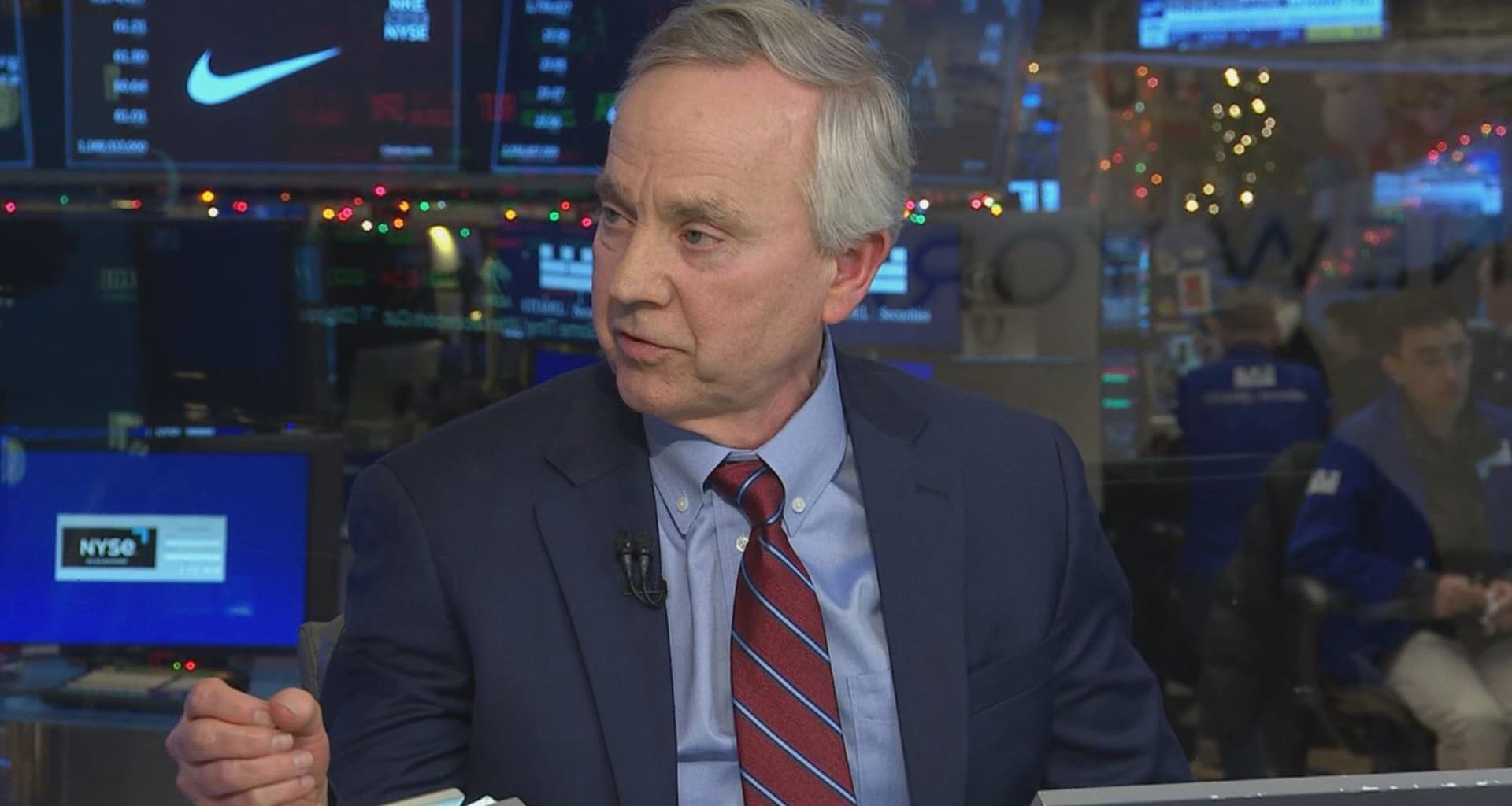

Michael Santoli’s “Mystery Broker” joined CNBC’s ” Closing Bell ” on Tuesday, where his identity was revealed to be David Snyder — and he’s not too hopeful about what’s ahead for the market. Snyder – whose predictions Santoli has been citing since 2009, when Santoli first introduced the financial advisor in his Barron’s column – entered the scene as a broker in 1986. His predictions have been more often right than not, especially with regards to making calls around market bottoms and before corrections. One of the reasons Snyder was unique at the time, Santoli noted, was because of his bearishness during the all-time market peak in 2007, and then asserted in April 2009 that the market’s lows in March of that year wouldn’t be contested and that a new cyclical bull market would have a lot of runway. Since then, he’s made a number of other right calls. In September 2011, for example, Snyder said that the bear market rally was over. He also said back then that the S & P 500 would most likely revisit the Aug. 8 lows of that year in late September or early October. He’s made calls on individual stocks as well, including Wells Fargo and General Electric. The calls can be viewed using the #MysteryBroker hashtag on X. In his approach, Snyder incorporates a slew of different indicators, ranging from economic, historical and technical factors to valuations and sentiment. He has even cited legendary investors such as Martin Zweig and well-known market strategists like Ned Davis. Snyder is currently the managing principal and chief investment officer of Journey 1 Advisors and a chartered financial analyst. Prior to starting the firm two years ago, he worked at Oppenheimer & Co. Inc., Janney Montgomery Scott and Morgan Stanley. He received a bachelor’s degree in economics from Swarthmore College, and then went on to receive a law degree from Temple Law School. So much can ‘go wrong’ Snyder struck a cautious tone when talking about the current bull market and what’s ahead in 2026. “Within two years, this is all going to end,” he said, noting the broader market could be at risk if the rally seen in recent years broadens away from the major artificial intelligence stocks. “People that want to see a broadening in the market, be careful what you wish for, because in the past, it has always been painful for the entire market.” The S & P 500 is up more than 17% this year, but most of that gain is concentrated in AI names such as Nvidia and Meta Platforms . “Every secular bull market has a new revolutionary technology that captures the enthusiasm of investors,” he said, pointing to railroads in the late 1800s, automobiles in the 1920s, aerospace in the 1960s, and then the dotcom bubble of the 1990s to 2000s. While Snyder believes that AI is “going to be phenomenal,” he expressed that the time between a bubble forming and bursting is in the first five years of a new technology coming into view. “You just have so many things that could go wrong,” he said, noting uncertainty surrounding return on investment and whether companies will get enough power from the data centers, not to mention signs that companies in China are training their language models more efficiently. “Just one of those things goes wrong, and everything blows up,” he also said.

Mike Santoli’s long-time ‘Mystery Broker’ is revealed, says bull run ‘going to end’ within 2 years

- December 31, 2025