Report Overview

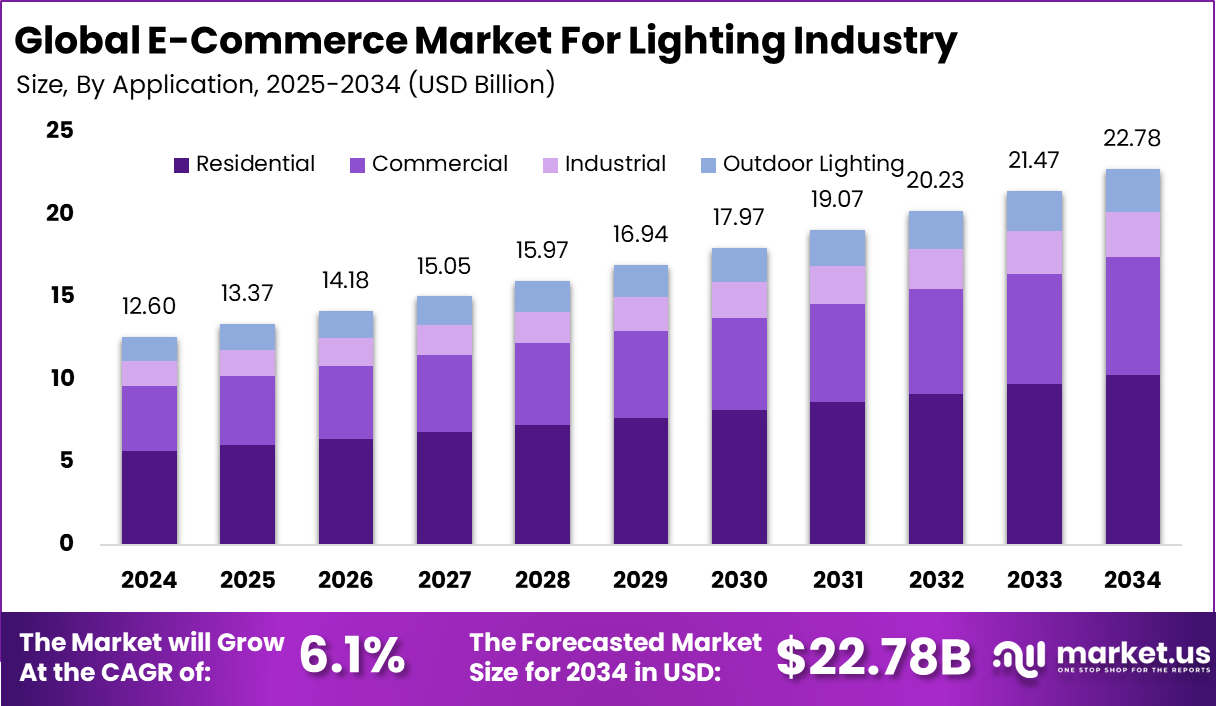

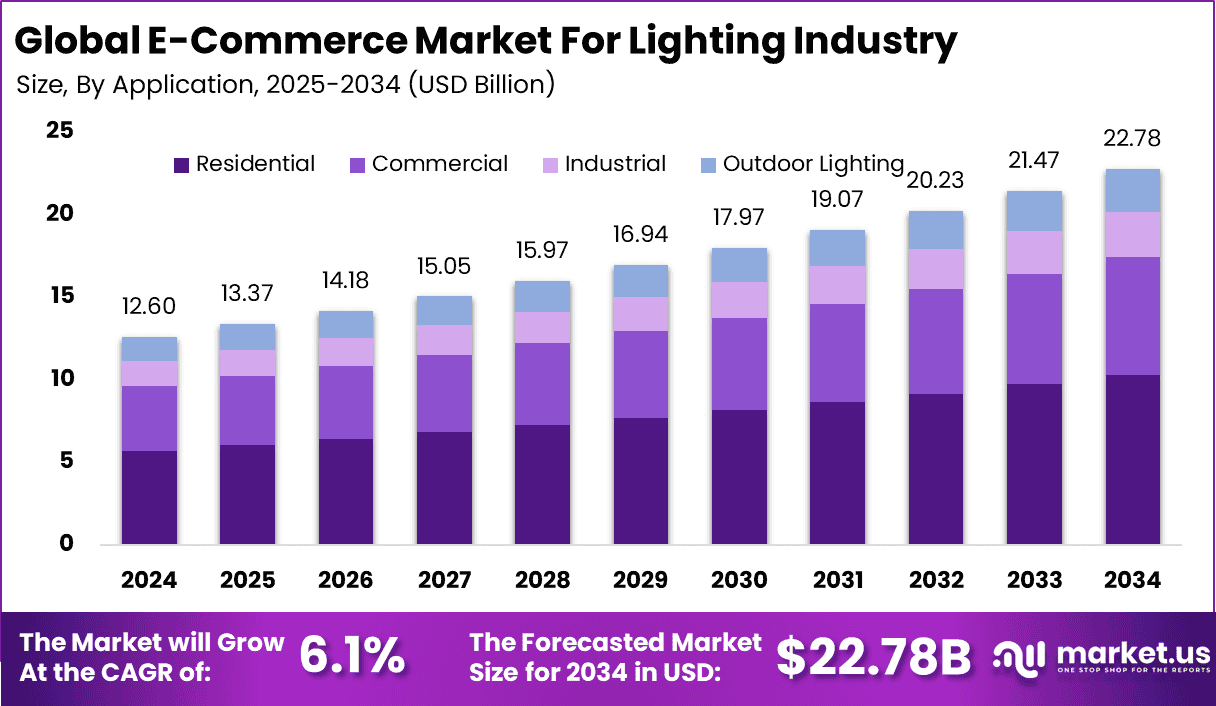

The Global E-Commerce Market For Lighting Industry size is expected to be worth around USD 22.78 Billion By 2034, from USD 12.6 billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.8% share, holding USD 5.1 Billion revenue.

The e-commerce market for the lighting industry is undergoing a remarkable transformation, driven by evolving consumer behavior and advances in digital technology. As people increasingly seek convenience and variety in their shopping experiences, more are turning to online channels to fulfill their lighting needs. This shift is strong in residential and commercial sectors, where buyers prefer comparing products, wider choices, and better prices.

A core driver behind this surge is the widespread adoption of smart technologies and connected home solutions. The popularity of Internet of Things (IoT) devices, smart bulbs, and app-controlled lighting systems is fueling demand for online lighting solutions. Consumers are looking for products that offer not just illumination, but automation, energy savings, and integration with voice assistants.

According to Market.us, the E-commerce Market is projected to reach approximately USD 151.5 Trillion by 2034, up from USD 28.29 Trillion in 2024, reflecting a robust compound annual growth rate of 18.29% from 2025 to 2034. This remarkable expansion is driven by increasing digital penetration, rising smartphone usage, and the convenience of online shopping across global demographic.

Scope and Forecast

Investment opportunities in the lighting e-commerce sector are plentiful. Digitalization enables scaling at lower costs than traditional retail, while targeted online marketing campaigns can reach wide audiences at a fraction of conventional advertising expenses.

Companies are investing in AI-powered recommendation engines and virtual assistance to improve user engagement and conversion rates, making the sector appealing for new entrants, tech innovators, and established players alike. The regulatory environment for e-commerce in lighting is evolving but still lags behind regulations observed in physical retail.

In many regions, basic frameworks like the Information Technology Act and consumer protection e-commerce rules govern aspects such as transparency, digital contracts, data privacy, and grievance resolution. However, there are gaps regarding the safety and reliability of listed products, as online marketplaces often have looser requirements for certification and verification

Key Insight Summary

- The residential sector remained the primary application area, contributing 45.3% share due to the surge in home improvement and energy-efficient lighting upgrades.

