![]()

This article is a part of your HHCN+ Membership

Thus far, 2025 has been tumultuous for home-based care providers. Regulation and policy shifts have prompted industry stakeholders to engage in a high-stakes guessing game as they predict the latest headline’s implications.

While a focus on the future is critical, looking to recent history can give providers essential information on how to angle their businesses for success – and how their peers are performing.

Activated Insights, formerly Home Care Pulse, released its latest benchmarking report last week, based on the results of a survey of nearly 1,000 home-based care providers, along with surveys of 120,000 home-based care clients and employees. Its findings surprised me on multiple counts. Much of the news was positive, from home care median revenue hitting a six-year high to significantly lower home health employee turnover rates from the year prior.

But also, pretty much every finding that gave me the most hope was followed by a takeaway of, “but also.”

Employee turnover is down, but hiring is harder, for example. Home care revenue is high – but two-thirds of providers are missing out on opportunities to capture additional revenue. I don’t think that’s a case of providers being forced to chase their tails, pursuing opportunities only to face eventual drawbacks. The report suggests how providers can start down a path to align resources and create positive change.

In this week’s exclusive, members-only HHCN+ Update, I’ll share the report’s findings that I think are the most critical for providers to consider in 2025, offering analysis and key takeaways including:

– The problem with home-based care client acquisition costs

– An employee retention success story

– The home care revenue jump and opportunity

Customer trends

Home-based care companies face a lengthy list of problems, from reimbursement to staffing, but ultimately, it all comes back to the patient or client. And there’s good news to be had.

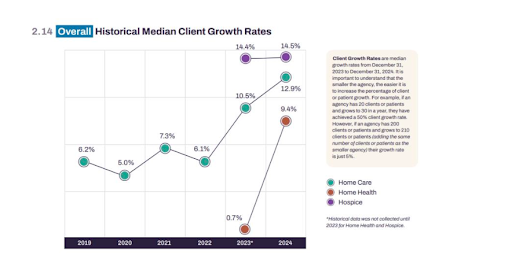

Overall, home care saw a median customer growth rate of 12.9% in 2024 – that’s higher than it has been in six years. Activated Insights doesn’t have as many years of data for customer growth rates for the home health and hospice industries, but there’s good news to be had anyways, with hospice client growth rates staying strong at 14.5% and home health jumping up significantly from 0.7% to 9.4%.

The good news about rising customer growth rates is, as is the theme here, tempered. In this case, my excitement about the revenue climb was balanced out by the news that customer acquisition costs also hit a six-year high, reaching $845 per client in 2024.

I’ve reported on high customer acquisition costs before, in the behavioral health industry. If you have been buffeted by BetterHelp ads on podcast episodes and YouTube videos like I have, you’ll understand the kind of investment that some digital behavioral health companies make to acquire a customer – who doesn’t already stick around.

Providers must balance customer acquisition costs with a customer’s lifetime value, behavioral health investors have previously told me, and hope that the acquisition cost is lower than the margin dollars on an episode of care.

Some providers have found novel ways to do so. For example, Asian American-focused mental health company Anise Health works with Asian employee resource groups (ERGs) or colleges with high Asian student enrollment to create referral pipelines.

While such a narrow focus may not be immediately applicable to home-based care, I anticipate that if this patient acquisition cost trend continues, we’ll see providers looking for new and creative ways to find people in need of their services.

Agencies that track every single inquiry and focus on their reputation are likely to overcome customer acquisition costs and grow revenue, according to Todd Austin, president and chief operating officer of Activated Insights.

“What’s fascinating is that the agencies that are tracking every single inquiry, or at least indicate that they have a high affection for tracking inquiries, have brought in nearly $1 million more in revenue than those who don’t,” Austin said on a recent webinar. “So if you’re not tracking every inquiry, there’s a huge gap in your business.”

Building reputation can also help address the customer acquisition costs, Austin said, because people are increasingly choosing care providers based on the quality of the experience and referrals they get from others. Two-thirds of providers now use reputation or recognition management programs, a substantial increase from a few years ago, Austin said.

“Reputation is no longer just optional,” he said.

Retention progress, hiring woes

Home-based care companies are all fighting a battle to have sufficient workers to meet rising demand. Leaders have emphasized the importance of retention to me again and again.

