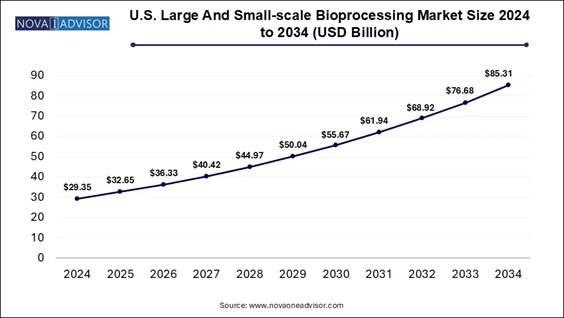

According to Nova One Advisor, the U.S.

large and small-scale bioprocessing market size is calculated at 29.35

billion in 2024 and is projected to surpass USD 85.31 billion by 2034 with a

remarkable CAGR of 11.26% from 2024 to 2034.

The U.S. large and small-scale bioprocessing market is

expanding because they are a primary source of major drugs and biologics

essential for medical treatments and scientific research, and development.

Significant pharma product derived from living organisms such as recombinant

proteins, tissues, cells, genes, blood components, allergens, and vaccines.

It comprises the cultivation and manipulation of

bioprocessing systems on a small and large scale to attain particular

industrial or scientific objectives. With this bioprocessing, the biotech

sector can contribute to the progress in different fields, from the food

industry and the production of biomass to the novel drug development sector.

The Complete Study is Now Available for Immediate Access

| Download the Sample Pages of this Report@ https://www.novaoneadvisor.com/report/sample/9182

U.S. Large and Small-scale Bioprocessing Market Highlights:

• By scale, the industrial scale segment dominated the

market with the largest share in 2024.

• By scale, the small-scale segment is expected to show the

fastest growth over the forecast period.

• By workflow, the downstream processing segment held the

largest market share in 2024.

• By workflow, the fermentation segment is expected to

register significant growth during the forecast period.

• By product, the bioreactors/ fermenters segment captured

the largest market share in 2024.

• By product, the cell culture products segment is expected

to show the fastest growth during the forecast period.

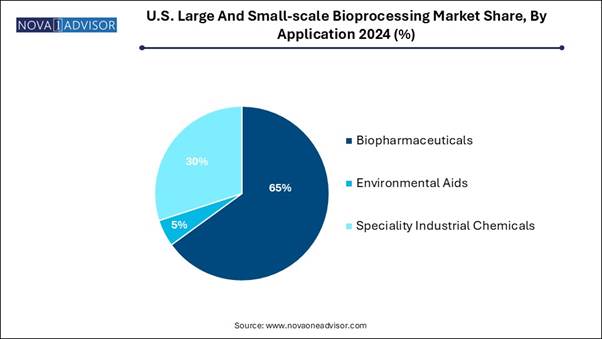

• By application, the biopharmaceuticals segment generated

the highest market revenue in 2024.

• By application, the specialty industrial chemicals segment

is expected to grow at a significant rate over the forecast period.

• By use-type, the multi-use segment accounted for the

highest market share in 2024.

• By use-type, the single-use segment is expected to grow

significantly during the predicted timeframe.

• By mode, the in-house segment dominated the market with

the biggest revenue share in 2024.

• By mode, the outsourced segment is expected to grow at the

fastest CAGR during the forecast period.

Market Size & Forecast

⬥︎

2024 Market Size: USD 29.35 Billion

⬥︎

2034 Projected Market Size: USD 85.31 Billion

⬥︎

CAGR (2025-2034): 11.26%

⬥︎

North America: Largest market in 2024

Market Overview and Industry Potential

The U.S. large and small-scale bioprocessing market is

expanding rapidly due to bioprocessing

is the management of naturally occurring living organisms and systems by

bioengineers to attain industrial and research goals. The U.S. has an

unparalleled ability to grow, store, harvest, and transport bioprocessing

products on a large scale. Increasing government support for small- and

large-scale bioprocessing, for instance, in 2023, the President’s commitment to

grow the bioeconomy spurred $46 billion in public and private sector

biomanufacturing investments for projects in the country.

Immediate Delivery Available | Buy This Premium Research https://www.novaoneadvisor.com/report/checkout/9182

Top Used Bioprocesses Across the Globe:

Processes

Application

Bioreactor

operation

It ensures an

ideal environment for cell growth and the synthesis of desired bioproducts,

enabling the optimization of bioprocesses and reducing costs.

