It rained all week for those who were long rising volatility, falling yields, or fading Old Wall narratives.

But for us, with a process rooted in the river’s current (not yesterday’s forecast), the sun has been out and #HedgeyeNation has been enjoying it.

Welcome to another Macro Monday @Hedgeye, where the quantitative Risk Ranges™ Signals are mapped, Macro Quad data is locked, and The Game remains humbling to anyone caught flat-footed in consensus.

Here’s your Top 3 things to watch this week:

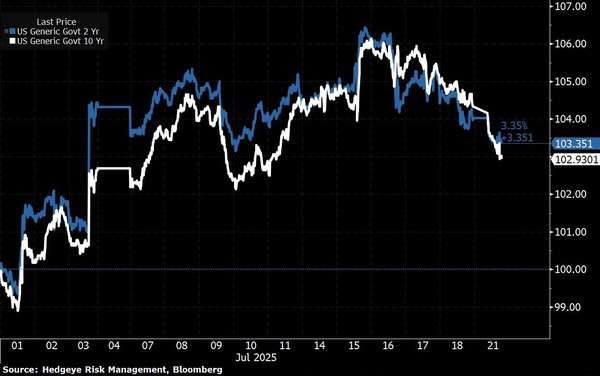

1. RATES — TEXTBOOK BREAKDOWN

The move in rates last week was right out of the Hedgeye playbook. Both the U.S. 2-year and 10-year Treasury yields broke down from the Top-End of the Risk Range™ Signal, right after a hotter-than-expected CPI report.

If that seems backwards to your econ professor, that’s because they don’t trade real-time markets.

“Anticipation is a feature unique to economics…A [security’s] price rises not because of good news from the company, but because investors anticipate it will rise further, so they buy…It is psychology, individual and mass.” —Benoit Mandelbrot, The Misbehavior of Markets

Mandelbrot nails it. The bond market isn’t reacting to the last CPI print—it’s front-running the next one. Our Hedgeye CPI Nowcast shows inflation set to decelerate in July, and yields are reflecting that expectation.

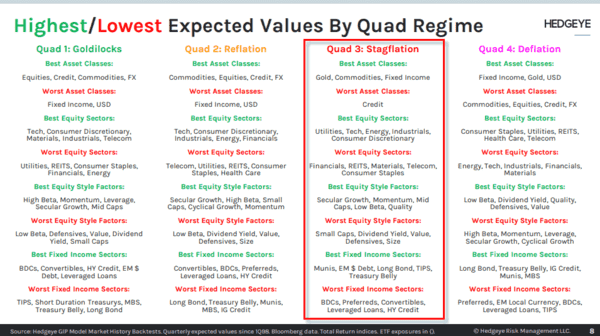

This kind of breakdown in yields is classic Quad 3 behavior: a regime defined by slowing growth and sticky inflation, where market psychology leads price action before the data confirms it.

We frame every macro regime using our Quad framework. Each one has a distinct signature—and a distinct playbook:

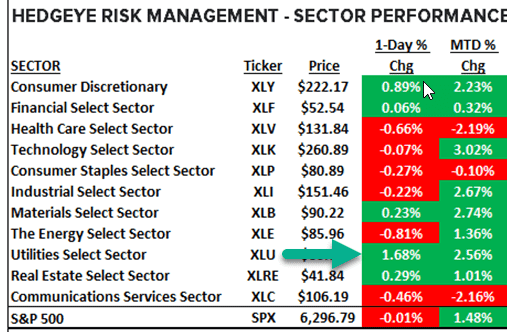

2. UTILITIES — WINNING ISN’T “BORING”

On Friday, Utilities (XLU) had themselves a day. A move of +1.7% might sound dull on paper, but it was a high-conviction signal confirmation for us. Why? Because it coincided with the breakdown in bond yields—and that’s not random.

This move correlated highly with the aforementioned breakdown in UST Bond Yields.

When Treasury yields fall and rate sensitivity spikes, Utilities—those so-called “boring” names—tend to pay off.

That’s exactly what we saw here: not some fluke defensive pop, but a deliberate market signal consistent with a shift toward Quad 3.

3. BITCOIN — THE OTHER ALL-TIME HIGH

Bitcoin is quietly doing exactly what the signal said it would: going higher.

It’s up over 13% in the past month and pushing toward all-time highs again this morning.

Alongside QQQ, crypto is moving with growthy exposure, momentum, and flow. We’re watching closely for top-end exhaustion signals in the Risk Range™ for both BTC and Big Tech, but until then, the setup remains bullish in Quad terms.

Want to stay ahead of the curve?

ETF Pro Plus is built for that—backed by the same Macro process and signals that caught the moves in Utilities, Bitcoin, Global Equities, and more.

If you’re not already in ETF Pro Plus, now’s your shot.

This limited-time offer is for new ETF Pro subscribers only—and it gets you 66% off 3 months of full access to our Macro-aligned ETF positioning.

Offer details below: