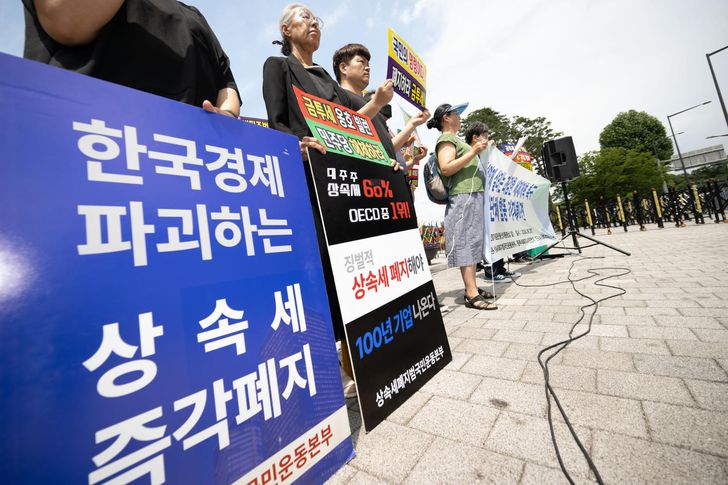

Civic groups picket in front of then-presidential office in Seoul’s Yongsan District, June 25, 2024, to demand the abolishment of the inheritance tax system. Korea Times photo by Lee Han-ho

Korea has emerged as one of the countries experiencing the world’s largest outflow of wealthy individuals, in part due to its rigid inheritance tax system.

A recent analysis by British consultancy Henley & Partners showed Tuesday that the net outflow of Korean millionaires last year was estimated at 2,400, double the 1,200 recorded in 2024. The figure was the fourth largest globally, following the United Kingdom, China and India.

“Korea’s inheritance tax rate of up to 60 percent may have been the main factor accelerating the migration of capital,” a Korea Chamber of Commerce and Industry (KCCI) official said.

With the National Assembly having suspended discussions on legislation to ease the world’s highest inheritance tax rate, the business association forecast that Korea’s inheritance tax revenue could reach 35.8 trillion won ($25 billion) by 2072, up from 9.6 trillion won in 2024.

That projection stems from a steady increase in those subject to inheritance taxes, caused by repeated delays in legal revisions and the rising number of people dying at older ages.

“Heavy inheritance taxes have weakened corporate investment, put downward pressure on stock prices and forced the sale of controlling stakes,” said Kang Seog-gu, executive director of the KCCI’s research division.

The KCCI urged the government to allow heirs of conglomerates to pay their inheritance taxes in installments over 20 years.

The 20-year installment option is currently available only to heirs of small- and medium-sized businesses. Those who inherit assets from individuals or conglomerate owners must make full payment within 10 years.

The organization also proposed allowing the payment of inheritance taxes with publicly traded stocks, suggesting that the government assess their value based on an average price over two to three years rather than two months.

“Diversifying payment methods is a practical way to avoid problems, as it can minimize declines in tax revenue and help preserve family-run businesses,” the KCCI said in a press release.