Upstream

bioprocessing

This process

helps to develop therapeutic proteins, stem cells, and viruses.

Fermentation

Optimization

of fermentation and bioprocessing is crucial to maximize production and

improve the efficiency of these processes.

Distillation

It is not

only used for product recovery but also for product purification.

Chromatography

Chromatography

is a powerful technique for the separation and purification of products.

U.S. DOE about Biotech Sector:

The U.S. Department of Energy (DOE) is initiating to use of biotechnology

and biomanufacturing to enhance the lives of U.S. people and is taking

significant steps to advance the National Biomanufacturing and Biotechnology

Initiative. Increasing government funding for advanced biomanufacturing.

•For instance, in August 2024, the US Department of

Agriculture is assuring a $25 million loan for a contract fermentation facility

Liberation Labs is building in Indiana, which will contribute to the growth of

the market.

• For Instance, In April 2025, Manus, the proven

bioalternatives scale-up platform, and Inscripta, a leading life science

technology company helping to create the bioeconomy, announced a strategic

merger to establish a unique end-to-end platform for scalable development,

biomanufacturing, and commercialization of bioalternative products.

Latest Trends of the Market

⬥︎

In September 2022, the US government invested over $2 billion to launch its

biomanufacturing initiative, whose goal is to expand manufacturing capacity in

the country and ensure pandemic preparedness.

⬥︎

In January 2025, U.S. Department of Agriculture (USDA) Secretary Tom Vilsack

announced that USDA is funding 586 projects to increase access to clean energy

systems and enhance the availability of domestic biofuels. Today, USDA is

providing nearly $180 million through the Rural Energy for America Program

(REAP) and the Higher Blends Infrastructure Incentive Program (HBIIP) with

funding from President Biden’s Inflation Reduction Act, the nation’s

largest-ever investment in combatting the climate crisis.

⬥︎

In May 2025, DuPont expanded its bioprocessing portfolio with the launch of

DuPont AmberChrom TQ1 chromatography resin for the purification of

oligonucleotides and peptides in support of a broad range of biopharma

applications.

Increasing Demand for Biopharma: Market’s Largest

Potential

Growing demand for biopharma products as the U.S. is a

global leader in biopharmaceutical

R&D, around half of the worldwide biopharma R&D activities are

hosted in the U.S. It leads because to its large domestic sector, IP

protections, limits on government drug price setting, supportive science

initiative, and helpful innovation clusters. The U.S. has a long history of

originally leading in progressive industries, only to subsequently lose its

competitive benefits to other countries with more efficient industrial

policies. The US government has recently been threatening a 25% tariff on

pharmaceuticals imported to the US to inspire more biopharma companies to

onshore manufacturing. These tariffs could add up to $750 million in costs,

which contributes to the growth of U.S. large and small-scale bioprocessing.

⬥︎

For Instance, In April 2025, Asahi

Kasei Bioprocess America, Inc. (AKBA), a leader in advanced filtration

and fluid management solutions for the biopharmaceutical industry, was

recognized with the Best Technologies Innovation Award at INTERPHEX 2025. This

recognition was for AKBA’s THESYS Cleavage & Deprotection (C&D) and

Tangential Flow Filtration (TFF) unit, a groundbreaking system redefining

oligonucleotide manufacturing efficiency.

Report Scope of U.S. Large and

Small-scale Bioprocessing Market

Report Coverage

Details

Market Size in 2025

USD 32.65 Billion

Market Size by 2034

USD 85.31 Billion

Growth Rate From 2025

to 2034

CAGR of 11.26%

Base Year

2024

Forecast Period

2025-2034

Segments Covered

Scale, Workflow,

Product, Application, Mode, Use-type

Market Analysis

(Terms Used)

Value (US$

Million/Billion) or (Volume/Units)

Key Companies

Profiled

Avantor, Inc.,

Bio-Synthesis, Inc., Corning Inc., Danaher (Cytiva), Distek, Inc., Entegris,

Eppendorf AG, F. Hoffmann-La Roche Ltd, Getinge AB, Lonza, Meissner

Filtration Products, Inc., Merck KGaA (MilliporeSigma),Thermo Fisher

Scientific, Inc., PBS Biotech, Inc., Repligen Corporation, Saint-Gobain,

Sartorius AG

U.S. Large and Small-scale Bioprocessing Market

Segmentation Analysis:

By Scale Analysis:

The industrial scale segment dominates in the U.S. large and

small-scale bioprocessing market, as this bioprocessing involves the production

of pharmaceuticals, flavours, foods, fuels, and chemicals with the help of a

biocatalyst like an enzyme, microorganisms, plant cells, or animal cells within

a bioreactor. They classically engage in widespread manufacturing, service

provision, or processing, also influencing worldwide sectors and economies.