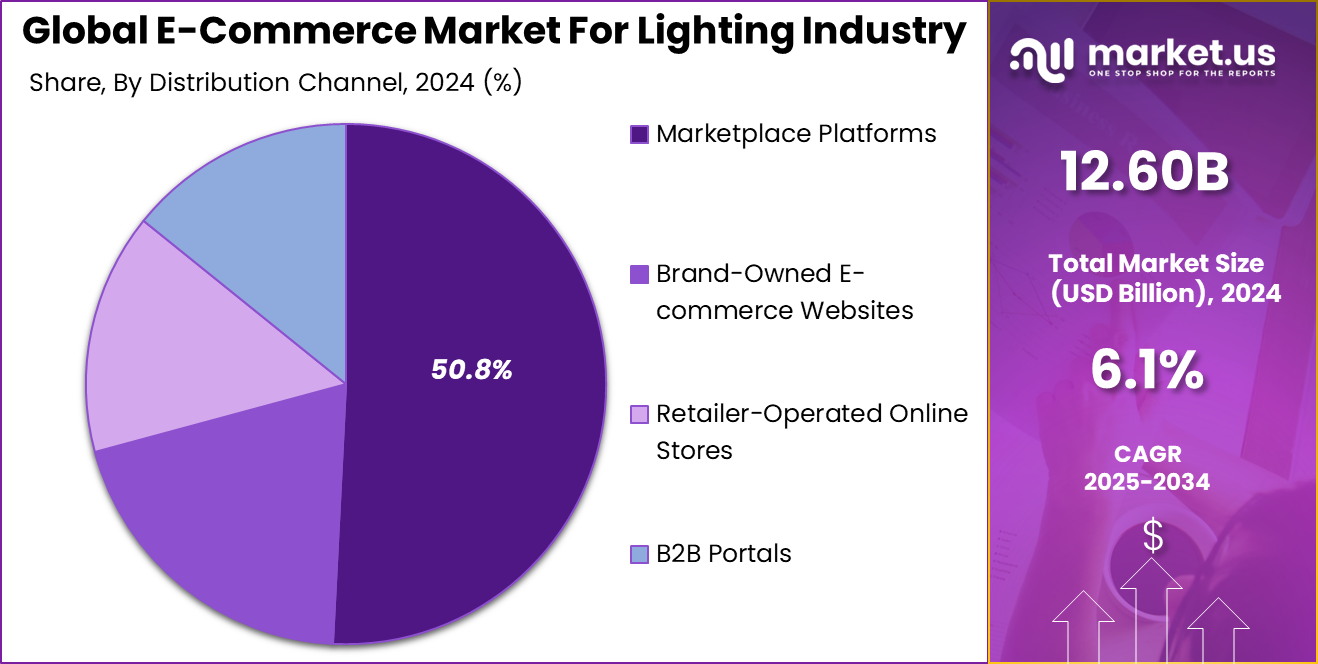

- Marketplace platforms dominated the distribution model with a commanding 50.8% share, as consumers preferred multi-brand variety and price comparison.

- LED bulbs and tubes accounted for 62.7% of total product sales, driven by longer lifespan, low energy consumption, and regulatory shifts away from incandescent options.

- The market is projected to reach USD 22.78 Billion by 2034, advancing at a 6.1% CAGR fueled by increasing demand for connected lighting and seamless online shopping experiences.

- Rising interest in smart lighting systems, especially voice-activated and sensor-based fixtures, is enhancing user experience and influencing purchase behavior.

Analysts’ Viewpoint

From an analyst’s perspective, the e-commerce lighting market stands at a dynamic crossroads, powered by rising digital adoption and the surging popularity of smart, efficient lighting solutions. In the present, robust demand is fueled by consumers’ appetite for convenient, feature-rich online experiences and businesses’ drive to streamline operations with data and automation.

Looking ahead, the market’s trajectory remains highly positive, supported by ongoing urbanization, increased digital penetration, and continual innovations in connected lighting technology. Growing environmental awareness, improved logistics, and stronger regulatory clarity are set to enhance consumer trust and accelerate market expansion, promising strong, sustained growth for forward-thinking companies.

