WASHINGTON (TNND) — The Secret Service revealed on Wednesday that it partnered with federal, state and local law enforcement agencies in operations across the country which curbed more than $400 million in fraud from card skimming operations in 2025.

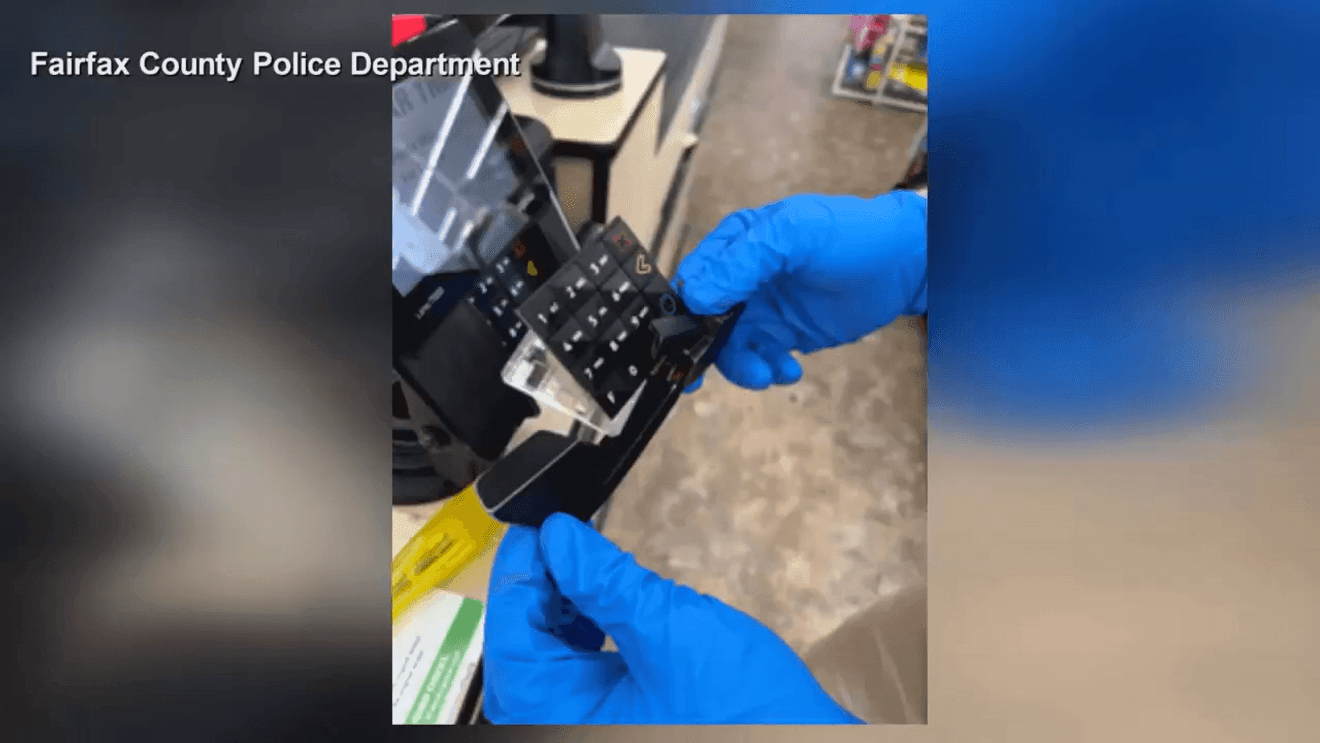

Secret Service agents and law enforcement partners visited more than 9,000 businesses, leading to the inspection of nearly 60,000 point-of-sale terminals, gas pumps and ATMs and the removal of 411 illegal skimming devices.

“These operations are only the start. We are working closely with our local, state, federal and international law enforcement partners to investigate and dismantle the criminal organizations that perpetrate these crimes,” Kyo Dolan, Assistant Director for the U.S. Secret Service’s Office of Field Operations said in a statement.

The operations occurred in dozens of cities, including Los Angeles, Washington DC, Anchorage, Boston, Orlando, Charlotte, Buffalo, San Diego, New York City, San Antonio, Baltimore, Tampa, Atlanta, Savannah, Memphis, Miami, and Pittsburgh.

The teams also distributed literature about Electronic Benefit Transfer fraud and skimming, so businesses are able to identify skimming devices.

Criminals will use skimming devices to record the card information from EBT cards and other banking cards and then “encode that data onto another card with a magnetic strip.” Law enforcement agencies have reportedly seen an uptick in skimming of EBT cards, which are food assistance benefits given to the most vulnerable populations.

“The U.S. Secret Service is committed to combatting EBT fraud and credit card skimming throughout the country. These proactive operations are aimed at finding and removing devices before criminals can recover the stolen card numbers they contain,” Dolan said.

The Secret Service is advising consumers to inspect all point-of-sale terminals and ATMs before using, and to keep an eye out for “anything loose, crooked, damaged, or scratched.” The law enforcement agency is also advocating for consumers to use tap-to-pay whenever possible and to run debit cards as a credit card to avoid putting in your pin number.