These industries benefit from economies of scale, allowing them to produce

services or goods more professionally and at minimal expenses compared to

smaller businesses.

On the other hand, the small-scale segment is expected to

grow significantly during the forecast period as it offers increased

flexibility, affordability, and reduced cross-contamination challenges. This

type of manufacturing often contains the application of manual labor and simple

machinery or devices.

By Workflow Analysis:

The downstream

processing segment dominates the U.S. large and small-scale

bioprocessing market, as this processing refers to the series of unit

operations used to separate, purify, and concentrate the product. Downstream

processing also identifies the economic feasibility of the process. The first

operation is cell separation, which is done by cross-flow microfiltration. This

processing generally involves numerous stages, including cell separation,

product recovery, and purification to achieve a high level of product purity.

The fermentation

segment is expected to grow significantly during the forecast period, as it is

suitable for entirely kinds of environments. It is the oldest metabolic process

that is common to prokaryotes and eukaryotes. Fermentation is broadly used in

different industries. Fermentation makes food nutritious, digestible, and

flavoured. Fermentation is an ordinary way of enhancing vitamins, essential

amino acids, anti-nutrients, food appearance, proteins, and improved aroma.

By Product Analysis:

The bioreactors/ fermenters segment captured the largest

market share in 2024, as it is the core of any biologica process in which

microbial, enzymes, plant, or mammalian cell systems are used for the

manufacture of a broad range of valuable biological products. The performance

of any bioreactor is based on many functions, such as biomass concentration and

Sterile conditions. Bioreactors ensure a perfect environment for cell growth

and the synthesis of wanted bioproducts, allowing the optimization of

bioprocesses and lowering costs and production time.

The cell culture products segment is expected to show the

fastest growth during the forecast period, as cell cultures have huge control

of the physicochemical environment, such as pH, temperature, osmotic pressure,

oxygen, and carbon dioxide tension, which can be controlled precisely, and the

control of physiological conditions, which can be constantly examined. Cell

culture is used as an ideal system to study basic cell biology and

biochemistry, to study the interaction among the cells and disease-causing

agents such as viruses, bacteria, and to study the effects of drugs.

By Application Analysis:

The biopharmaceuticals

segment generated the highest market revenue in 2024, as bioprocessing is a

moderately advanced concept in the manufacturing of biopharmaceuticals.

Entirely of the active pharmacological ingredients must be sterile for their

administration. Thus, they must be produced under sterile conditions. It

revolutionizes the massive mainstream biomanufacturing process steps in

accommodations of biopharmaceutical industries. There is high potential in

making processes more affordable due to customization and simplification of

some aspects of bioprocessing technology and reducing the cost of products.

The specialty industrial chemicals segment is expected to

register the fastest CAGR during the predicted timeframe as bioprocesses over

traditional chemical processes require mild reaction conditions, are more

efficient and specific, and produce renewable by-products. The expansion of recombinant

DNA technology has prolonged and extended the potential of

bioprocesses.

By Use-Type Analysis:

The multi-use segment generated the highest market revenue

in 2024, as large-scale multi-use processes are time-saving technologies in the

world. Although they have demonstrated process effectiveness, a company

considers major aspects when acquiring it. Large-scale multi-use processes

often evolve as customized solutions. It requires high capital investment and

operational costs, and the device’s footprint is large.

The single-use chemicals segment is expected to register the

fastest CAGR during the predicted timeframe, as it is alternative solutions

have become available for commercial cell-culture–based manufacturing.

Single-use technology is intended to be disposable, meaning it almost

eliminates the challenges of leftover contamination between manufacturing runs.

By Mode Analysis:

The in-house segment generated the highest market revenue in

2024, as this manufacturing allows for product development as rapidly and as

economically as possible because consumers have control over it. Therefore,

in-house approaches are critical for CGT entrants and drug developers that are

designated to become fully integrated companies.

The outsourced segment is expected to register the fastest

CAGR during the predicted timeframe as outsourcing bioprocess development

provides many advantages. This includes the opportunity and potential to

accelerate the bioprocess development timeline, allowing companies to enter

pre-clinical studies quicker and to enroll their drug in clinical trials in a

time-efficient manner.

