Turkish steelmakers await decisions from the country’s Central Bank that could affect market dynamics

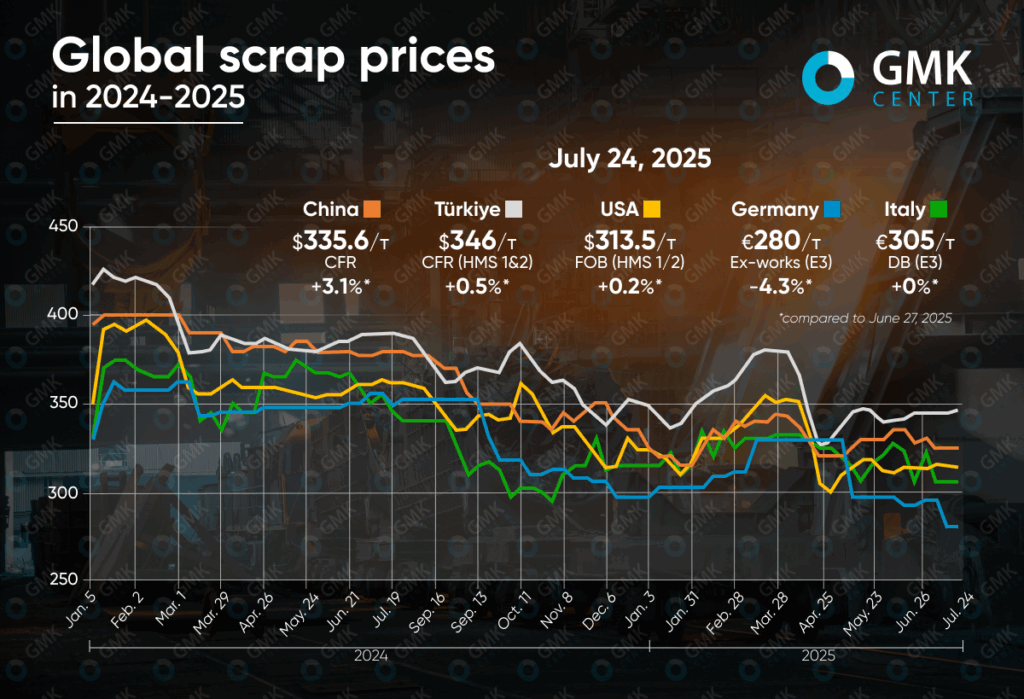

In July 2025, the global scrap market showed limited price growth in most key regions. The impact of unstable demand, seasonal decline in activity, logistical difficulties, and currency fluctuations created a challenging environment. In particular, Turkey saw a slight increase in prices amid a shortage of raw materials, while China stood out with an increase in domestic prices despite a decline in imports.

Turkey

In July 2025, the Turkish scrap market showed moderate growth amid unstable demand and limited supply. Between June 27 and July 24, the average price for HMS 1&2 (80:20) scrap rose by 0.5% to $346/t CFR. Prices rose by 0.3% in the last week of the month.

At the beginning of July, activity was low: Turkish steelmakers completed their purchases for July shipments and refocused on selling finished products. Expectations of lower prices from the EU did not materialize due to the strengthening of the euro and limited availability of raw materials. At the same time, European and British suppliers began to look for alternative markets, particularly in Egypt and Saudi Arabia.

Rising freight rates, limited shipping tonnage, and weak scrap collection in Europe kept raw material costs high. Turkish mills, despite attempts to pressure prices down, were forced to conclude deals in the range of $345-348/t CFR. The share of offers from the US increased, while European supplies declined due to unfavorable currency fluctuations.

Additional pressure on the market was exerted by internal factors: weak demand for rebar, the devaluation of the lira, rising energy costs, and political instability. There were almost no alternatives to scrap imports: supplies of semi-finished products from Asia were hampered by geopolitical risks in the Red Sea.

By the end of July, most of the demand for August deliveries had been met. Market participants focused on the prospects for September, watching for signals from the Turkish Central Bank, whose decision could determine the further dynamics of prices.

EU

The EU scrap market showed mixed price dynamics during the month, driven by seasonal factors, reduced demand, and production instability. In Germany, prices fell by 4.3% to €280/t (E3, Ex-works), mainly due to summer holidays, reduced export volumes, and overall weak demand from steelmakers. Most deals were for limited volumes, and trading activity remained low.

At the same time, the situation in Italy was more balanced: despite pressure from producers seeking to reduce costs, prices for some scrap grades remained stable amid limited supply. E3 scrap offers remained at €305/t (Delivered Basis). However, some companies have already begun to reduce production activity, and some have announced shutdowns for August.

The key factors influencing prices were reduced consumption, cautious buyer behavior, and a shortage of certain categories of raw materials. Market participants expect prices to stabilize in August, but overall market activity will remain low until the end of the holiday season.

USA

The US scrap market remained stable in July despite a number of external factors. Scrap prices rose by only 0.2% to $313.5/t (FOB East Coast). At the beginning of the month, trading took place against the backdrop of holidays and threats of intensifying trade wars, in particular due to the introduction of new import duties on imports from BRICS countries. Export sales to Turkey were hampered by weak demand and high freight rates.

In mid-July, the market remained balanced, with stable summer supplies and limited activity providing no grounds for price changes. Canadian and Mexican supplies to the US continued uninterrupted thanks to the USMCA rules in force.

At the end of the month, despite the growth in scrap volumes and high capacity utilization at US mills, the situation remained under pressure from geopolitical uncertainty. At the same time, domestic demand supported the market, while exports to Turkey and Asia faced resistance from buyers. Participants expect stability to continue in August.

China

In China, domestic scrap prices rose by 3.1% to $335.59/t. The main factor was improved sentiment in the steel sector: rising futures and official signals about combating domestic price competition supported purchasing activity. Steel producers agreed to raise purchase prices in order to secure raw materials. At the same time, average daily scrap deliveries to enterprises declined, as did consumption volumes, putting additional pressure on prices.

The import market saw the opposite trend: prices fell by 1.1% to $324/t CFR. Despite lower Japanese offers, imports remained limited due to the tax burden and a significant price gap with the domestic market. Although China eased quality standards for imported scrap in June, the effect of this policy has been limited so far. It is expected that the lifting of restrictions on imports of mixed scrap from August will revive interest in external supplies, provided that prices converge.