“People spend so much time recruiting staff and then training staff, only for those staff within the first couple of months [to] move on because what they anticipated may not have been there,” Bill Dombi, senior counsel for Arnall Golden Gregory law firm, previously told me. “Devoting time to retention is the most efficient, economical and successful way to deal with the workforce shortages today.”

The Activated Insights report demonstrates progress on the retention front (hold please, for the less sunny staffing news).

Caregiver turnover dropped from 79% to 75%, the lowest rate in three years and a positive indicator of labor markets and improved company cultures, according to Austin.

An example of improved company culture, according to Austin, is a Visiting Angels location, which set out to improve onboarding, recognition and ongoing communication with employees in 2024. The location achieved its top growth quarter in company history, attributing the success to creating an environment in which caregivers want to stay.

“That commitment to build a positive employee culture translated directly into business success, and we see that time and time again,” Austin said.

The home health and hospice side got even better news, with a dramatic drop from 32% clinician turnover to 17%.

Here’s the bad news. While retention has improved, recruitment is getting harder.

Application-to-hire ratios worsened in 2024, according to Austin. Only 9.6% of home-based care applicants got hired, a drop of nearly 5% year-over-year. Simultaneously, 39% of providers reported turning down cases due to insufficient staffing.

“So we have to think about our approach. So not just hiring more, but hiring smarter,” Austin said. “I was getting feedback from that Visiting Angels location, they were focusing more about who they hire and what that first 90 days looked like, that impression of creating a good match. … That’s a great starting point to apply at your own organization, dig into your funnel and data and identify [where] the drop off really happens. That insight will tell you where to focus your energy.”

While improving retention rates is a good sign for the industry, these hiring statistics are certainly a concern. Working “smarter” is likely a key factor for both recruitment and retention – for example, soliciting applications through word-of-mouth referrals may be a better use of company time than casting as wide of a net as possible.

Home care revenue high

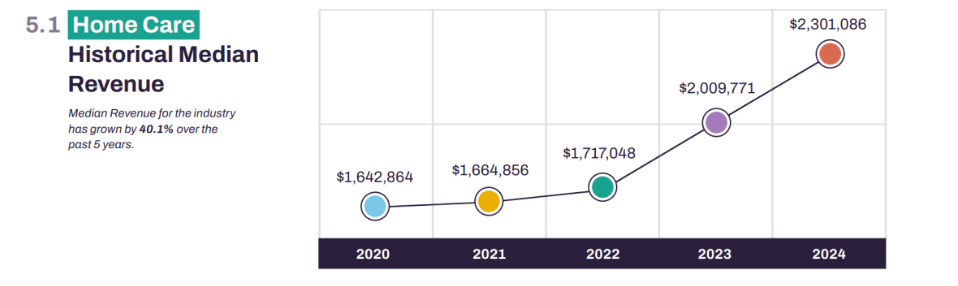

The report included several reasons for home care industry stakeholders to be optimistic. Most notable to me was the finding that the median revenue for home care providers reached $2.3 million in 2024, an increase of $291,315 and the highest it has been in six years.

The discussions I have with providers so often focus on struggles in the industry, from Medicaid budget uncertainty to a chronically insufficient caregiver workforce. To be sure, median revenue is not the only benchmark of the health of an industry. But it certainly is one benchmark and indicates that providers are staying solvent to expand access to essential services.

Revenue climb is outpacing client growth rate, which Austin said means that rate increases are starting to take effect and show up in home care companies’ top-line performances.

The downside associated with this finding is also an upside. One of the key drivers of increased revenue, according to Austin, is that more agencies are billing based on both length of visit and the skill of the caregiver. Just over 32% of agencies did so in 2024.

While that figure is an increase from 2023, when it came in at 29%, it still leaves a sizable opportunity for more providers to jump in on. Home care providers – especially those with robust employee training programs – have a clear path to capture more revenue.

“We’re seeing organizations really think about, ‘What are the chronic conditions of the individual I’m going to care for, and what are the skill levels of my caregiver, and are those matching into the billable hours?”’ Austin said. “ My takeaway is pretty simple here, a financial scale and smarter billing create[es]the room to do more of what matters, serving your clients well and growing sustainably.”