Country Level Analysis:

The U.S. is dominant in the market as a presence of robust

product pipelines in gene and cell therapies, tissue engineering, and more is

driving demand for large and small-scale bioprocessing. U.S. government to

build more databases, progress standards, raise R&D funding opportunities,

and increase consumer facilities for scale-up. Increasing government support

from NIH, BARDA, and private investors drives the infrastructure and innovation.

⬥︎

For Instance, In April 2025, Thermo Fisher Scientific

announced a $2 billion investment in US operations over the next four years to

bolster domestic innovation and manufacturing capabilities in the life sciences

sector. According to the company, the investment consists of $1.5 billion in

capital expenditures to expand manufacturing and $500 million towards R&D

aimed at supporting high-impact innovations.

U.S. Large and Small-scale Bioprocessing Market

Companies:

• Avantor,

Inc.

• Corning Inc.

• Danaher (Cytiva)

• Distek, Inc.

• Entegris

• F. Hoffmann-La Roche Ltd

• Lonza

• Meissner Filtration Products, Inc.

• Merck KGaA (MilliporeSigma)

• Thermo Fisher Scientific, Inc.

• Repligen Corporation

• Saint-Gobain

• Sartorius AG

What is Going Around the Globe?

⬥︎

In June 2025, Ecolab Life Sciences launched its new Purolite AP+50 affinity

chromatography resin at the Biotechnology Innovation Organization (BIO)

International Convention, which is being held in Boston. The new resin

optimizes operations during the antibody manufacturing process.

⬥︎

In April 2025, Culture Biosciences, headquartered in South San Francisco,

Calif., announced the launch of Stratyx 250, which the company said in a press

release is the first mobile, cloud-integrated bioreactor that is designed to

provide biotech companies with simultaneous flexibility, automation, and remote

process control.

You can place an order or ask any questions, please feel

free to contact at sales@novaoneadvisor.com

| +1 804 441 9344

Related Report –

⬥︎

U.S. Single-use Bioprocessing Market – https://www.novaoneadvisor.com/report/us-single-use-bioprocessing-market

⬥︎

Single-use Bioprocessing Market – https://www.novaoneadvisor.com/report/single-use-bioprocessing-market

⬥︎

India Single-use Bioprocessing Probes And Sensors Market – https://www.novaoneadvisor.com/report/india-single-use-bioprocessing-probes-and-sensors-market

⬥︎

Single-use Bioprocessing Probes & Sensors Market- https://www.novaoneadvisor.com/report/single-use-bioprocessing-probes-sensors-market

⬥︎

Single-use Bioprocessing Probes And Sensors Market – https://www.novaoneadvisor.com/report/single-use-bioprocessing-probes-and-sensors-market

⬥︎

Continuous Bioprocessing Market – https://www.novaoneadvisor.com/report/continuous-bioprocessing-market

Segments Covered in the Report

This report forecasts revenue growth at country levels and

provides an analysis of the latest industry trends in each of the sub-segments

from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the

U.S. large and small-scale bioprocessing market.

By Scale

• Industrial Scale (Over 50,000 Liter)

• Small Scale (Less Than 50,000 Liter)

By Workflow

• Downstream Processing

• Fermentation

• Upstream Processing

By Product

• Bags & Containers

• Bioreactors/Fermenters

• Bioreactors Accessories

• Cell Culture Products

• Filtration Assemblies

• Others

By Application

• Biopharmaceuticals

• Environmental Aids

• Speciality Industrial Chemicals

By Use-Type

• Multi-Use

• Single-Use

By Mode

• In-House

• Outsourced

Immediate Delivery Available | Buy This Premium Research https://www.novaoneadvisor.com/report/checkout/9182

About-Us

Nova One Advisor is a global leader in market

intelligence and strategic consulting, committed to delivering deep,

data-driven insights that power innovation and transformation across

industries. With a sharp focus on the evolving landscape of life sciences, we

specialize in navigating the complexities of cell and gene therapy, drug

development, and the oncology market, enabling our clients to lead in some of

the most revolutionary and high-impact areas of healthcare.

Our expertise spans the entire biotech and

pharmaceutical value chain, empowering startups, global enterprises, investors,

and research institutions that are pioneering the next generation of therapies

in regenerative medicine, oncology, and precision medicine.

Web: https://www.novaoneadvisor.com/

Contact Us

USA: +1 804 420 9370

Email: sales@novaoneadvisor.com

For Latest Update Follow Us: LinkedIn