Enactment of the One Big Beautiful Bill Act (OBBBA) was a major action, but now the work begins to decipher the 870-page law and how it impacts you.

While there are hundreds of changes and thousands of implications, here are 10 items you should understand right now as you begin to plan for the future.

What does health care / life sciences need to know about OBBBA

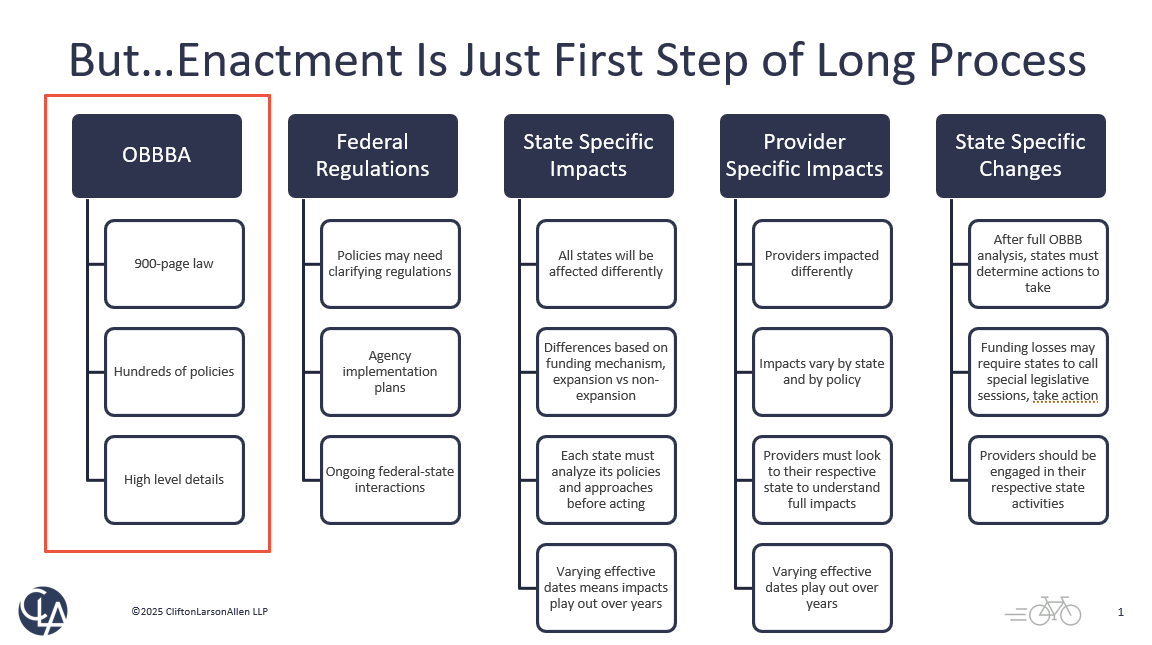

1. Enactment is only the beginning

While enactment was major, many changes in the OBBBA will roll out over months and years. For example, the federal government will need to release regulations with additional details on tax and health care policies.

The health care law changes, particularly to Medicaid, will impact states differently. States will need to decipher exactly what those impacts are and make any legislative or regulatory changes necessary. Providers must pay close attention to their state’s legislative activities.

2. Limits Medicaid provider taxes

One of the largest Medicaid policy changes relates to states’ use of provider taxes. All states but one use provider taxes to help fund their Medicaid programs. Doing so allows them to leverage more federal Medicaid matching funds. See our article explaining how the federal-state matching payments work.

The OBBBA enacts major limits to the use of these taxes. The law freezes existing taxes, bans new taxes, tightens tax methodology requirements, and phases down taxes from 6.0% to 3.5% over five years in “expansion” states — states that have taken advantage of the Affordable Care Act’s expansion coverage option.

While nursing homes and intermediate care facility taxes in expansion states are exempted from this phase down, this does not necessarily mean a state will hold them harmless from any state-specific funding or reimbursement changes.

3. Limits Medicaid state directed payments (SDPs)

A second consequential Medicaid policy relates to the use by states of what’s called “state directed payments.” SDPs are typically funded via provider taxes or intergovernmental transfers and are another mechanism states rely on to draw down additional federal Medicaid matching funds.

The OBBBA significantly limits the use of SDPs by capping any SDPs in expansion states to 100% of Medicare and in non-expansion states to 110% of Medicare. Grandfathered SDP rates will be reduced by 10% each year until the rate equals the allowable payment limit of 100% Medicare or 110% Medicare, as applicable.

For context, SDP arrangements are frequently used to raise provider payment rates above Medicare rates or even average commercial rates. Their use by states has been growing. One recent analysis found a 21% increase in the number of unique SDP arrangements and a 60% increase in spending — from $69.3 billion to $110.2 billion.

These statistics highlight the potential funding fallout for states with heavy use of SPDs in order to increase provider reimbursement rates.

4. Limits retroactive Medicaid coverage

For those needing services but not yet covered by Medicaid, Medicaid had allowed up to 90 days of retroactive eligibility from the date of application for coverage. The OBBBA changes this time period to one month for expansion population enrollees or two months for traditional enrollees.

Hospitals and nursing homes should be particularly attuned to this policy change.

5. Limits health insurance coverage for immigrants

The OBBBA makes multiple changes to which classes of immigrants can qualify for government health care coverage or subsidies under Medicaid, Medicare, or Affordable Care Act (ACA) marketplace. The changes generally restrict coverage or subsidies only to green card holders, certain Cuban and Haitian immigrants, and a few others.

6. Creates $50 billion rural health transformation fund

To attempt to address negative impacts on rural providers and locations, the OBBBA creates a $50 billion fund for rural health care transformation. These dollars will be available to states — $10 billion distributed each year for five years.

States will apply once by outlining their rural transformation plans. They must then use funds for specifically outlined activities — such as paying health care providers, recruitment and retention activities, and advancing technology solutions, among others.

States should begin developing a rural transformation plan based on statutorily outlined requirements. Rural hospitals, nursing homes, federally qualified health centers and other providers should also review those requirements and work with their states to advance activities that support their unique roles and needs.

7. Extends many individual and business tax policies

There are dozens of tax policy changes that could impact your tax strategy. For health care and life sciences, a few key policies include research and development credits (Section 174), bonus depreciation, and business interest deduction. For tax-exempt entities, of note is a 21% excise tax on any executive compensation above $1 million, not just the top 5 highest paid individuals.

8. Phasedowns of energy credits

The OBBBA accelerates the phasedown of many energy tax credits created under the Inflation Reduction Act (IRA). For details, watch our Planning Opportunities With the New Tax Law webinar.

9. Changes employee retention credits (ERC)

The OBBBA extended the period for the IRS to challenge some ERC claims and will stop processing certain refunds. See our tax bill summary article for details and get ongoing tax policy updates.

10. Increases Medicare physician reimbursements

The OBBBA provides physicians a 2.5% Medicare payment update for calendar year 2026.

How CLA can help with policy changes

There are many, many other changes — but understanding these 10 can help as you begin to plan for their impact.

Reach out today.

This blog contains general information and does not constitute the rendering of legal, accounting, investment, tax, or other professional services. Consult with your advisors regarding the applicability of this content to your specific circumstances.