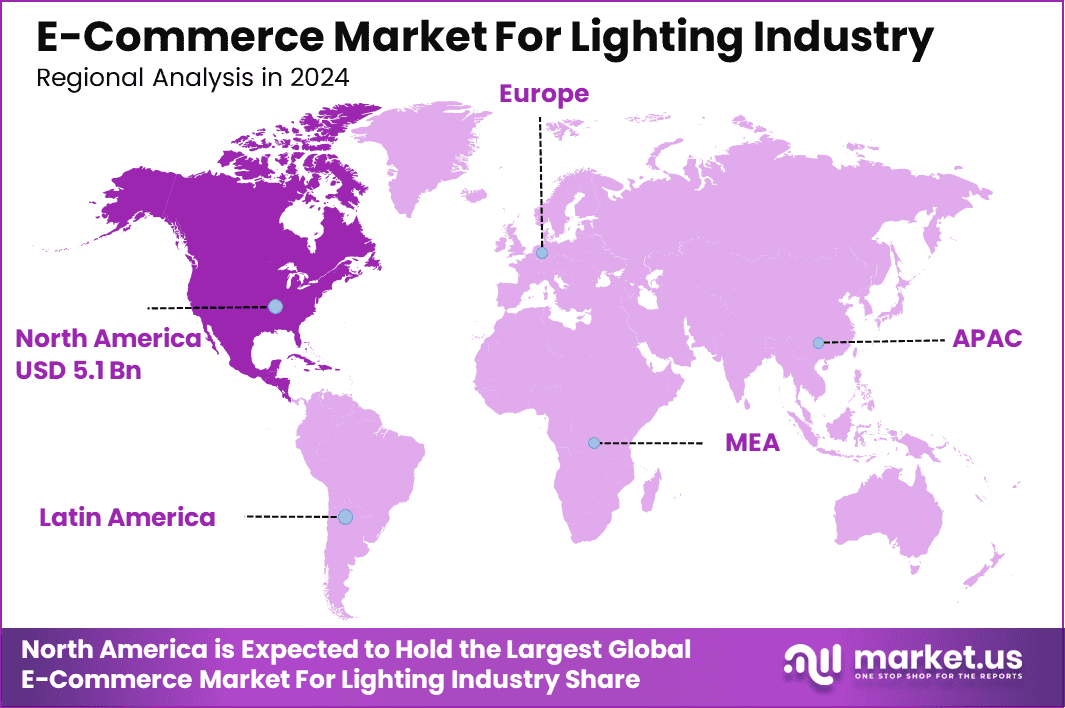

Regional Insight

In 2024, North America held a dominant market position, capturing more than a 40.8% share, holding USD 5.1 Billion in revenue in the e-commerce market for lighting products. This leadership can be directly linked to the region’s mature digital retail infrastructure, high smartphone penetration, and growing consumer preference for online purchases of home improvement and lighting solutions.

The U.S. and Canada continue to witness rising demand for LED lighting, smart bulbs, and automated fixtures, all of which are increasingly purchased through direct-to-consumer platforms and major e-commerce marketplaces. The preference for contactless shopping, wider product selection, and same-day delivery in urban zones have further cemented North America’s lead.

In addition, strong investment by lighting manufacturers in digital marketing, AR-based product visualizations, and virtual showrooms has improved the online shopping experience. The integration of voice assistants, smart home ecosystems, and sustainability mandates in both commercial and residential sectors have driven a clear shift toward smart lighting solutions, often sourced online.

By Application Analysis

In 2024, the residential segment held a dominant position in the e-commerce market for lighting, accounting for more than 45.3% of the total share. This growth was mainly driven by a shift in consumer behavior toward online shopping for home improvement products. Buyers are increasingly turning to digital platforms for convenience, wider selection, and quick delivery.

The surge in DIY home renovations and interior upgrades has encouraged more individuals to explore smart and aesthetic lighting solutions tailored for living spaces, bedrooms, kitchens, and even outdoor areas. The rise of smart homes has further influenced demand in this segment.

Consumers now seek lighting that is not only functional but also connected to digital assistants and mobile apps. Features such as dimmable lights, voice controls, and energy tracking have become popular. E-commerce channels enable customers to access detailed product descriptions, reviews, and installation videos, making online platforms a preferred shopping destination for residential lighting products.

By Distribution Channel Analysis

In 2024, marketplace platforms led the distribution channel segment by capturing over 50.8% share of total sales. This dominance was largely supported by their ability to aggregate a diverse range of lighting brands and products under one digital roof.

Platforms like Amazon, Flipkart, and Alibaba have created a seamless ecosystem where manufacturers, third-party sellers, and consumers interact with ease. The ability to compare prices, filter by energy efficiency, and check delivery timelines has made these platforms attractive to price-conscious and quality-focused buyers alike.

Another factor boosting marketplace leadership is trust and convenience. These platforms often feature verified product listings, flexible return policies, and buyer protection programs, enhancing consumer confidence. Moreover, marketing tools such as sponsored listings, seasonal discounts, and influencer collaborations help lighting brands improve visibility and increase conversions.

By Product Type Analysis

In 2024, the LED bulbs and tubes segment dominated the product type category, holding a substantial 62.7% market share. This dominance can be attributed to the global push toward energy efficiency, sustainability, and cost savings.

LED products offer longer lifespan and lower power consumption, making them an ideal choice for both consumers and businesses. E-commerce platforms have further supported this transition by highlighting these advantages through certifications, ratings, and bundled offers. The demand for LED lighting has also been amplified by regulations banning or restricting incandescent bulbs in many countries.

Alongside environmental concerns, consumers are also drawn to the aesthetics and design variety of modern LED lights. Online platforms provide access to a wide range of designs including smart LEDs, color-changing lights, and ultra-slim fixtures. This variety, coupled with frequent promotional campaigns, has made LED bulbs and tubes the first choice among online lighting buyers.

Key Drivers of Demand

Key Features & Trends

Opportunities & Challenges

Key Market Segments

By Application

- Residential

- Commercial

- Industrial

- Outdoor Lighting

By Distribution Channel

- Marketplace Platforms

- Brand-Owned E-commerce Websites

- Retailer-Operated Online Stores

- B2B Portals

By Product Type

- LED Bulbs & Tubes

- Smart Lighting

- Decorative Lighting

- Outdoor & Garden Lighting

- Commercial & Industrial Fixtures

- Others

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the E-Commerce Market for Lighting Industry, established players such as Savant Systems Inc., Osram Licht AG, and Signify NV are prioritizing smart lighting integration. These companies are known for offering advanced connected solutions through digital platforms. Their focus remains on energy efficiency, IoT-enabled lighting, and intuitive user experiences.

Retail-centric firms like Amazon Basics, Wayfair, Walmart, and BulbAmerica have captured strong consumer trust through competitive pricing and faster delivery models. These platforms are capitalizing on bulk inventory, personalized recommendations, and aggressive marketplace strategies. Their dominance in the online retail space enables high visibility and streamlined access to lighting products.

Global manufacturers such as Zumtobel Group AG, Panasonic Corporation, Acuity Brands Inc., and Hubbell Incorporated are optimizing their e-commerce strategies by expanding direct-to-consumer models. Companies like BestBuy, IKEA, Bajaj Electricals, Dialight PLC, and Nichia Corporation are also accelerating digital transformation to strengthen logistics, inventory control, and customer interface. These firms are increasingly focusing on omnichannel strategies to align in-store and online operations.

Major players

Leading companies in the E-Commerce Market For Lighting Industry market include:

- Savant Systems Inc.

- Osram Licht Ag (AMS OSRAM AG)

- Signify NV

- Amazon Basics

- Wayfair

- Walmart

- BulbAmerica

- Alibaba.com

- Zumtobel Group AG

- Panasonic Corporation

- Acuity Brands Inc.

- Hubbell Incorporated

- BestBuy

- IKEA

- Bajaj Electricals

- Dialight PLC

- Nichia Corporation

Recent Developments

- January 2025: Chauvet made headlines by acquiring LiteGear, a leader in cinematic LED lighting, officially effective from January 22, 2025. This strategic acquisition strengthens Chauvet’s position in high-end, professional lighting and signals increased investment into cinematic and specialty lighting markets.

- In July 2024, Signify launched its NatureConnect lighting at the India Light Festival, an industry-first product designed to mimic natural sunlight, enhancing indoor well-being. This biophilic lighting solution aligns with the growing demand for health-oriented smart lighting.

- Amazon Basics expanded its home lighting collection in March 2024 with smart, color-changing LED bulbs, tapping into consumer demand for affordable, app-controlled lighting systems. MCGOR under-cabinet LED lights, showcased as a trending Amazon Choice product later in December 2024, reflect shifting retail momentum towards DIY and home upgrades.

Report Scope